Dow Jones, Nasdaq 100, FTSE 100, DAX 30 Forecasts:

- The Dow Jones lags the S&P 500 and Nasdaq but could look to close the gap with nearby resistance lacking

- Meanwhile, the DAX 30 will look to surpass resistance in its pursuit of a bullish continuation

- Learn the different facts and opportunities when trading the Dow Jones, Nasdaq and S&P 500

Dow Jones, Nasdaq 100, FTSE 100, DAX 30 Technical Forecasts

Friday saw the S&P 500 and Nasdaq 100 grasp at all-time highs, while an underperforming Boeing worked to keep Dow Jones from similar levels. Nevertheless, the technical picture for each of the US indices suggests resistance to the topside still remains, but so too does investor’s bullish appetite. With that in mind, arguing against a continuation higher with stocks at such levels would be rather presumptuous.

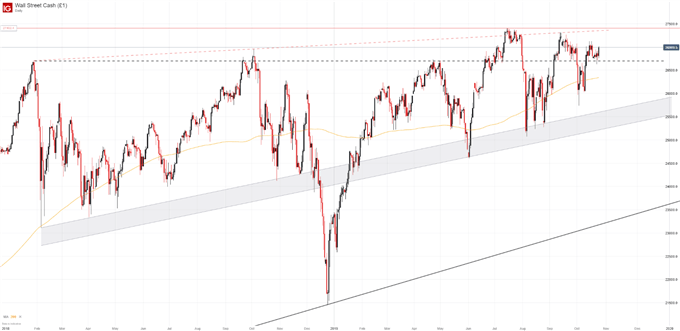

Dow Jones Forecast

Outlook: Bullish

To that end, the Dow Jones may continue higher in the week ahead. While there are undoubtedly underlying fundamental concerns for stocks, more often than not, the trend is your friend. Therefore, the Dow Jones could look to drive higher to 27400 as it enjoys a relatively unobstructed path before resistance.

Dow Jones Price Chart: Daily Time Frame (February 2018 – October 2019) (Chart 1)

Day Trading the Dow Jones: Strategies, Tips & Trading Signals

Conversely, if bullishness abates allowing bears to wrest control, initial support will look to reside around 26700. Secondarily, the Industrial Average will look for buoyancy at the 200-day moving average around 26350 which coincides with the upper bound of the Dow’s August range.

Nasdaq 100 Forecast

Outlook: Bullish

Like the Dow Jones, recent price action suggests the Nasdaq 100 has bullish momentum behind it. In pursuit of a bullish continuation, the tech-heavy index will first have to overcome prior highs around 8035. If surmounted, an ascending band of resistance marked by a series of prior highs will look to pose the final hurdle for a fresh breakout.

Nasdaq 100 Price Chart: Daily Time Frame (September 2018 – September 2019) (Chart 2)

On the other hand, bulls will look to enjoy support around 7860, marked by the Nasdaq’s swing high in May. Should the level fail to stall a bearish takeover, the index may enjoy subsequent support around 7715 where a confluence of technical levels reside.

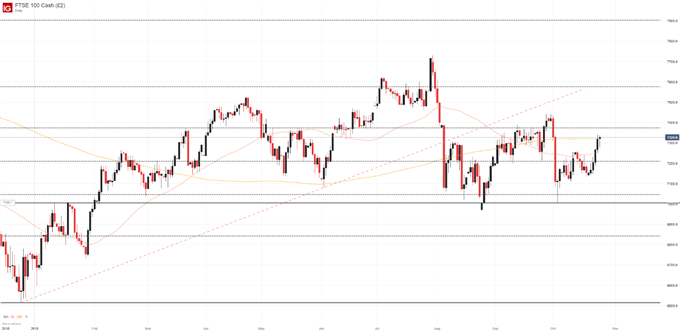

FTSE 100 Forecast

Outlook: Neutral

Given the fundamental backdrop for the FTSE 100, recent price trends may carry less weight. Nonetheless, the index’s proximity to the 200-day moving average is encouraging. Closing narrowly above the level on Friday, a higher open on Monday could look to start the index off on the right foot for the week ahead. Further, a reclamation of the level speaks to bullish interest which could see the FTSE 100 catch up to the gains of the French CAC 40 and German DAX 30 which have far outpaced the UK’s index.

FTSE 100 Price Chart: Daily Time Frame (December 2018 – October 2019) (Chart 3)

DAX 30 Forecast

Outlook: Neutral

Shifting to DAX 30, Friday’s price action highlighted the commitment of bears at resistance around 12895. A failure to break above the level last week could translate to a brief period of consolidation next week, especially given the index’s parabolic rally in October. While the longer-term technical picture is bullish, a minor drawdown in the shorter-term may be a healthy development. Thus, while confluent resistance at 12895 will look to keep the DAX in check, bulls will enjoy nearby support around 12700 in the event of contraction.

DAX 30 Price Chart: Daily Time Frame (June 2018 – October 2019) (Chart 4)

How to Trade the Dax 30: Trading Strategies and Tips

Still, the possibility of a bullish extension remains. If initial resistance can be surpassed, the index will enjoy an area of open air until the next technical barrier comes into play around 13200. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis on all the major stock indices.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Read more: Stock Market Q4 Forecast: The Weight of Trade Wars May Finally Crack the Dow Jones