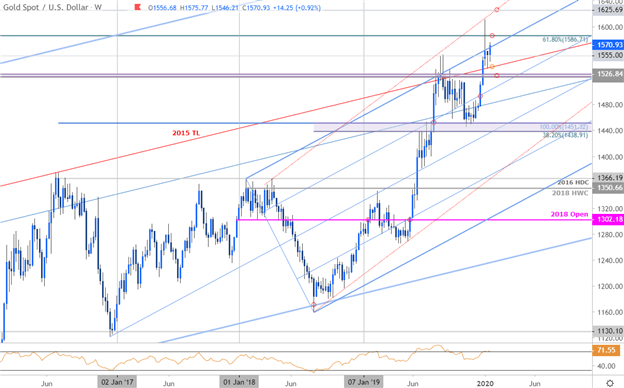

Gold Technical Price Outlook: XAU/USD Weekly Trade Levels

- Gold price updated technical trade levels - Weekly Chart

- XAU/USD attempting to mark fresh multi-year, high-close; remain vulnerable sub-1586

- New to Gold Trading? Get started with this Free How to Trade Gold -Beginners Guide

Gold prices rallied nearly 1% this week with XAU/USD trading at 1570 ahead of the New York close on Friday. Bullion is attempting to mark the highest weekly close since April 2013 and while the broader focus remains weighted to the topside, the advance may still be vulnerable below key Fibonacci resistance just higher. These are the updated targets and invalidation levels that matter on the XAU/USD weekly chart. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold trade setup and more.

Gold Price Chart - XAU/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; Gold on Tradingview

Notes:In last Gold Price Weekly Outlook we noted that, “immediate focus is on 1555 backed closely by the upper parallel of the ascending pitchfork formation we’ve been tracking off the 2016 / 2018 lows (currently ~1566). A topside breach / close above is needed to keep the broader long-bias viable targeting the 61.8% retracement of the 2011 decline at 1586 and 1625.” A topside breach on January 5th fueled a rally that saw prices register a high at 1611 before reversing with gold failing to mark a weekly close above pitchfork resistance / the 1586 resistance target. XAU/USD is once again eyeing these resistance barriers with price attempting to post the first weekly close above the upper parallel.

Ultimately a breach / close above 1586 would be needed to keep the broader long-bias in play targeting 1625. Initial weekly support rests with the February 2013 lows at 1555 backed by the 2015 trendline (currently ~1535s) and key support / broader bullish invalidation at 1522/26 – an area of interest for possible exhaustion / long-entries IF reached.

Bottom line:The focus is on a weekly close in relation to long-term upslope resistance with a close above needed to keep the focus on 1586- look for a bigger reaction there IF reached. From a trading standpoint, the focus does remain higher for now, but the rally may be vulnerable while below this lateral level with the exhaustion risk still high here. Review my latest Gold Price Outlook for a closer look at the near-term XAU/USD technical trading levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

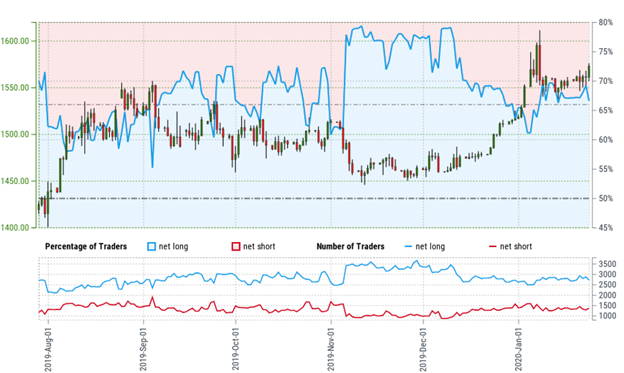

Gold Trader Sentiment – XAU/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-long Gold - the ratio stands at +2.15 (68.24% of traders are long) – bearish reading

- Long positions are6.46% lower than yesterday and 0.93% lower from last week

- Short positions are5.12% higher than yesterday and 5.13% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Yet traders are less net-long than yesterday but more net-long from last week and the combination of current positioning and recent changes gives us a further mixed Gold trading bias from a sentiment standpoint.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

---

Previous Weekly Technical Charts

- Canadian Dollar (USD/CAD)

- New Zealand Dollar (NZD/USD)

- US Dollar (DXY)

- Euro (EUR/USD)

- Australian Dollar (AUD/USD)

- Crude Oil (WTI)

- Japanese Yen (USD/JPY)

- Sterling (GBP/USD)

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex