Volatility risk seems to be on the rise, with the VIX ‘fear gauge’ having just come off its largest surge over a week since the end of February. Most benchmark stock indexes around the world, such as the Dow Jones, FTSE 100 and Nikkei 225, wrapped up a negative week. This allowed for the haven-linked US Dollar and Japanese Yen to recover some lost ground.

Risk appetite notably waned in the aftermath of the Federal Reserve rate decision as Chair Jerome Powell arguably cooled robust economic recovery bets. Meanwhile, coronavirus cases in states like California and Texas picked up following protests and riots after the killing of George Floyd. Growth-linked crude oil prices suffered as gold remained in directionless trade.

The week ahead is filled with fundamental event risk. The Yen eyes the Bank of Japan, the British Pound awaits the Bank of England and the Swiss Franc turns to the Swiss National Bank. Central banks from developing nations such as Russia and Brazil. Mr Powell is also presenting the semi-annual monetary policy report before the Senate Banking Committee.

Outside of central banks, all eyes turn to retail sales data from the world’s largest economy, where consumption is about two-thirds of GDP. Crude oil will be awaiting the monthly report from the Organization of the Petroleum Exporting Countries (OPEC). This is as nations continue relaxing lockdown measures, perhaps raising the risk of another wave of the coronavirus.

Discover your trading personality to help find optimal forms of analyzing financial markets

Fundamental Forecasts:

Euro Forecast: Outlook for EUR/USD Still Positive, Focus on Recovery Fund

The key event for Euro traders to watch out for in the coming week is Friday’s European Council video conference, called to discuss an EU recovery fund and the EU budget.

Gold Prices May Fall as Virus Cases Rise With Risks of Staggered Reopening

Gold prices may turn lower if sentiment sours and US equity markets plunge amid growing concerns of rising Covid-19 cases and the prospect of a delayed reopening of the economy.

Oil Price Recovery to Linger as US Crude Output Continues to Contract

The ongoing contraction in US production may keep the price of oil afloat as crude output narrows for ten consecutive weeks.

USD/MXN Outlook: Risk-On Recovers Swiftly but Road Ahead is Bumpy

Thursday’s selloff mania has caused a dent in the Peso’s post-covid recovery but buyer support is still abundant

S&P 500 and FTSE 100 Forecasts for the Week Ahead

Global equity markets face a reality check as second wave concerns linger. Central banks in focus.

US Dollar Outlook: Will Fed Spook Investors Again? S&P 500 Eyed

The US Dollar remains glued to the Dow Jones and S&P 500. All eyes turn to local retail sales, Fed Chair Jerome Powell, creeping virus cases and the central bank’s balance sheet.

Weekly Australian Dollar Forecast: Continuing to Track Broad Risk Appetite

The Australian. Dollar has been one of the best performing currencies since the end of March, when risk aversion bottomed out, so to speak.

Technical Forecasts:

US Dollar Bounces At Pre-Crisis Lows, Divergence Hints At Reversal

The US Dollar ended 10 consecutive days of losses against its major counterparts, as the haven-linked currency collapsed to three-month lows. Could USD be staging a comeback?

EUR/USD Struggling to Push Higher, EUR/GBP Ranging - Euro Forecasts

EUR/USD reversed sharply lower on Thursday and may find it difficult to re-capture its recent high. EUR/GBP is now setting up a new range at slightly higher levels.

Sterling Forecast: GBP/USD Pivots Lower as EUR/GBP Holds Range

GBP/USD price action recoiled sharply lower and spot EUR/GBP maintained its choppy 200-pip trading range last week amid mixed market activity, but the Pound Sterling could face a broader reversal.

Gold Price Outlook: Consolidation Sets XAU Up to Rally

Gold continues to move sideways, and with the congestion pattern developing amidst a general uptrend it is seen as likely a breakout to new highs develops soon.

Oil Price Outlook: Crude Weekly Reversal Snaps Six-Week Rally in WTI

Oil prices are poised snap a six-week winning steak with crude reversing off downtrend resistance. Here are the levels that matter on the WTI weekly technical chart.

Japanese Yen Technical Forecast: Long-Term Support Thwarts Sellers

After the fireworks of February and March USD/JPY has settled into a pattern of mean reversion. But reading between the lines a sharp trend developed this week.

S&P 500, Dow Jones, DAX 30 & FTSE 100 Technical Forecasts for the Week

The S&P 500, Dow Jones, DAX 30 and FTSE 100 fell rather abruptly last week as they retreated from recent highs and threatened a variety of technical levels beneath. Will the fall continue?

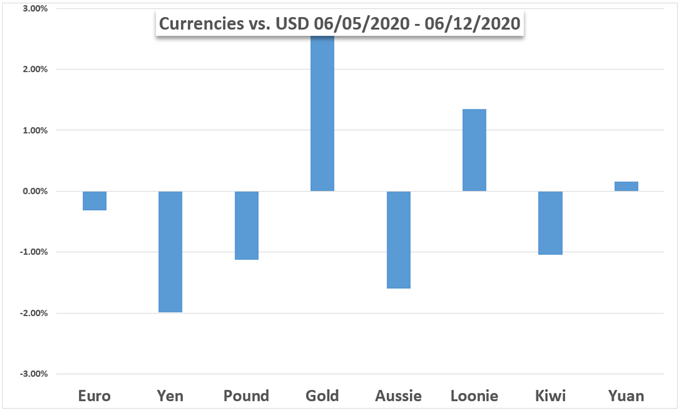

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD