Despite civil unrest on Capitol Hill this past week, US and global equities finished on a high note to start off the first full week of the new year. The Russell 2000, an index measuring the performance of mostly small-cap American companies, outperformed the tech-heavy Nasdaq 100. The S&P 500 and Dow Jones followed closely behind.

What was rather more interesting was the tale of fixed income assets. Longer-term Treasury yields soared, with 10-year and 30-year rates surging the most since August. Financial markets welcomed Democratic Senators winning both runoff elections in Georgia. This has opened the door to larger fiscal stimulus, offering much-needed support to an economy recovering from the coronavirus.

December’s disappointing non-farm payrolls report underpinned the case for more support. As a consequence of rising government bond yields, gold prices could be left vulnerable following the worst week since late November. Meanwhile, crude oil prices may benefit, also supported by an unexpected output cut from Saudi Arabia after this past week’s OPEC meeting.

The US Dollar could also catch a break as rising local bond yields make it a more attractive investment, but the extent to which it could benefit is unclear given the Fed’s still-dovish stance. Further gains in equities would likely continue to work against the haven-linked Greenback, with the sentiment-linked Australian and New Zealand Dollars ripe to benefit.

Stricter lockdowns remain a risk for markets amid the new more-contagious strain of Covid-19. Markets will be eyeing a plethora of speeches from Federal Reserve Presidents such as Eric Rosengren and Raphael Bostic. ECB’s Chief Christine Lagarde is also on tap. Towards the end of the week, watch out for US retail sales and sentiment. What else is in store for markets ahead?

FUNDAMENTAL Forecasts:

Sterling (GBP) Weekly Outlook: Covid-19 Vaccination Program Underpins Sterling

Looking ahead, the British Pound will continue to draw strength from an acceleration in the UK vaccination program, despite rising infection numbers.

Australian Dollar Outlook: Rising Commodity Prices to Drive AUD Higher

Australia’s success in suppressing the novel coronavirus and soaring commodity prices may continue to underpin the cyclically-sensitive AUD in the coming months.

Mexican Peso Forecast: USD/MXN Balances on Support as Covid-19 Cases Surge in Mexico

The strong downtrend in USD/MXN has stagnated in recent weeks as bearish momentum eases.

Crude Oil Prices Eyeing OPEC Outlook Report After Saudi Output Cut, US Stimulus

Crude oil prices may extend gains after Saudi Arabia unexpectedly cut production ahead of the monthly OPEC outlook report. US fiscal stimulus bets may also underpin WTI.

Will the S&P 500 Extend Its Record Rally on Reflation Hopes?

The seemingly unstoppable rally in US stocks may have more room to go before time is ripe for a correction. The reflation trade appears to be gaining traction, but overstretched valuations may flag risk ahead.

Euro Forecast: EUR/USD Outlook Upbeat on Sunny Market Sentiment

Trader confidence has been boosted by the US Democrats winning control of the Senate, suggesting further flows out of the safe-haven US Dollar into ‘risk-on’ currencies such as the Euro.

Gold Price Outlook Mired by Spike in US Treasury Yields

The price of gold tumbles to a fresh weekly low ($1834), with the weakness in bullion largely coinciding with the recent spike in US Treasury yields.

TECHNICAL Forecasts:

Euro Weekly Technical Outlook: EUR/USD Channel Structure in Focus

The EUR/USD is trending higher, but momentum has waned; still giving it the benefit of the doubt, but keep a watchful eye on the channel.

British Pound Forecast: Sterling Rally Falters at Trend Resistance

British Pound snapped a three week-winning streak with the Sterling rally stalling at technical resistance. Here are the levels that matter on the GBP/USD weekly chart.

Gold Price Forecast: (XAU) Gold Grounded as Bitcoin Shoots to the Moon

Gold bulls just got grounded this week while Bitcoin flew to the moon. Do we have a new safe-haven taking the crown, or a mere pause in a bigger picture cycle?

Crude Oil Technical Outlook: Oil Surges on Saudi Surprise – Key Levels to Watch

Strong start to 2021 as crude oil soars on Saudi surprise and market melt-up.

Dow Jones, Nasdaq 100, FTSE 100 Forecasts for the Week Ahead

Stocks pushed to new heights last week as they creep into overbought territory after more than two months of essentially continuous gains. Can they continue to push higher despite running hot?

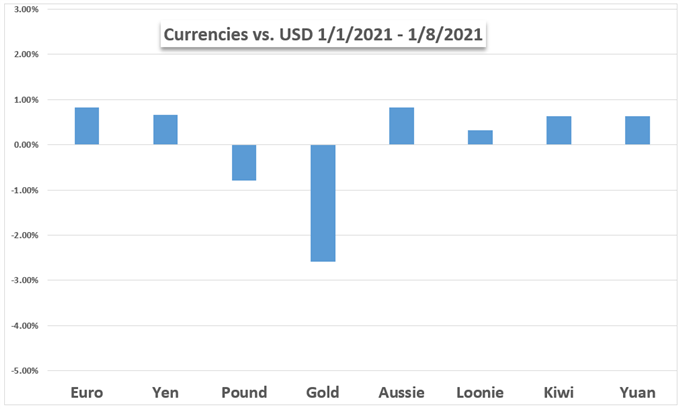

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD