New Zealand Dollar Technical Price Outlook: NZD/USD Weekly Trade Levels

- New Zealand Dollar updated technical trade levels - Weekly Chart

- NZD/USD plummets into uptrend support- July opening-range in focus

- Critical support 6941/69 – Resistance 7111, 7169

The New Zealand Dollar is trapped in a contractionary zone against the US Dollar just below critical technical resistance and the focus is on a possible breakout as we head into the June open. These are the updated targets and invalidation levels that matter on the NZD/USD weekly price chart heading into next week. Review my latest Strategy Webinar for an in-depth breakdown of this Kiwitrade setup and more.

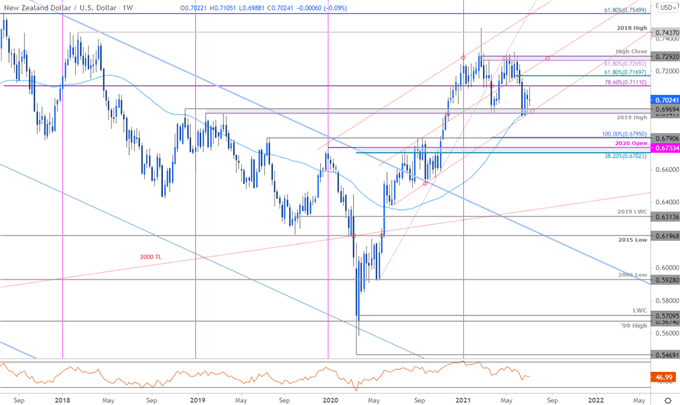

New Zealand Dollar Price Chart – NZD/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; NZD/USD on Tradingview

Notes: In last month’s New Zealand Dollar Price Forecast I noted that Kiwi was ranging just below a key resistance confluence at 7265/92- a region defined by the 61.8% Fibonacci retracement of the yearly range / 2021 high-close. We highlighted that, “Initial support rests with the parallel near ~7150s with a break / close below 7085-7111 needed to shift the broader focus lower again in Kiwi towards the yearly lows / key support at 6941/69.” NZD/USD broke lower the following week with price plummeting more than 5.3% to register a low at 6923 before rebounding. The focus now shifts to July opening-range as Kiwi responds to confluence uptrend support.

Initial weekly resistance now stands back at 7111 backed by the 61.8% retracement of the May decline at 7169- look for topside exhaustion ahead of this threshold IF price is indeed heading lower. Key support steady at 6941/69 (note that the 52-week moving average also now converges on this zone)- a break / close below would likely risk another bout of accelerated losses with such a scenario exposing the 100% extension of the yearly decline / July 2019 swing high at 6790/95backed by 6702/33.

Bottom line: The New-Zealand Dollar has plunged into confluence uptrend support and we’re looking for possible inflection off this zone. From at trading standpoint, a good region to reduce short-exposure / lower protective stops – look for a break of the July opening-range for guidance here with the May decline at risk while above the yearly lows. Ultimately, a breach / close above 7265/92 would be needed to mark resumption of the broader uptrend. I’ll publish an updated New Zealand Dollar Price Outlook once we get further clarity on the near-term technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

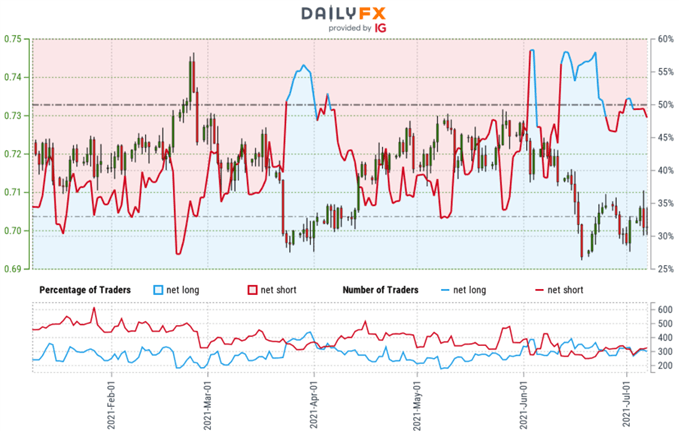

New Zealand Dollar Trader Sentiment – NZD/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-short NZD/USD - the ratio stands at -1.12 (47.20% of traders are long) – typically weak bullish reading

- Long positions are 7.42% higher than yesterday and unchanged from last week

- Short positions are 17.07% lower than yesterday and 12.14% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests NZD/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current NZD/USD price trend may soon reverse lower despite the fact traders remain net-short.

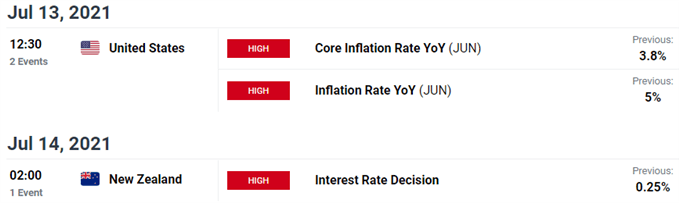

Key New Zealand / US Economic Releases

Economic Calendar - latest economic developments and upcoming event risk.

Previous Weekly Technical Charts

- Japanese Yen (USD/JPY)

- Gold (XAU/USD)

- Sterling (GBP/USD)

- Australian Dollar (AUD/USD)

- Canadian Dollar (USD/CAD)

- Euro (EUR/USD)

- US Dollar Index (DXY)

- Crude Oil (WTI)

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex