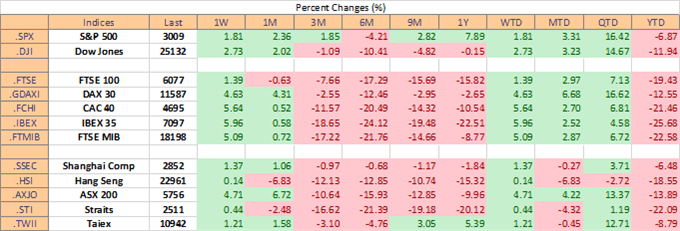

S&P 500, DAX 30, FTSE 100 Analysis and News

- S&P 500 | Escalation in US-China Tensions Raises Macro Risk

- DAX | ECB Ready to Boost PEPP

- FTSE 100 | Eyes on EU-UK Trade Talks

Source: DailyFX

S&P 500 | Escalation in US-China Tensions Raises Macro Risk

Key technical breaks see the S&P 500 back to early March levels having pierced the 200DMA and 3000 level. This is despite the rising tensions between the US and China, particularly after China passed the Hong Kong Security Bill. Fears over the potential re-emergence of a trade war are likely misguided in the short-term, however, the rising uncertainty will likely see further upside capped. Downside support situated at 2930-50.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -1% | 0% |

| Weekly | 15% | -13% | -1% |

S&P 500 Price Chart: Daily Time Frame

Source: IG Charts

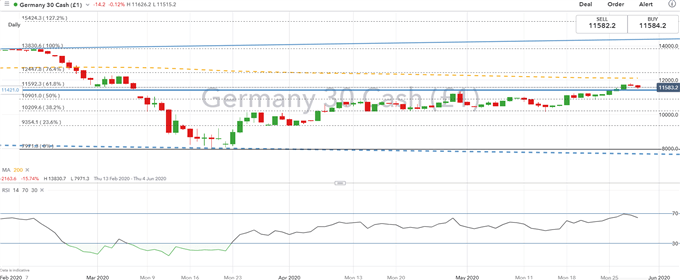

DAX | ECB Ready to Boost PEPP

The beginning of the week saw the European Commission announce its recovery aid proposal, which propelled European assets higher with the DAX trading at its highest level since the beginning of March. However, with the “frugal four” already highlighting that the package should largely be in the form of loans, tough negotiations are ahead. Alongside this, the ECB is due to release its latest monetary policy decision, expectations are for the central bank to expand PEPP (Pandemic Emergency Purchase Programme). However, with US-China tensions persisting, risks are asymmetrically tilted to the downside, 12000 level likely to be a tough nut to crack.

| Change in | Longs | Shorts | OI |

| Daily | -9% | 7% | 2% |

| Weekly | -27% | 9% | -5% |

DAX 30 Price Chart: Daily Time Frame

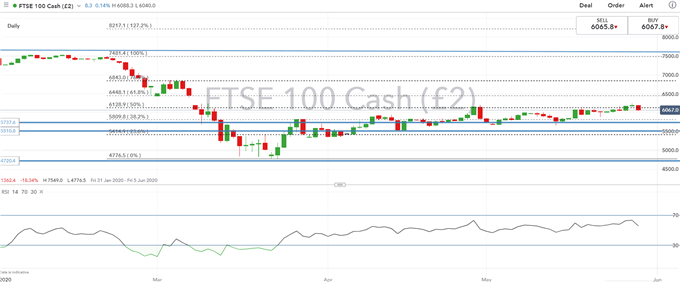

FTSE 100 | Eyes on EU-UK Trade Talks

EU-UK trade negotiations are at the forefront of investors’ minds. Although, given that both parties have shown little signals that they are willing to break away from its red-lines, the chance of a breakthrough appears minimal. Therefore, the absence of notable progress will in turn heighten no-deal Brexit risks and thus keep UK assets on the backfoot.

| Change in | Longs | Shorts | OI |

| Daily | -30% | 25% | 2% |

| Weekly | -44% | 44% | 0% |

FTSE 100 Price Chart: Daily Time Frame

Source: IG Charts

RESOURCES FOR TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX