Fundamental Forecast for GBP: Bullish

Sterling (GBP) Talking Points:

- Brexit continues to dominate although hard UK data surprises to the upside.

- Bank of England remains cautious as talks progress.

The DailyFX Q3 GBP Forecast is available to download.

We remain bullish on Sterling going into next week after the latest jobs, wages and GDP data all came in better-than-expected this week, while a lack of any negative Brexit news leaves the British Pound looking under-valued. The main data point next week is the latest Consumer Price Inflation release on Wednesday at 08:30 GMT with the latest market expectations a nudge lower in annual CPI to 2.4%. This remains above the central bank’s target of around 2% and the latest uptick in wages will be closely watched by the BOE for any additional inflationary feed through into prices. The central bank left all policy measures unchanged at this week’s MPC meeting.

Brexit negotiations remain ongoing with the atmosphere around the talks more amenable with both sides mentioning concessions on previous red-lines, sending a slightly more positive signal to the financial markets. With talks ongoing and nearing deadlines, much work is still needed, especially over the Irish Border, and headlines will continue to drive Sterling.

The comprehensive DailyFX Economic Calendar for the week ahead provides traders with updated data and forecasts across all major currencies. On Monday we will be taking an in-depth look at the important UK data releases, Brexit and other UK asset market drivers at 10:30GMT in our weekly UK Key Events and Markets Webinar.

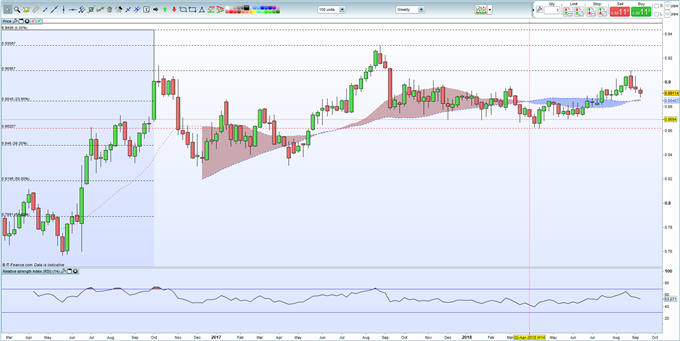

EURGBP continues to move slowly lower and should be used as a Brexit barometer over GBPUSD and other crosses. Any positive news sees the pair move lower within a 2018 range of 0.8600 to 0.9100.

EURGBP Weekly Price Chart (March 2017 – September 14, 2018)

DailyFX analyst Paul Robinson’s latest video on how to become a better, more consistent trader is a must listen for market participants seeking an edge. As Paul notes early in his piece, ‘Markets are too dynamic, full of too much uncertainty, to try and navigate them without a framework in place. Trading plans are imperative for creating consistent results'. Becoming a Better Trader – How to Create a Trading Plan.

Traders may also be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1

Other Fundamental Forecast:

New Zealand Dollar Forecast - NZD Rise to Gain if GDP Sinks RBNZ Rate Cut Bets, Trade War a Risk

Oil Forecast – Brent Up 10% Since August Low, Stubborn Supply Concerns Persist