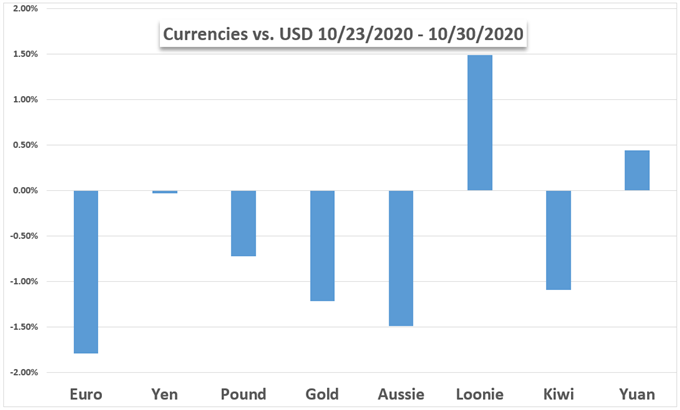

On average, the Dow Jones, S&P 500 and Nasdaq 100 suffered their worst week in over 7 months ahead of the US Presidential Election. This is as the VIX ‘fear gauge’ spiked the most since June over the same period. Rising volatility and a premium for safety propelled the anti-risk US Dollar and Japanese Yen. Anti-fiat gold prices suffered.

A combination of rising Covid-19 cases, an erosion of US fiscal stimulus hopes and a contested election have likely worked together to deteriorate risk appetite. The sentiment-linked Australian and New Zealand Dollars underperformed. Growth-linked crude oil prices declined the most since the middle of April.

All eyes turn to the November 3rd election as markets will try to digest what the outcome could mean for another fiscal package. The Senate adjourned for recess this past Monday until perhaps November 9th. Without its blessing, policymakers won’t be able to get a package through. This is complicated by the unknown timeline of when the outcome of the election could be understood.

Check out DailyFX’s content around this likely volatility-inducing event here.

Another key event will be November’s FOMC monetary policy announcement. No changes are anticipated in benchmark lending rates or in the pace of asset purchases. The Fed has been reiterating concern over a lack of progress in fiscal stimulus in recent weeks. Traders may watch for any commentary around whether or not the central bank could step in more to support growth.

October’s non-farm payrolls report may show a slowing pace of job gains since the extra unemployment benefits of the $2.2 trillion CARES Act expired and a second one pending. Rising coronavirus cases have resulted in lockdowns being reintroduced, particularly in Europe. Brexit talks also continue. What else is in store for markets in what is expected to be a volatile week?

Fundamental Forecasts

Euro Forecast: EUR/USD Outlook Bleak if 1.16 Support Breaks

A steep fall in EUR/USD is on the cards if strong support at 1.16 breaks after last week’s strong hint by the ECB that it’s planning still more stimulus for the Eurozone economy in December.

US Dollar Outlook Hinges on Presidential Election, Covid-19, FOMC

A significant rise in coronavirus infections and US presidential election jitters may buoy the haven-associated US Dollar ahead of the FOMC interest rate decision.

Crude Oil Volatility to Surge on FOMC Decision, US Presidential Election?

Sentiment-sensitive crude oil prices may have a volatile week ahead of the highly-anticipated US presidential election and the FOMC rate decision.

Gold Price Forecast - The Calm Before the US Election Storm

Gold is likely to get buffeted next week as investors watch the US presidential election voting out-turns

Mexican Peso Fundamental Forecast: Election Outcome to Determine Momentum

As the run up to election day comes to an end, USD/MXN looks for any clues on risk appetite

GBP/USD Weekly Forecast: US Election the Main Risk, BoE to Boost QE

USD awakens, placing GBP/USD on the backfoot, while EUR/GBP cracks 0.90.

AUD/USD Breaks September Low Ahead of RBA, Fed Rate Decisions

The future implications of the US election may influence AUD/USD following the RBA and Fed rate decisions as Congress struggles to pass another round of fiscal stimulus.

Technical Forecasts

S&P 500, DAX 30, FTSE 100 Forecasts for the Week Ahead (Charts)

Stock markets could be in for some more turbulence with the U.S. election next week; lines and levels to watch on the charts.

Gold Technical Forecast: Election Raises Volatility Risk, But Support Holds

Gold prices declined in the aftermath of bearish technical cues, but a key zone of support was reinforced. XAU/USD volatility risk is elevated ahead of the US Presidential Election.

Euro Technical Outlook: EUR/USD Breakdown Aims For Multi-month Lows

A Euro reversal off technical downtrend resistance now risks a larger correction in price. Here are the levels that matter on the EUR/USD weekly chart.

British Pound Technical Forecast: GBP/USD, GBP/JPY, GBP/AUD, GBP/CAD

GBP fell against both the US Dollar and Japanese Yen but, did manage to extend gains against CAD and Aussie.

Nasdaq 100, Dow Jones, DAX 30 Forecasts for the Week Ahead

Stocks capped off their worst month since March and run the risk of suffering further losses after multiple levels of support were breached. Where are stocks headed in the week ahead?

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD