Gold Price Technical Forecast - Neutral

- Gold prices declined last week in the aftermath of bearish technical cues

- Volatility risk elevated ahead of US presidential election for XAU/USD

- Key zone of support was reinforced as prices were unable to breach it

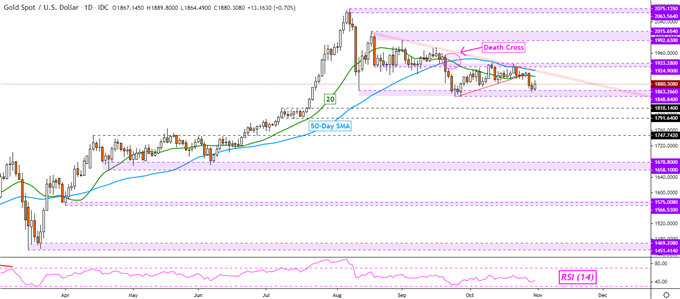

The gold technical forecast is neutral as XAU/USD faces conflicting cues. In September, the short-term 20-day Simple Moving Average (SMA) crossed under the 50-day one. This formed a bearish ‘Death Cross’ that has since been confirmed. After its formation and some initial weakness, gold saw cautious gains. However, the 50-day SMA held as resistance alongside a descending range from August.

What is arguably keeping the outlook fairly neutral is a zone of support between 1848.84 and 1863.26. Established in August and then reinforced in September, this range kept prices from declining more this past week, further validating this technical barrier. Having said that, gold is running out of room to consolidate as the space between falling resistance and horizontal support will slowly narrow in the days ahead.

US Election Volatility Risk

A breakout may have to wait until after the US Presidential Election passes and results are known. Anti-fiat gold prices suffered this past week as market volatility picked up and the VIX ‘fear gauge’ soared to June highs. A lot of the benefit went to the liquid haven-linked US Dollar, which can rally during intense volatility, sapping gold’s potential. Check out DailyFX’s content around this likely volatility-inducing event here.

For more updates on gold, technical or fundamental, make sure to follow me on Twitter here @ddubrovskyFX

Gold Daily Chart

Gold Chart Created in TradingView

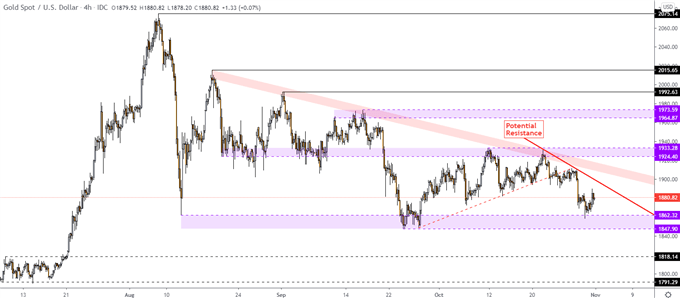

Zooming in on the 4-hour chart can help paint a better picture of the technical landscape gold is facing. Even if XAU/USD can manage to push above the falling range of resistance from August, the 1924 -1933 inflection zone could keep prices at bay. Pushing above this zone would expose highs from September and likely shift the outlook increasingly bullish.

Potential resistance – see chart below – may also keep the focus tilted lower in the near term. In the event XAU/USD can clear key support, that would expose a zone of consolidation that the precious metal experienced in early July. The upper bound was around 1818 with the lower one around 1791, these could come back into play as new support.

| Change in | Longs | Shorts | OI |

| Daily | 5% | -4% | 0% |

| Weekly | 12% | -1% | 5% |

XAU/USD 4-Hour Chart

Gold Chart Created in TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter