The first full week of 2019 was quite the bumpy one for market sentiment. S&P 500 futures temporarily declined about 2.5 percent as Iran retaliated to a U.S. airstrike that killed its Revolutionary Guard general. Investor confidence swiftly recovered however as the two nations managed to avoid escalation. A mixed NFP report ended Wall Street on a cautious note Friday.

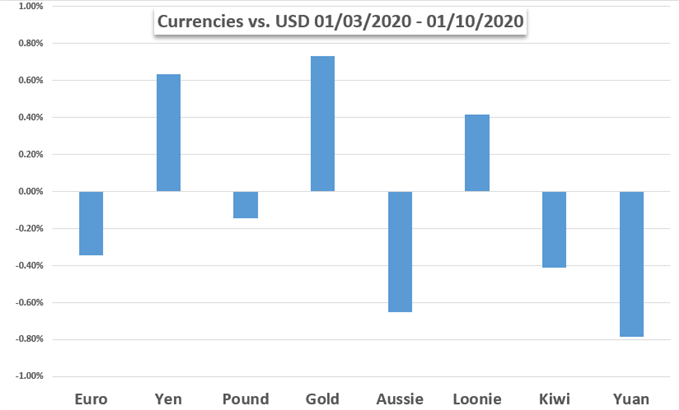

This did come at the cost of crude oil prices which suffered their worst 5-day performance since the middle of July. Anti-fiat gold prices trimmed most of their gains and left behind a large wick that some may call a Shooting Star. Forex volatility in the majors remained fairly low. While the US Dollar cautiously climbed on average, it still is adhering to its steady descent since August.

Geopolitical tensions may take a backseat as the focus in the week ahead shifts to fundamental themes that helped drive broad sentiment in 2019. The US and China are expected to sign the highly-anticipated “phase one” trade deal. Meanwhile across the Atlantic Ocean, Boris Johnson’s Brexit deal should have fairly little trouble making its way through Parliament.

Further insight into the health of the world’s second-largest economy could have major consequences for global growth as China releases its next round of GDP data. The British Pound may look past UK CPI data as the focus remains on Brexit headlines. Can the US Dollar find momentum behind inflation data out of its own home country instead?

US Dollar Outlook Bullish on Trade Deal, Retail Sales Data

The US Dollar may rise if optimism on US-China trade relations and better-than-expected retail sales data deflates 2020 Fed rate cut bets.

Australian Dollar May Gain If Global Focus Moves From Iran to Trade

The Australian Dollar saw sharp falls as US-Iran confrontation drained risk appetite. De-escalation could see some of these clawed back this week.

EUR/USD Weekly Forecast: 2020 Opening Range Points to Further Losses

The 2020 opening range for EUR/USD raises the scope for a further decline in the exchange rate amid the failed attempt to test the August high (1.1250).

Crude Oil Weekly Forecast: Oil Price Needs Support, Eyes US-China Trade Deal

Next week’s signing of phase one of the US-China trade deal, on January 15, may underpin crude oil prices at current levels after this week’s sharp selloff.

Dow Jones, DAX, FTSE Technical Forecast for Next Week

Stocks continue to be supported by bullish sentiment, and for now it is hard to bet against them in the absence of any signs of sellers.

Dow Jones, Nasdaq 100, DAX 30 Forecasts: Trade and Earnings to Headline

Last week global equity markets had to weather a tense geopolitical flare up between the United States and Iran. This week, the all too familiar US-China trade war will take center stage once more.

British Pound Technical Outlook: GBP/USD, EUR/GBP, GBP/JPY, GBP/AUD

The British Pound has on average been consolidating against its major counterparts lately. This leaves GBP/USD, EUR/GBP, GBP/JPY and GBP/AUD approaching key psychological barriers.

AUD/USD Outlook in the Balance at Pivotal Chart Levels

The Australian Dollar has made a preliminary play at downward trend resumption, but sellers must manage a break of key support to have hope for follow-through.

Gold Technical Forecast: Gold Gains Driven by Confluent Crosswinds

Gold prices spiked to another fresh six-year-high this week, but buyers pulled back as US-Iran tensions calmed. Can buyers continue to drive?

Canadian Dollar Price Outlook: USD/CAD Recovery to Face Resistance

The Canadian Dollar is weaker this week but keeps price within the broader Loonie rally. Here are the levels that matter on the USD/CAD weekly chart.

Gold Price Weekly Forecast: Is the Gold Price Break a False Alarm?

Gold prices rally to highest level since March 2013 on geopolitical concerns. Calming of tensions pares gold spike. Eyes on US-China phase 1 sign off.