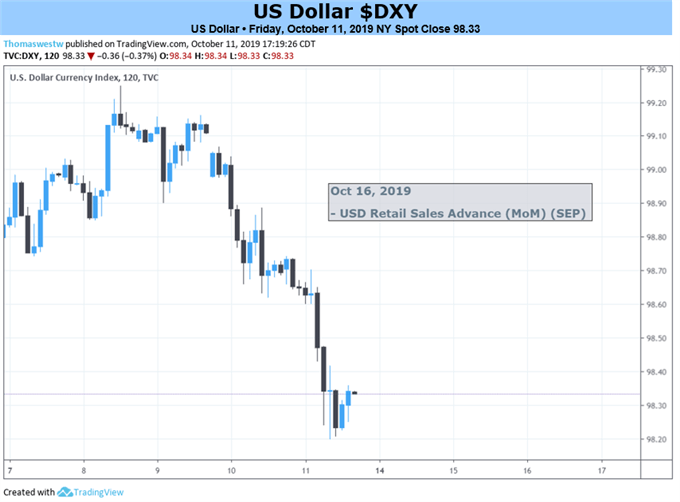

USD 2-Hour Price Chart

US Dollar Forecast: Neutral

- US-China trade talks are going ’really well’ according to President Trump.

- Risk-on markets weigh on the US dollar

Brand New Q4 2019 USD Forecast and Top Trading Opportunities

USD Under Pressure as Trade Talks Progress

The US dollar has fallen around 1.5% from its 27-month high made on October 1, with sell-off accelerating in the last two days as the US and China sit down for trade talks. US President Trump is seemingly pleased with progress, describing the talks as going ‘really well’, but proof will be needed in the next couple of days to keep current market sentiment afloat. Reports say that China will buy additional agricultural products and may look at acting on market access and intellectual property.

Real progress needs to be made very quickly with a tariff increase - from 25% to 30% - due to be applied to USD250 billion of Chinese goods on October 15. In addition, a fresh round of tariffs - 15% - are due to be slapped on a further $156 billion of Chinese imports on December 15.

The ongoing trade spat between the world’s two largest super powers has caused global growth to not just stagnate but, in some instances go into reverse, so the outcome of today’s meeting will be a potential market mover across a range of financial markets. We should know the upshot of the latest talks very soon.

The economic calendar next week is busy but with only a few top line releases for traders to look at. The release of the latest Federal Reserve Beige Book next Wednesday will probably be the most important event of the week.

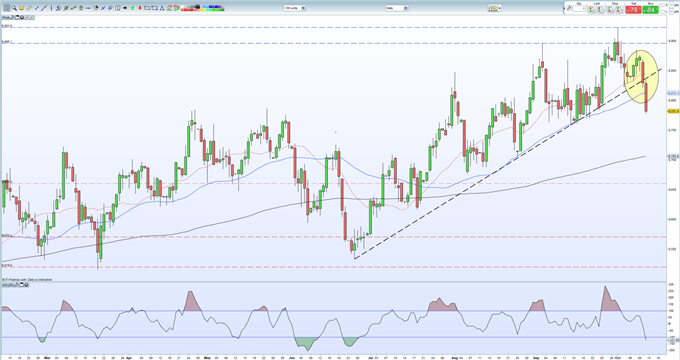

The latest slide lower in the US dollar basket has broken the recent supportive uptrend and DXY may struggle to break back above trend soon, unless trade talks break down and the US dollar regains its safe-haven status. Additional US dollar analysis can be found in the USD technical report.

US Dollar Basket (DXY) Price Chart (February – October 11, 2019)

IG Client Sentiment shows that how traders are positioned in a wide range of assets and markets.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.