- EUR/USD reverses offcritical resistance range into yearly open at 1.12

- Risk for further losses with near-term technical support in view

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Euro has been on the defensive against the US Dollar since the start of the year with EUR/USD down nearly 0.5% this week after turning from a key resistance range. While further losses area likely, we’re looking for more significant weekly support just lower. These are the updated targets and invalidation levels that matter on the EUR/USD weekly price chart. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Euro trade setup and more.

Euro Price Chart – EUR/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; EUR/USD on Tradingview

Notes: In my last Euro Weekly Price Outlook we noted that EUR/USD was approaching a critical barrier at 1.1187-1.1209 – a region defined by the 61.8% retracement of the 2017 advance and the 61.8% retracement of the June 2019 decline. Price briefly registered a high at 1.1239 into the close of the year before reversing sharply with Euro now down more than 1.2% off the highs. Note that weekly RSI has continued to hold sub-60 since the 2018 highs in price and suggests the momentum profile still leans in favor of the bears for now.

Weekly support is eyed at the 1.44% parallel, currently around ~1.1050s, backed by the 61.8% retracement of the September rally at 1.1017. Broader bullish invalidation remains with the 2019 low-week reversal close at 1.0977. A topside breach / close above 1.1209 is needed to mark resumption with a such a scenario eyeing subsequent resistance objectives at 1.1282/98- look for a larger reaction there IF reached.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line: Euro has responded to key weekly resistance and the focus is on this pullback early in the month. IF this is corrective, losses should be limited to the 1.10-handle. From a trading standpoint, look for downside exhaustion on stretch towards the lower parallels for possible entries. I’ll publish an updated Euro Price Outlook once we get further clarity on the near-term EUR/USD technical trade levels.

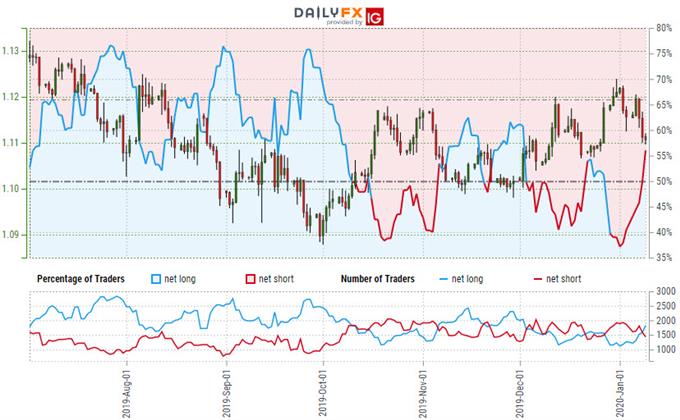

Euro Trader Sentiment – EUR/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-long EUR/USD - the ratio stands at +1.26 (55.84% of traders are long) – weak bearish reading

- Long positions are21.82% higher than yesterday and 64.66% higher from last week

- Short positions are 5.72% lower than yesterday and 23.99% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Traders are further net-long than yesterday & last week, and the combination of current positioning and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias from a sentiment standpoint.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

---

Previous Weekly Technical Charts

- Australian Dollar (AUD/USD)

- Crude Oil (WTI)

- Japanese Yen (USD/JPY)

- Sterling (GBP/USD)

- Gold (XAU/USD)

- US Dollar Index (DXY)

- Canadian Dollar (USD/CAD)

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex