Sterling (GBP/USD) Price, Analysis and Chart:

- UK vaccination program hitting its straps.

- Sterling nudging higher across the board.

The British Pound continues to move slowly higher but Covid-19 headwinds are becoming increasingly tougher to push through. Sterling hit levels against the US dollar last seen back in April 2018, while EUR/GBP hit and broke and noted multi-month support low. The moves look to be reasonably well underpinned and further, small, gains are likely over the next few weeks although progress may be slow.

With Brexit in the rear mirror, Sterling is becoming increasingly dictated to by various coronavirus scenarios, and to a certain extent, economic data. The UK vaccination program is progressing with great speed and over 5 million doses have now been given, which is well on the way to the government’s target of 13 million by mid-February. This positive news is keeping Sterling bid and counteracting the negatives coming from the high infection and fatalities figures. As long as the vaccination plan keeps to target, Sterling will retain an underlying bid.

The latest UK PMI data showed the current weakness of the UK economy with the services index falling further into contraction territory, while the overall picture was also worse than market expectations and at an eight-month low. The numbers point to a double-dip recession in the UK.

The UK economic calendar is fairly sparse next week with only the October employment change, November average earnings, and December claimant count change – all out on Tuesday, January 26 – to keep traders interested.

Technical vs Fundamental Analysis in Foreign Exchange

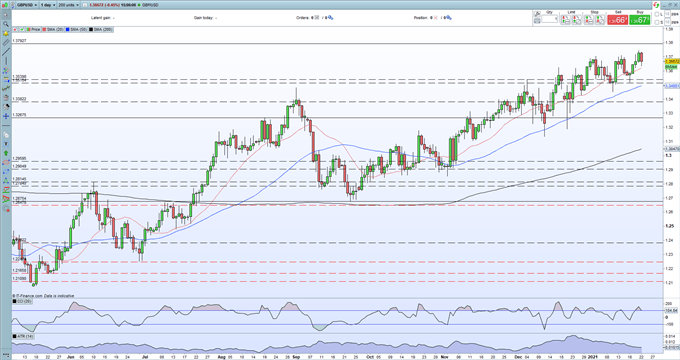

The daily GBP/USD chart shows the positive trend since mid-September last year. The pair trade above all three moving averages, a positive technical set-up, and with notably higher lows made over the last few months.

GBP/USD Daily Price Chart (June – January 22, 2021)

| Change in | Longs | Shorts | OI |

| Daily | -12% | 14% | 0% |

| Weekly | -16% | 20% | -1% |

IG client sentiment data show 38.85% of traders are net-long with the ratio of traders short to long at 1.57 to 1.We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse lower despite the fact traders remain net-short.

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.