New Zealand Dollar Technical Price Outlook: NZD/USD Weekly Trade Levels

- New Zealand Dollar updated technical trade levels - Weekly Chart

- NZD/USD plummets off late-2019 high but holding multi-month uptrend

- Risk for Kiwi downside exhaustion heading into key technical support confluence

The New Zealand Dollar is poised to mark the fourth consecutive weekly decline against the US Dollar with NZD/USD down more-than 2.4% off the late-December highs. The pullback keeps price within the broader September rally and Kiwi will need to respond to nearby support to keep the long-bias viable. These are the updated targets and invalidation levels that matter on the NZD/USD weekly price chart. Review my latest Strategy Webinar for an in-depth breakdown of this Kiwitrade setup and more.

New Zealand Dollar Price Chart – NZD/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; NZD/USD on Tradingview

Notes: In my last New Zealand Dollar Weekly Price Outlook we noted that Kiwi was approaching a,“major level of confluence resistance at 6506,” with a close above needed to fuel the next leg higher in NZD/USD. A topside breach in mid-December saw price register a high at 6755 last year before turning sharply lower off a sliding parallel extending off the April 2018 high (red). Weekly confluence support rests near 6545 where the 38.2% retracement of the September advance converges on basic trendline support and the 25% parallel of the ascending pitchfork formation extending off the 2018 / 2019 lows. We’re on the lookout for an exhaustion low while above this threshold IF Kiwi is to hold this uptrend.

Weekly resistance remains with the 2019 open at 6705 backed closely by the 2020 yearly open at 6733. Ultimately a breach / close above the July high-week close at 6760 would be needed to suggest a more significant breakout is underway targeting the median-line, currently just above 6800. A close below medium-term bullish invalidation at 6545 would expose subsequent support objectives at the 2016 low-week close at 6481 and the 2018 low-close at 6436 – both levels of interest for possible downside exhaustion IF reached.

Bottom line: The New Zealand Dollar is pulling back from long-term down-trend resistance and the immediate focus is on this pullback. The medium-term outlook remains constructive while within this channel – look for a reaction on a stretch lower towards uptrend support. From at trading standpoint, look to reduce short-exposure / raise protective stops heading into 6545 – risk for downside exhaustion while above. I’ll publish an updated New Zealand Dollar Price Outlook once we get further clarity on the near-term NZD/USD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

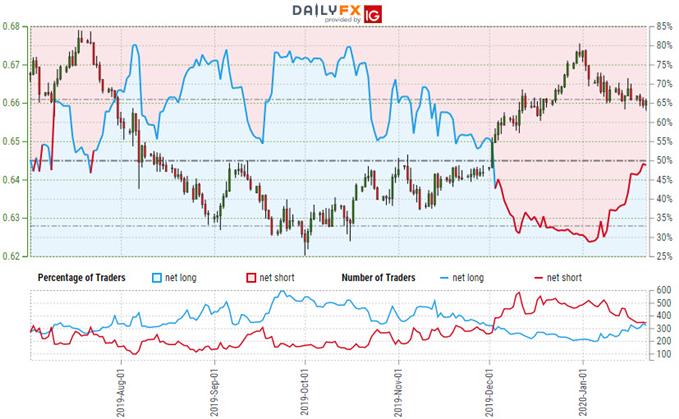

New Zealand Dollar Trader Sentiment – NZD/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-short NZD/USD - the ratio stands at -1.07 (54.8% of traders are long) – neutral reading

- Long positions are4.31% higher than yesterday and 7.62% higher from last week

- Short positions are 3.12% higher than yesterday and 18.20% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests NZD/USD prices may continue to rise. Yet traders are less net-short than yesterday & compared with last week and the recent changes in sentiment warn that the current NZD/USD price trend may soon reverse lower despite the fact traders remain net-short.

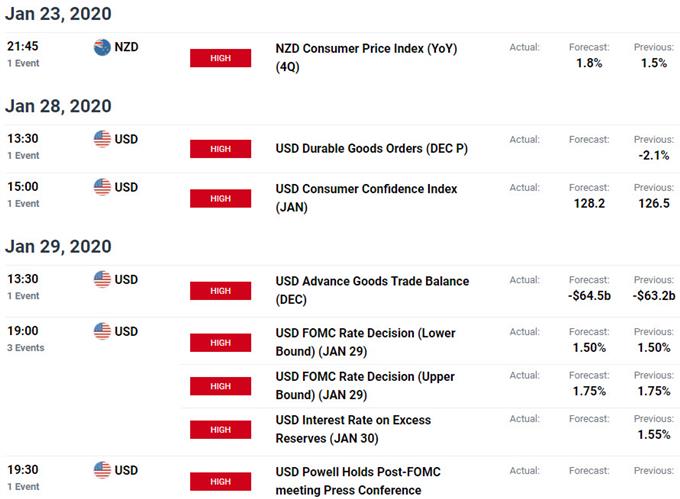

Key New Zealand / US Economic Releases

Economic Calendar - latest economic developments and upcoming event risk.

Previous Weekly Technical Charts

- US Dollar (DXY)

- Canadian Dollar (USD/CAD)

- Euro (EUR/USD)

- Australian Dollar (AUD/USD)

- Crude Oil (WTI)

- Japanese Yen (USD/JPY)

- Sterling (GBP/USD)

- Gold (XAU/USD)

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex