GBP Forecast, Brexit, EU Summit

- British Pound may experience unusually-high volatility ahead of crucial EU summit

- Markets may find out this week if the UK can deliver an orderly Brexit – or a crash

- GBP also faces headwinds from global growth forecasts and possible snap election

Learn how to use political-risk analysis in your trading strategy!

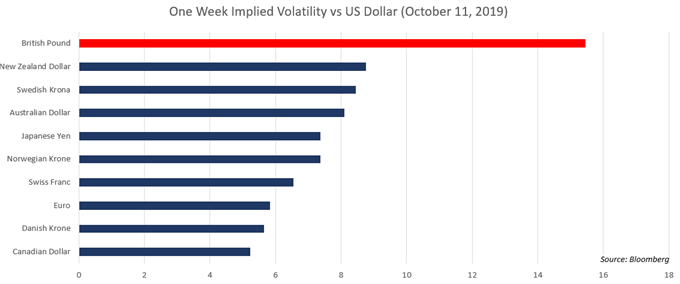

The British Pound is expected to be the most volatile G10 currency vs the US Dollar over a one-week period. However, given the circumstances and timeline of events, this does not come as a surprise. UK Prime Minister Boris Johnson will be attending the EU summit from October 17-18 in a bid to secure a Brexit deal with European policymakers before the formidable October 31 deadline is reached.

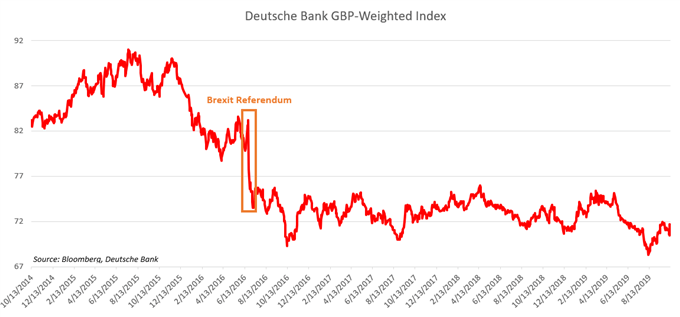

Last week, Mr. Johnson met with Irish Prime Minister Leo Varadkar who said after the meeting that there could be a potential “pathway” for a divorce deal. This proceeded gloomy presentiments between Johnson and German Chancellor Angela Merkel which eroded hopes for an orderly Brexit. Progress with Mr. Varadkar gave traders a reason to rejoice because it may lead to a resolution to the highly-contested Irish backstop.

If he fails, he is compelled by law to ask the EU for an extension – with a pre-written request he would submit to Brussels – to delay the divorce until January 2020. However, this may be difficult as Mr. Johnson has said that he would rather be “dead in a ditch” than delay Brexit. Investors and policymakers alike will be very closely monitoring key comments and developments from the summit.

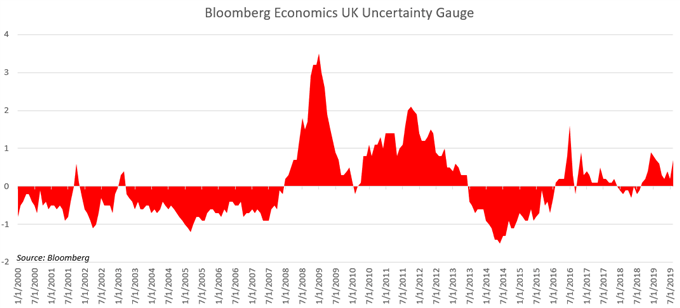

Prior to the summit, on October 14, Queen Elizabeth II will open a new session of Parliament where she will speak about the PM’s new legislative plans. Lawmakers are expected to vigorously debate Mr. Johnson’s framework and may even vote down his proposed policies. There is speculation that this could lead to a vote of no confidence and a possible snap election less than three weeks from the official deadline.

To put it simply: this will be a week of tense uncertainty because each decision will likely have radical implications for how Brexit plans will proceed which will be mirrored in price action in the Pound. As I have been writing for several months in regard to Brexit and Sterling: There is no telling when a sudden political development will cross the headlines and what the respective magnitude of the price swing will be.

The week ahead also contains other potential market-moving events that may exacerbate price swings in the Pound. These include the IMF’s updated World Economic Outlook with an accompanying speech by the newly-appointed Director Kristina Georgieva who last week warned of a “synchronized” global slowdown. It is anticipated her speech will likely carry the same gloomy undertones amid international trade tensions.

The US is scheduled to impose multi-billion dollars tariffs against the European Union after a recent WTO ruling awarded former the right to retaliation for the latter’s illegal subsidies to air crafter giant Airbus. The levies are expected to be goods ranging from cheese to scotch whiskey. A continent that is already being plagued by internal economic strife is now about to face additional pressure from protectionist-unilateralism.

GBP TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter