For an extensive analysis of gold’s fundamental and technical outlook, download our complimentary quarterly trading forecast now!

GOLD PRICE TECHNICAL ANALYSIS

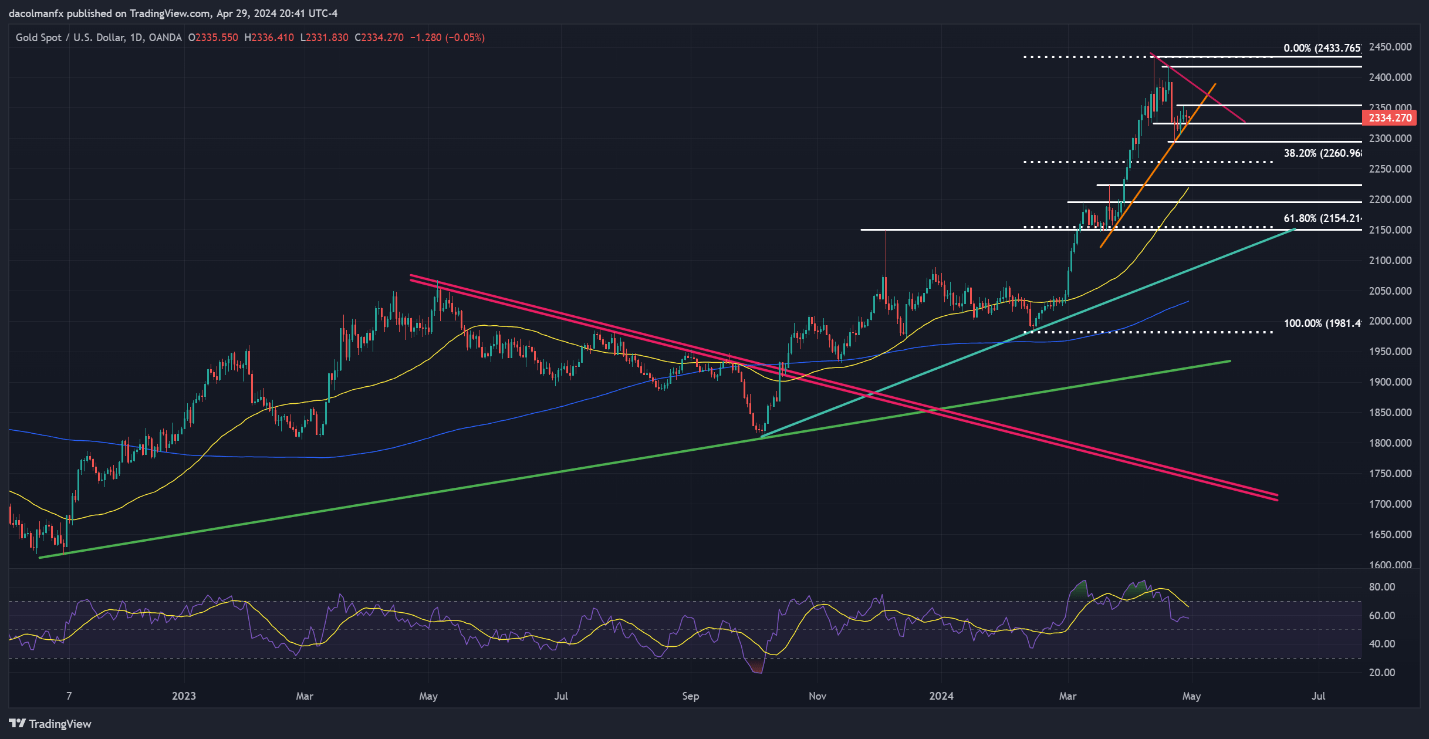

Gold prices fell on Monday, but the decline was modest, with many traders on the sidelines and avoiding making large directional bets ahead of high-profile events later in the week, such as the FOMC monetary policy announcement and the release of U.S. employment data. Against this backdrop, volatility could be limited at least until Wednesday afternoon, when the U.S. central bank's decision/guidance is expected.

Focusing on price action analysis, trendline support at $2,320 could bring stability to the market and prevent the recent pullback from gaining momentum. However, a breach of this technical indicator could encourage the bears to launch an attack on $2,295. Continued losses from this point forward could pave the way for a retrenchment towards $2,260, the 38.2% Fib retracement of this year’s rally.

In case of a bullish rebound from current levels, resistance can be spotted at $2,355, followed by $2,395, which corresponds to a key trendline extended off the all-time high. Overcoming this barrier may prove challenging for bulls, but if a breakout emerges, a move toward $2,420 is conceivable, followed by a potential retest of last week's record.

GOLD PRICE TECHNICAL CHART

Gold Price Chart Created Using TradingView

Want to understand how retail positioning can impact USD/JPY’s journey in the near term? Request our sentiment guide to discover the effect of crowd behavior on FX market trends!

| Change in | Longs | Shorts | OI |

| Daily | -13% | 1% | -3% |

| Weekly | -13% | -8% | -9% |

USD/JPY TECHNICAL ANALYSIS

USD/JPY rallied late last week, with prices blasting past the upper boundary of a medium-term ascending channel to reach new multi-decade highs. However, this bullish momentum quickly reversed on Monday. Sellers emerged when the exchange rate flirted with the 160.00 mark, pushing the pair back down towards 156.00, suggesting the breakout may have been a fakeout.

The cause of Monday's bearish reversal remains unclear. Intervention by the Japanese government to stem the yen’s bleeding and curb speculation is a possibility. This uncertainty, coupled with the fear of being caught off guard by further intervention, may keep USD bulls at bay for the time being. With buyers on the sidelines and upward pressure fading, USD/JPY could see a slight pullback in the coming days.

In the event of USD/JPY continuing in a downward trajectory in the near term, support is seen at 154.65, followed by 153.20. On further weakness, all eyes will be on 152.00 mark, located slightly above the 50-day simple moving average. Further down, channel support emerges at 150.90. On the flip side, if bulls regain control and spark a decisive breach of 157.00, a retest of the 160.00 level could be in the cards.

USD/JPY TECHNICAL CHART