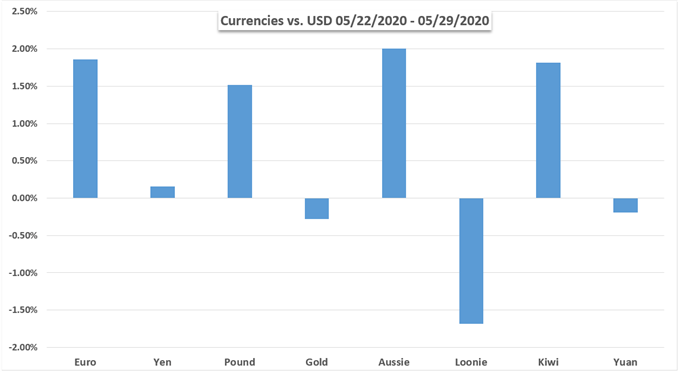

Sentiment was reinvigorated this past week as US benchmark stock indexes resumed the bounce off March lows. The haven-linked US Dollar succumbed to selling pressure despite rising tensions between the United States and China over the latter’s proposed security law over Hong Kong. Lockdown easing bets helped push WTI crude oil prices to the best month on record.

There are plenty of event risks next week for financial markets to digest. Three central banks from major economies are due: the RBA, BoC and ECB for Australian Dollar, Canadian Dollar and Euro traders respectively. While benchmark lending rates are seemingly likely to remain around zero, it is their assessment of economic conditions that will likely offer scope for volatility.

For those that are avid followers of the British Pound, Brexit talks resume and there is rising concern over progress as the late-June extension deadline approaches for the transition period. If there is no agreement on a postponement, then lawmakers will have until the end of this year for a Brexit deal. A lack in the latter risks adding more uncertainty to virus economic recovery efforts.

All eyes at the end of the week turn to May’s US non-farm payrolls report. Despite the nation accumulating over 40 million jobless claims since March, the Dow Jones and S&P 500 have not been thrown off. Investors are still likely still looking ahead to lockdown easing impacts as the Fed continues to lubricate credit markets with quantitative easing as it accumulates corporate debt.

Discover your trading personality to help find optimal forms of analyzing financial markets

Fundamental Forecasts:

Oil Price to Stay Afloat as US Output Falls to Lowest Level Since 2018

The ongoing contraction in US production may keep oil prices afloat in June as crude output falls to its lowest level since October 2018.

Gold Prices Face RBA, BoC, ECB, US Jobs Data and Brexit Talks

The medium-term gold outlook still seems favorable as the Fed, ECB and more keep rates around 0. Immediate event risk ahead includes the RBA and BoC interest rate decisions, US jobs data and Brexit talks.

Upbeat RBA Could Fuel Australian Dollar Strength

The Australian dollar may continue to outperform major counterparts should the Reserve Bank of Australia tame speculation for additional monetary support.

US Dollar (USD) Outlook: US-China Tensions Likely to Escalate Further

The US dollar continued to sell-off this week and the greenback’s future will be decided by commentary from the White House and not the Federal Reserve over the coming days and weeks.

USD/MXN Outlook: Mexican President Sees Opportunity in Worsening US-China Relationship

López Obrador hopes USMCA will help tighten trade relationships between the US and Mexico

S&P 500, DAX 30 and FTSE 100 Forecasts for the Week Ahead

US-China tensions remain, ECB stands ready to expand QE purchases, EU-UK trade talks in focus.

Euro Forecast: EUR/USD Outlook Positive, ECB May Boost Asset Purchases

The European Central Bank will likely boost its Pandemic Emergency Purchase Program at Thursday’s meeting of its Governing Council; a move that could give the Euro a lift.

Technical Forecasts:

Crude Oil Prices Stalling at Resistance, Multi-Week Uptrend at Risk?

Crude oil prices may face heightened liquidation pressure as the cycle-sensitive commodity finds itself under the pressure of resilient resistance and a vulnerable, multi-week rising channel.

British Pound Outlook: GBP/USD May Go Along for the Ride

GBP/USD doesn’t have the cleanest set of technical indications, but USD may give indications if it can break its trading range via the DXY.

US Dollar Technical Forecast: USD Bears Drive Dollar to Two-Month-Low

The tension from March continues to subside, allowing for the USD to slide to fresh two-month-lows.

Japanese Yen Price Outlook: USD/JPY Rebound Faces First Test

Japanese Yen fell for a third consecutive week with price testing resistance into June open. Here are the levels that matter on the USD/JPY weekly technical chart.

Dow Jones, Nasdaq 100 & DAX 30 Forecasts for the Week Ahead

The month of May saw equities rise across the board. The Dow Jones and DAX 30 will look to hold above nearby support while the Nasdaq 100 may look to attack all-time highs.

Weekly Gold Price Forecast: Bullish Breakout Potential Persists

Gold prices have seen their bullish breakout attempt fail to gain traction, although it’s still too soon to say that further gains are out of the question.

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD