Canadian Dollar Technical Price Outlook: USD/CAD Weekly Trade Levels

- Canadian Dollar updated technical trade levels - Weekly Chart

- USD/CAD breakout eyed first major resistance hurdle- rally vulnerable into yearly open

- Critical support 1.2230- Resistance 1.2579-1.2635, 1.2713 Key

The Canadian Dollar has embarked on what could be a third weekly losing streak against the US Dollar with the USD/CAD breakout now up more than 4.1% off the May low. Although the medium-term outlook remains constructive, the immediate advance may be vulnerable in the days ahead as price stalls into the first major technical resistance zone. These are the updated targets and invalidation levels that matter on the USD/CAD weekly technical price charts. Review my latest Strategy Webinar for an in-depth breakdown of this Loonie technical setup and more.

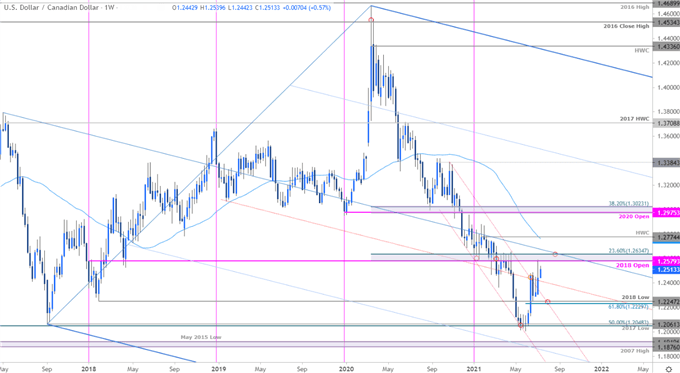

Canadian Dollar Price Chart – USD/CAD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; USD/CAD on Tradingview

Notes: In my last month’s Canadian Dollar Weekly Price Outlook we highlighted a rebound off confluence downtrend support in USD/CAD while noting that, “losses should be limited to 1.2247 IF price is indeed heading higher with a breach / close above 1.2634 ultimately needed to suggest a more significant low is in place.” Price registered a low at 1.2252 the following week before rallying more than 2.7% with the advance taking Loonie into a key technical resistance range at 1.2579-1.2634- a region defined by the 2018 objective yearly open and the 23.6% Fibonacci retracement of the 2020 decline. We’re on the lookout for possible price inflection off this threshold.

Monthly open support rests at 1.2395 with broader bullish invalidation now raised to the 61.8% retracement of the May advance / 2018 low at 1.2230/47- an area of interest for possible downside exhaustion IF reached. A topside breach / close above the median-line (blue) / yearly open at 1.2713 would be needed to mark resumption with such a scenario exposing 52-week moving average / 2021 high-week close at 1.2762/74 and the yearly highs at 1.2881.

Bottom line: The USD/CAD breakout has extended into the first major weekly resistance hurdle- looking for inflection here with the May rally at risk while below. From at trading standpoint, the threat remains for a larger correction while below the yearly open- ultimately losses should be limited by 1.2230 IF price is indeed heading higher with a topside breach keeping the focus on the yearly high-week close. Review my latest Canadian Dollar Price Outlook for a closer look at the near-term USD/CAD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

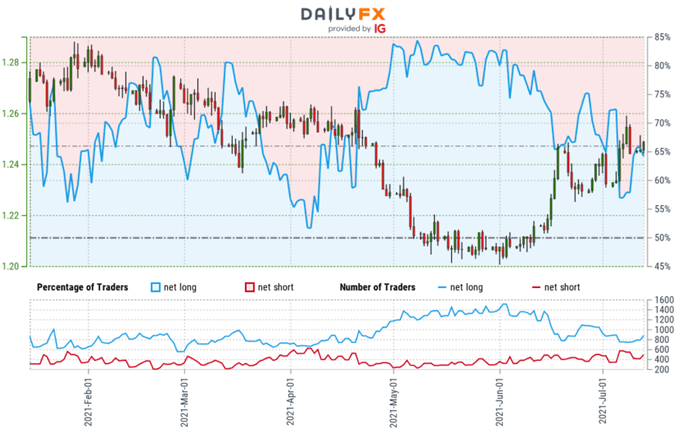

Canadian Dollar Trader Sentiment – USD/CAD Price Chart

- A summary of IG Client Sentiment shows traders are net-long USD/CAD - the ratio stands at +2.06 (67.31% of traders are long) – typically bearish reading

- Long positions are11.93% higher than yesterday and 6.41% higher from last week

- Short positions are 9.33% higher than yesterday and 6.72% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall. Traders are more net-long than yesterday but less net-long from last week. The combination of current positioning and recent changes gives us a further mixed USD/CAD trading bias from a sentiment standpoint.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

---

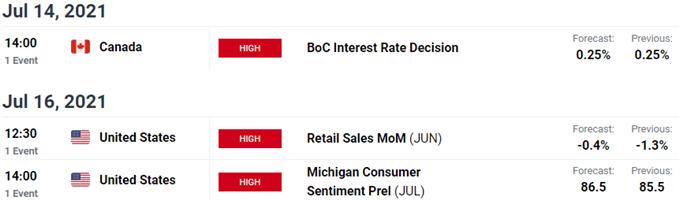

US / Canada Economic Calendar

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- US Dollar Index (DXY)

- Gold (XAU/USD)

- Crude Oil (WTI)

- New Zealand Dollar (NZD/USD)

- Japanese Yen (USD/JPY)

- Sterling (GBP/USD)

- Australian Dollar (AUD/USD)

- Euro (EUR/USD)

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex