Sentiment was just starting to find its balance this past week when another US-China trade war headline involving the US President hit the wires. Will this theme return to prominence next week or will we fall back on scheduled event risk?

US Dollar Forecast - US Dollar Rally May Resume on Fed Rate Hike Bets, Risk Aversion

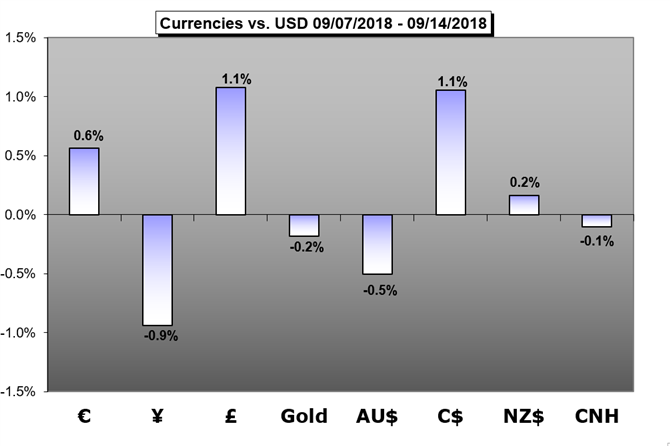

The US Dollar backtracked last week but a durable upshift in Fed interest rate hike expectations and the threat of renewed risk aversion may put it back on the offensive.

Euro Forecast: After ECB Holds, Italy to Come Back into Focus for Euro

The European Central Bank is sticking to its preset policy course as uncertainty around its inflation forecasts is receding, but with Italy back in the news, any goodwill injected into the Euro from the recent policy decision will likely be neutralized.

New Zealand Dollar Forecast - NZD Rise to Gain if GDP Sinks RBNZ Rate Cut Bets, Trade War a Risk

The recovery in New Zealand Dollar prices may continue if GDP data lowers RBNZ rate cut bets. US President Donald Trump rekindling trade war fears poses a risk for NZD/USD

Oil Forecast – Brent Up 10% Since August Low, Stubborn Supply Concerns Persist

Brent crude oil traded to the highest levels since May breaching $80/bbl, up nearly $10/bbl since the August low showing that price may move higher in line with longer-term fundamentals.

British Pound Forecast – Sterling Continues to Benefit From a Lack of Bad News

Sterling is back above GBPUSD 1.3100, despite a strong dollar, as a lack of negative Brexit news leaves GBP bolstered and inching higher.

Gold Forecast - Gold Price Hinges on US-China Trade War Developments

Gold continues to act out of character, trading lower when risks arise and higher when markets climb. Retail positions are net-long, so gold may fall further.

Australian Dollar Forecast – Australian Dollar Remains Pressured But May Get Some More Respite

The Australian Dollar has swooned this year despite a strong domestic economic performance. Its fall may pause into this week but it’s probably not over

Chinese Yuan Forecast –Yuan Looks to Resumed Trade Talks, Summer Davos Forum for Outlook

The USD/CNH approaches 6.9, a key threshold once again; whether it can hold or break may be determined by the progress of resumed trade talks as well as the outlook of China’s economy.

Equities Forecast – S&P 500 Maintains Solid Trend, Can the DAX and FTSE Follow Higher?

U.S. stocks continue to look poised for higher prices, can the DAX and FTSE find their footing and feed of strength in the world’s largest stock market?

See what live coverage is scheduled to cover key event risk for the FX and capital markets on the DailyFX Webinar Calendar.

See how retail traders are positioning in the majors using the IG Client Sentiment readings on the sentiment page.