Sterling (GBP/USD) Price, Analysis and Chart:

- GBP/USD trading on either side of 1.3600 with support growing.

- UK inoculation program targets 13 million by mid-February.

The British Pound has had a fairly lackluster week but is seemingly building decent support around the low 1.3500 level which should hold again next week. With EU/UK trade talks now in the rear mirror, although regular updates of problems and friction can be expected, the near-term driver of Sterling will be the Covid-19 virus, its increased spread and the UK government’s vaccination program. While PM Boris Johnson has had vocal critics of his handling of the pandemic so far, it is beginning to look like the government’s inoculation program is one of his better moments in power. A further positive today saw the UK approve the Moderna drug, its third Covid-19 vaccine. The government has ordered a total of 17 million doses of the new drug that should available by Spring.

The Department of Health has already vaccinated over 1.3 million people in the UK with at least one dose so far and has been set a target of 13 million by mid-February, including everyone over-80. The program so far has seen the UK have one of the highest inoculation rates, by total, across the world and with plans to increase the availability of the vaccine, the ambitious target may well be hit. This in turn will increase pressure on the government to begin relaxing the current lockdown rules, bringing a much-needed boost to the ailing UK economy. The Treasury continues to support the economy, announcing a further GBP4.6 billion in lockdown grants earlier this week, with reports also suggesting that Chancellor Rishi Sunak is also considering helping 700,000 smaller businesses excluded from the original bailout scheme.

Technical vs Fundamental Analysis in Foreign Exchange

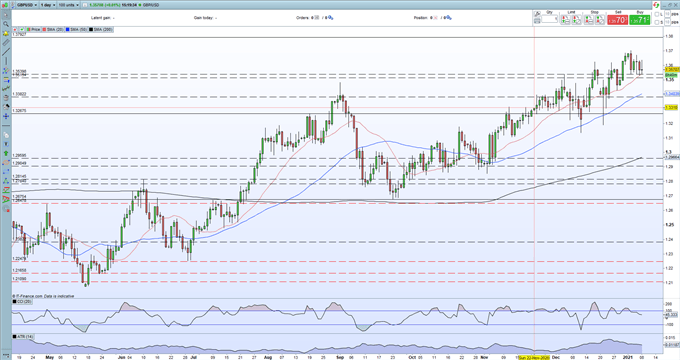

There is little on the economic calendar next week until the monthly GDP figures on Friday, leaving the Sterling traders looking out for Covid-19 updates. As previously mentioned, GBPUSD should find support around the 1.3500 level, while the recent 1.3705 high may be difficult to overcome next week. If Sterling continues to respect support, GBP/USD may start to move again over the next few weeks.

GBP/USD Daily Price Chart (June – January 8, 2021)

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

IG client sentiment data show48.90% of traders are net-long with the ratio of traders short to long at 1.05 to 1. The number of traders net-long is 9.99% higher than yesterday and 43.00% higher from last week, while the number of traders net-short is 0.12% lower than yesterday and 15.86% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse lower despite the fact traders remain net-short.

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.