- Technical trade setups we’re tracking across the USD Majors / Commodities this week

- Check out our latest projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

US Dollar Testing Major Yearly Uptrend Support - Gold Prices Rip into Major Resistance

It’s the start of a new month / quarter / year and the US Dollar is testing multi-year trend support into the open. The position leaves the immediate decline off the October highs vulnerable early in the month and we’re looking for an exhaustion recovery to fade in the greenback. Meanwhile, gold prices have surged into a critical long-term resistance target which is likely to interrupt / cap the recent rally near-term. In this webinar we review updated technical setups on DXY, EUR/USD, GBP/USD, USD/JPY, USD/CAD, AUD/USD, Gold(XAU/USD), Silver (XAG/USD), Crude Oil, and SPX (S&P 500).

Key Trade Levels in Focus

US Dollar – The US Dollar Index is trading just above multi-year upslope support. The immediate downside bias is vulnerable into the start of the week – key lateral support 95.98-96.14–look for a larger reaction there IF reached. Initial resistance 97.30 with bearish invalidation 97.71/87. Review my latest US Dollar Price Outlook for a closer look at the longer-term weekly DXY technical trade levels.

EUR/USD – Euro opens the week just below a critical resistance range at 1.1187-1.1209 – looking for a reaction off this mark early in the week with the immediate advance vulnerable while below. Initial support 1.1140 backed by near-term bullish invalidation at 1.1110 – both levels of interest for possible exhaustion IF reached. A topside breach / close higher targets 1.1250 and 1.1282-1.1306. Review my latest Euro Price Outlook for a closer look at then longer-term weekly EUR/USD technical trade levels.

GBP/USD – Sterling is trading within a wide range and a re-work of the daily chart highlights the risk for a test of upslope support before resumption higher. Initial resistance at 1.32 backed by 1.3281-1.3310 – look for failure ahead of this region IF price is indeed heading lower first. Downside support objectives at 1.3049 and 1.2990 – a break / close below 1.2907 would suggest a larger correction is underway. Review my latest Sterling Price Outlook for a look at the longer-term GBP/USD technical trade levels.

USD/CAD – Price is testing confluence support into the open at 1.2971 – looking for a reaction here early in the week. Resistance at 1.3050 backed by 1.3086 (near-term bearish invalidation). A break lower exposes subsequent support objectives at 1.2916 and 1.2861/84. Review my latest Canadian Dollar Price Outlook for a closer look at the USD/CAD intraday technical trade levels.

Gold– Gold is testing critical, long-term, Fibonacci resistance at 1586 – the long-bias is at risk while below this threshold. Initial support now 1522/26 with bullish invalidation set to the monthly / yearly open at 1520. A topside breach exposes 1626. Review my latest Gold Price Outlook for a closer look at the longer-term XAU/USD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

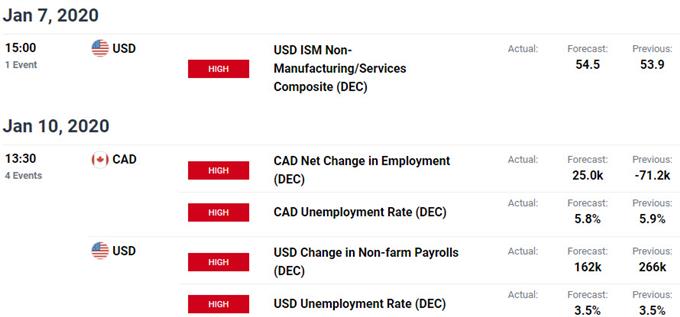

Key Event Risk This Week

Economic Calendar - latest economic development and upcoming event risk

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex