Emerging Markets, Capital Flows, EEM - Talking Points

- Emerging market capital outflows have been noticeably cooling

- Risks do remain, as highlighted by the Federal Reserve recently

- MSCI Emerging Markets Index stalling above key 61.8% Fib?

Recent optimism in global financial markets has meant that the aggressive pace in capital flowing out of emerging markets has been cooling. Earlier this year, the introduction of lockdown measures across the world as the coronavirus spread sank stocks. At one point, cumulative capital outflows from developing economies surpassed levels seen during the global financial crisis by twice.

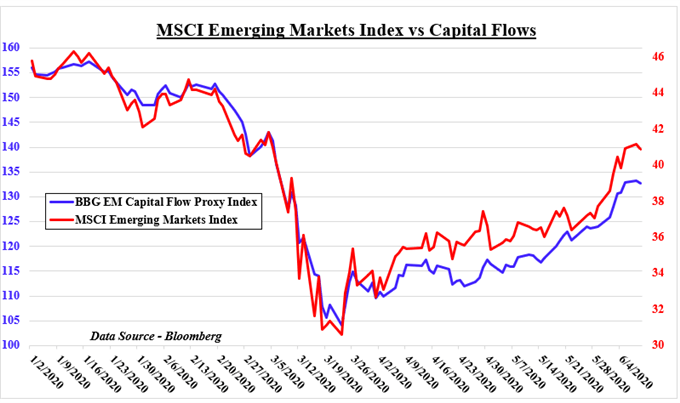

On the chart below, the MSCI Emerging Market Index (EEM) can be seen closely following a proxy of developing capital flows. If sentiment remains on the current upward path, this could continue pushing equities from countries such as India, Mexico and Brazil higher. Not to mention that the haven-oriented US Dollar could keep being pressured to the downside.

However, risks remain. The Federal Reserve left rates unchanged near-zero levels and signaled the intention to keep borrowing costs depressed for some time. Meanwhile Chair Jerome Powell left the door open for vigilance and caution. He mentioned that a full recovery is ‘unlikely to occur until people feel safe’. A second wave of the coronavirus may very well keep consumers cautious about discretionary spending.

MSCI Emerging Markets Technical Analysis

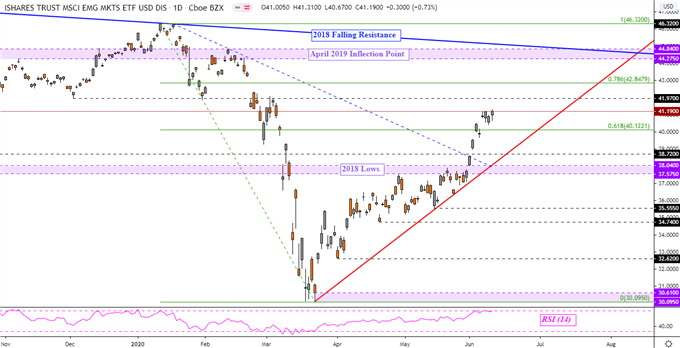

From a technical standpoint, the EEM remains in an uptrend. Prices pushed higher after closing above key falling resistance from the beginning of this year. Since then, the EEM has struggled to make meaningful progress above the 61.8% Fibonacci retracement at 40.12. Prices are sitting just under what may be immediate resistance at 41.97. A turn lower may send the EEM towards rising support from the March bottom.

MSCI Emerging Markets Index – Daily Chart

EEM Chart Created in Trading View

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter