Market sentiment ended on an upbeat this past week, but it was not without some hiccups along the way. On Wall Street, the Dow Jones, S&P 500 and Nasdaq 100 climbed as well as equities from the APAC region. The latter include the ASX 200, Hang Seng and Nikkei 225. Those in Europe traded mixed, with the DAX outperforming while the FTSE 100 underperforming.

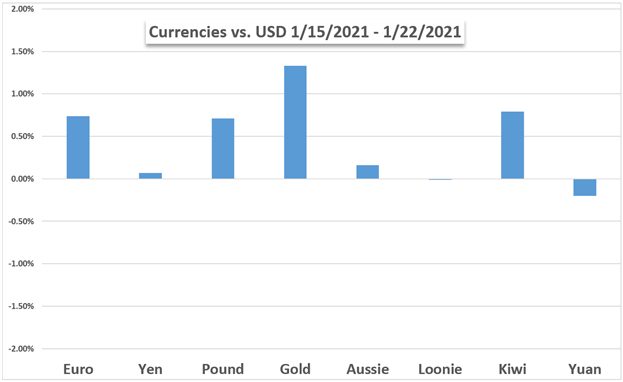

The haven-linked US Dollar cautiously weakened as the Euro and British Pound pulled ahead. Growth-linked crude oil declined as gold prices gained slightly. Investors’ attention was on tech stocks this past week which outperformed the broader market. An earnings surprise from Netflix may have dominoed outward ahead of what is going to be a very busy week.

Earnings season will pick up the pace with key tech companies, such as Apple and Microsoft, reporting alongside Boeing and Caterpillar. So far, fourth-quarter results have been generally upbeat, opening the door to continuation. All eyes will also be on the Federal Reserve, which is expected to keep borrowing costs unchanged and continue asset purchases with a dovish bias.

The United States and Canada will release their latest growth figures for more insight into the state of the global economic recovery. This is as the IMF will update its World Economic Outlook in the same week global leaders will speak at the World Economic Forum’s “The Davos Agenda”. German Chancellor Angela Merkel and Chinese President Xi Jinping will speak at the latter.

For markets, ongoing updates about the state of Joe Biden’s USD 1.9 trillion fiscal package remain a key topic. Ever since the election and Georgia Senate runoffs, investors have been looking forward to a larger-than-expected package. This is as preliminary data from the UK warn that the new more-contagious Covid strain may have a higher mortality rate. What else is in store for markets ahead?

Fundamental Forecasts:

Euro Week Ahead Forecast: EUR/USD Outlook Bullish, EUR/GBP Bearish

The Euro looks to have broken higher against the US Dollar but lower against the British Pound, trends that will likely continue in the days ahead.

Gold Price Tracks Weakness in US Treasury Yields Ahead of Fed Meeting

The Federal Reserve’s first meeting for 2021 may do little to prop up the price of gold as the central bank relies on its non-standard tools to achieve its policy targets.

Australian Dollar Capped by Falling Iron Ore Demand Ahead of Inflation Data

The notable drop-off in Chinese iron ore demand appears to have notably weighed on the Australian Dollar in recent days as attention turns to the upcoming Q4 inflation release.

Sterling (GBP) Weekly Outlook: Two Steps Forward, One Step Back

GBP/USD continues to move higher, despite Friday’s weakness, as vaccination hopes continue to fuel positive sentiment despite ongoing lockdown fears and downbeat UK data.

Mexican Peso Forecast: USD/MXN Drifts Back Above 19.90 as it Holds its Range

Mexico continues to see record numbers in new virus cases as USD/MXN converges to the center of its range

Dow Jones, Nasdaq 100, DAX 30 Forecasts for the Week Ahead

The Dow Jones and Nasdaq 100 will look to key earnings from the likes of Apple, Tesla, Boeing and more while juggling a FOMC rate decision midweek. The DAX 30 awaits broader economic data.

Canadian Dollar Forecast: Busy Week Ahead, GDP, Fed, IMF, Earnings Season

The Canadian Dollar will likely remain glued to news that can drive risk appetite, with USD/CAD eyeing GDP data, the Federal Reserve, IMF, earnings season and more in a very busy week.

Technical Forecasts:

Gold Price Outlook: Gold Weekly Reversal- Bear Market Rally or More?

Gold snapped a two-week losing streak but keeps price within the broader August downtrend. These are the levels that matter on the XAU/USD weekly chart.

Euro Weekly Technical Outlook: EUR/USD May Dip More Before Finding Support

The EUR/USD chart is still tilting in favor of some more weakness, but if the longer-term trend-line holds then selling may be short-lived.

FTSE 100, DAX 30 Technical Forecast For The Week Ahead

FTSE 100 extends pullback after extension rejection, DAX risks breakout as range narrows.

British Pound Technical Outlook: GBP/USD, EUR/GBP Wedge Patterns in Focus

The British Pound finds itself trading within converging trendlines, as Rising and Falling Wedge Patterns define GBP/USD and EUR/GBP price action.

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD