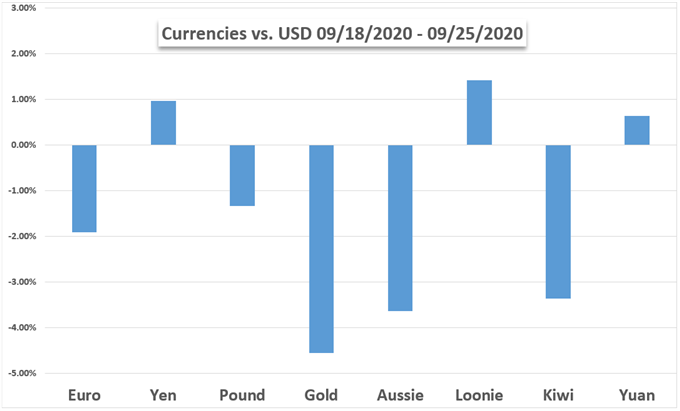

Global risk appetite continued to sour this past week. In the United States, the Dow Jones and S&P 500 declined while the tech-heavy Nasdaq Composite managed to inch out a cautious rise. The haven-linked US Dollar outperformed its major peers, seeing its best 5-day performance in about 6 months. This likely weighed against anti-fiat gold prices.

Investors might have been growing increasingly impatient with a lack in expediency of additional US fiscal stimulus. At a congressional testimony, Fed Chair Jerome Powell stressed the need for further support from the government. Still, volatility cooled into the end of the week. The VIX ‘fear gauge’ failed to accumulate material upside momentum.

Might volatility pick back up? This coming week is certainly filled with event risk. All eyes will turn to the US House of Representatives where the chamber may vote on a $2.4 trillion fiscal package. This is as Donald Trump takes on Joe Biden on Tuesday during the first presidential debate ahead of what is likely to be a tense election come November.

The Euro has been seeing some selling pressure, particularly as coronavirus cases in parts of Europe pick up pace. Might the British Pound regain some lost ground as the EU and UK head into another round of Brexit talks? All eyes at the end of the week turn to the US non-farm payrolls report. Chinese manufacturing PMI will also be watched to gauge the health of global growth.

Discover your trading personality to help find optimal forms of analyzing financial markets

Fundamental Forecasts:

Euro Forecast: EUR/USD Outlook Still Bearish But Bounce Due

EUR/USD fell sharply last week and there are few signs yet that the selling is over. However, a bounce is likely before the decline resumes.

USD Volatility Ahead? Presidential Debate, Stimulus Talks & NFPs on Deck

The US Dollar will be bracing for a cascade of political risks including the first presidential debate, ongoing stimulus talks, the Supreme Court vacancy against the backdrop of key employment data.

Oil Price Rebound Stalls Ahead of Monthly High with OPEC on Sidelines

The price of oil may continue to trade in a narrow range as the rebound from the September low ($36.13) appears to have stalled ahead of the month high ($43.43).

S&P 500 Price Forecast: US Presidential Election May Spook Volatility

The S&P 500 index may struggle with a consolidation in view of several headwinds. The US presidential election may cool risk appetite and spook volatility.

Mexican Peso Fundamental Forecast: Banxico Tries to Aid Economic Recovery

USD/MXN pushes higher as a long-awaited correction in the US Dollar gets underway

GBP/USD Weekly Forecast: Cautious Optimism Signals a Brexit Deal is Near

GBP turbulence persists as investors eye the next round of EU-UK Brexit negotiations. Cautious optimism signals a deal is near.

Gold Price Outlook: Rising US Dollar Sinks XAU/USD, Will Losses Extend?

Anti-fiat gold prices suffered the worst week since August as the US Dollar gained ground. Will losses extend? All eyes turn to fiscal stimulus hopes and non-farm payrolls data.

Australian Dollar May Extend Fall Despite Easing Covid-19 Restrictions

The Australian Dollar may extend its slide lower despite the planned easing of Covid-19 restrictions, as the market continues to price in an RBA rate cut on October 6.

Technical Forecasts:

Gold Price Forecast: XAU/USD Plummets, Are the Bulls Done For?

Gold prices have plunged nearly 11% off the record highs with a breakout risking further losses. Here are technical trade levels that matter on the XAU/USD weekly chart.

Pound Technical Outlook: GBP/USD Sell-off Set Up to Continue

Cable looks set up for another leg lower as a new week is set to roll around; levels and lines to watch.

US Dollar Technical Forecast: EUR/USD, AUD/USD, USD/CAD, GBP/USD

The US Dollar continues to show tones of reversal as Q3 winds down. Can buyers drive the currency through the Q4 open?

Nasdaq 100, DAX 30, FTSE 100, CAC 40 Forecasts for the Week Ahead

Weakness in equity markets continued last week as losses built and technical patterns hint further bearishness might be ahead.

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD