Though there was some moderate lift in risk-leaning assets and even a few technical milestones marked this past week, the markets have not yet committed to a clear direction nor even shift in momentum. That may change quickly in the week ahead as the docket holds a long list of critical events including the FOMC rate decision; key developed economy 3Q GDP updates; NFPs; Brexit votes and much, much more.

US Dollar Technical Forecast: EUR/USD, GBP/USD, USD/CAD, DXY

The Dollar rebounded last week, but can it turn that rebound into something more or will it fizzle out and resume lower?

Dow Jones, Nasdaq 100, DAX 30 and FTSE 100 Technical Forecasts

The Dow Jones and Nasdaq 100 tick ever closer to all-time highs, while the DAX 30 will look to pierce nearby resistance. Elsewhere, the FTSE 100 will look to reclaim its 200-day moving average.

Euro Price Outlook: EUR/USD Breakout Fails at Resistance- Reversal?

Euro is down more than 0.8% this week with price now probing areas of interest for support. Here are the levels that matter on the EUR/USD price charts.

Crude Oil Price Week Ahead, Technical Analysis Hints Turn Lower?

WTI crude oil prices still lack a clear trend this year despite the best week in over a month. Near-term technical signals hint a turn lower may be in store, will support give way?

Australian Dollar Technical Forecast: AUD/USD, AUD/JPY, GBP/AUD

The Australian Dollar is juxtaposed between an intimidating zone of technical resistance and rising trend support. As Aussie bears and bulls battle it out, watch these levels on AUDUSD, AUDJPY and GBPAUD.

Crude Oil Price Outlook Bearish on OPEC Output, Fed, US-China Trade

The crude oil price outlook is bearish as the Fed rate decision, US-China trade tensions and Brexit uncertainty risk overpowering upside pressure from the next OPEC production report.

Gold Price Outlook Hinges on Fed Rate Decision and Forward Guidance

The Federal Reserve interest rate decision is likely to influence the price of gold as the central bank is widely expected to deliver another rate cut in October.

Dow Jones and FTSE 100 Forecast for the Week Ahead

FTSE 100 posts the strongest weekly rise in 9-months as Pound drops on election risks, while Dow Jones looks to corporate earnings, NFP and Fed decision.

Sterling (GBP) Weekly Outlook Under Pressure From Brexit and Parliament

Sterling is flagging going into the weekend and may struggle to recover as the shambles otherwise known as Brexit continues to weigh on the British Pound.

Australian Dollar Market Will Be Fed Focused, But Watch Aussie CPI

A livelier week is in prospect for the Australian Dollar with one or two fascinating domestic data points in prospect before we get to the main event.

Pound Looks Primed for Technical Reversal…If Brexit Headlines Allow

Following an incredible sprint that swung GBPUSD over 6.5 percent higher in just two weeks, the pair finally took a breather this past week. A retreat looks overdue, but volatility and Brexit should make traders circumspect.

Gold Prices Must Break Key Chart Barrier to Resume Uptrend

Gold prices might be on the cusp of resuming an uptrend dating back to mid-2018 but they must first clear a critical chart barrier holding back gains.

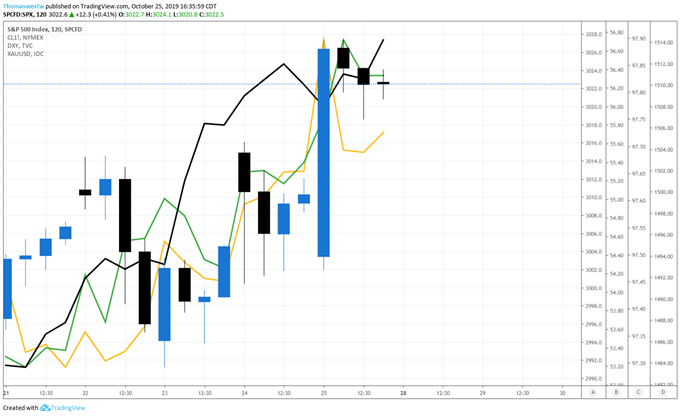

Chart Legend:

Oil – Black

USD – Green

Gold – Yellow