USD/MXN Technical Forecast: Neutral

USD/MXN looks set to resume upside momentum after a volatile week has left the pair pushing above key resistances as a risk-off move returned a much needed bid to the US Dollar.

Whilst last week we saw the Mexican Peso outperforming, USD/MXN hit a seven week high on Thursday as investors culminated a week dominated by risk aversion, which saw equities embark on a corrective move after continuously hitting higher highs for the last two months. The Dollar Basket (DXY) – which tracks the performance of the US Dollar against other major currencies – managed to pick up some buyer momentum as investors looked for safer returns, pushing the index above 94.00 for the first time since July 26th.

This in turn led to a risk-off move in assets, where growth-linked currencies were hardest hit as investor sentiment soured. Many factors contributed to this, like the political tension in the US and the renewed concerns about the rapid spread of coronavirus in Europe, but ultimately it came down to a long-awaited corrective move in what had been an over-bullish market for the last few months.

The question now is whether assets like the USD/MXN are at their fundamental fair value. On Thursday, Banxico delivered its xx rate cut this year, taking it from 4.5% to 4.25%, in line with most analyst expectations. In their statement, they noted the decision was unanimous but they acknowledged that room for manoeuvre is now limited, given in part due to the unexpected rise in inflation above the target of 4%.

This marks another step forward in Banxico’s easing of monetary policy to combat faltering economic growth, which managed to put a stop to the Peso’s rapid declines seen this week, pushing USD/MXN back towards the 22.00 handle. I see the central bank pushing for another one or two 25 bps cuts in the next few months, taking the rate closer to 3.5%, which could see a positive price impact in MXN given that Mexican rates are still much more attractive than those in most other countries, including its LatAm counterparts.

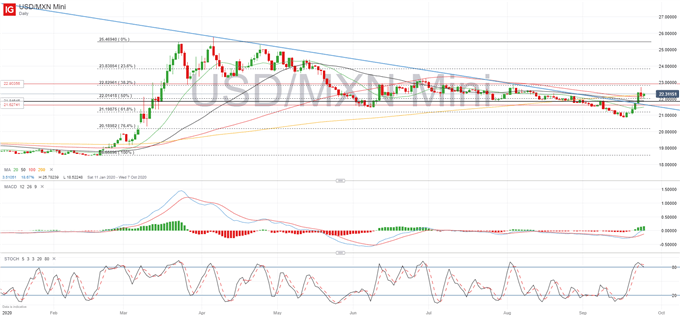

USD/MXN daily chart (12 January – 25 September 2020)

From a technical standpoint, the short term trend has a neutral bias. Although USD/MXN took a while to react to the weakness in equities, short-term direction will be determined by the stock market. Since Friday the 18th, USD/MXN has appreciated by 8.77%, eliminating the losses seen in the last six weeks. The cut in interest rates, together with somewhat weak employment data in the U.S., have offered sufficient buying support in the Mexican Peso to halt the gains in the pair, but this is unlikely to hold.

Continued weakness in U.S. economic data along with the rapid increase in Covid-19 cases leaves gains in USD/MXN limited at the fundamental level, with immediate resistance at the intraday high of 22.69, followed by 22.88, August highs after an attempted upward reversal.

That said, markets are recently moving on investor sentiment, and given that the political situation in the US is getting more complicated, along with the worsening global health situation, we could see the dollar receive buying support due to its safe haven value alone, even if it has become "residual".

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin