This past week reflected a strong charge in risk-leaning assets like the Dow under the auspices of an impending US-China trade deal. Progress was found between these two key players through Friday, but does that translate into an unrestrained climb in speculative assets ahead? What about the expectations around recession warnings from the IMF or the Dollar’s tentative reversal from multi-year highs?

AUD in Thrall to US-China Trade Story, RBA Minutes, Jobless Data Loom

There’s domestic interest for Australian Dollar investors this week. Full-time employment growth disappointed last month. If it does so again the currency could slide.

Oil Prices to Stay Afloat for as OPEC Emphasizes December Meeting

Recent developments coming out of OPEC may fuel the recent rebound in the price of crude oil as group emphasizes its pledge to balance the energy market.

US Dollar (USD) Weekly Outlook: US-China Trade Talks are Key

The US dollar is on the back foot and is trading at lows seen three-weeks ago as optimism builds that the US and China will find some common ground and avert escalating the 15-month old trade war.

GBP Braces For Brexit Turmoil, EU Summit: Will There be a Deal?

The British Pound will be in for a volatile week ahead of critical talks at the EU-UK summit as the October 31 deadline approaches. Will policymakers be able to avoid a no-deal Brexit?

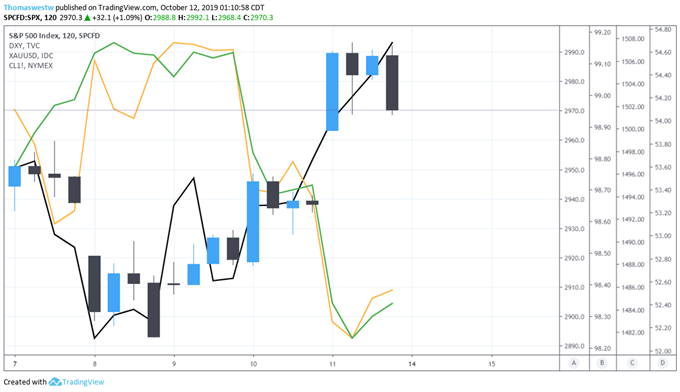

S&P 500 & FTSE 100 Fundamental Forecast

Event-driven sentiment means that key focus remains on Brexit negotiation and US-China trade talk progress to extend equity market gains. We are ourselves, deal of no deal?

Euro Signal for Reversal Not as EURUSD Alone Suggests

EURUSD ended this past week with a tempting technical move: an extended rebound that has pushed the market through a three-month descending bear trend to multi-year lows. But, is this a reliable reversal?

Gold Price Forecast: Constrained by Pattern, Long-term Resistance

Gold weakened a bit last week, but weakness might only be modest as bigger-picture pattern develops under long-term resistance.

Sterling Price Outlook: British Pound Surges into Critical Resistance

Sterling surged more than 2.7% this week with the British Pound now testing major down-trend resistance. Here are the levels that matter on the GBP/USD weekly chart.

Australian Dollar Technical Forecast: AUD/USD, AUD/JPY, GBP/AUD

The Australian Dollar arguably needs more progress to reverse downtrends against the US Dollar and Japanese Yen. Meanwhile, will the British Pound accelerate its advance against AUD?

Chart Legend:

Oil = Black

XAUUSD = Yellow

DXY = Green