Sterling FX-Pairs Technical Analysis

- GBPUSD remains within range and may soon flash a positive technical signal.

- EURGBP slips around 0.5% lower on the week and nears resistance.

We have recently released our Q1 Trading Forecasts for a wide range of Currencies and Commodities, including GBPUSD with our fundamental and medium-term term technical outlook.

Last week’s technical outlook outlined a bullish Sterling set-up but also warned that both GBPUSD and EURGBP were at or in overbought territory using the RSI indicator. Technical bias for both remains positive but invalidation levels are near and should be noted.

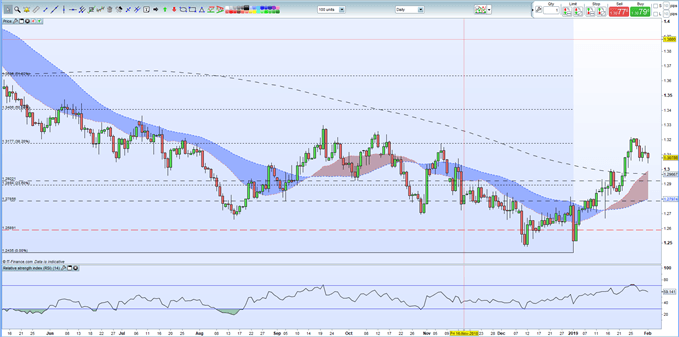

The updatedGBPUSDchart shows the pairstill trading above all three moving averages including the important long-term 200-dma and while this remains the case then sentiment remains positive. We also noted mid-week that a potential ‘Golden Cross’ is taking shape although the 50-day and 200-day cross, if it happens, may take another few days to show up on the chart. To the upside the 38.2% Fibonacci retracement level at 1.3177 blocks the recent multi-week high at 1.3220, before the important September 20 high at 1.3298. A break and close above here should fully negate the recent series of major lower highs and leave further upside possible. Support between 1.2990 and 1.2965.

Looking for a fundamental perspective on GBP? Check out the Weekly GBP Fundamental Forecast.

GBPUSD Daily Price Chart (May 2018 - February 1, 2019)

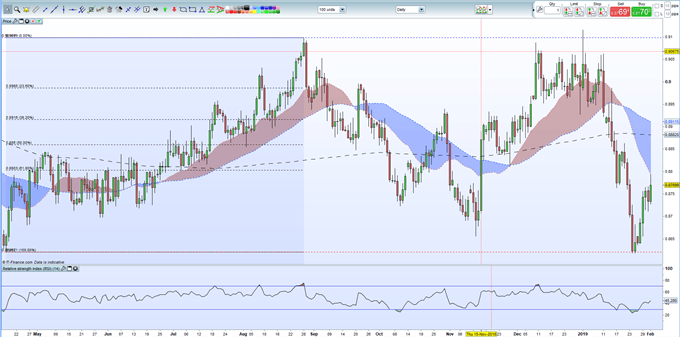

EURGBP upside is currentlyblocked by Fibonacci retracement at 0.8803 although the pair have already made one attempt to breach this level. As long as this remains intact, further downside moves should be seen with minor horizontal support at 0.8656 ahead of the multi-month low at 0.8618. The pair have moved out of oversold territory and in contrast to GBPUSD, this chart is suggesting a potential negative ‘Death Cross’ set-up with the 50-dma at 0.8911 nearing the 200-day moving average currently at 0.8882.

EURGBP Daily Price Chart (March 2018 - February 1, 2019)

DailyFX has a vast amount of resources to help traders make more informed decisions. These include a fully updated Economic Calendar, and a raft of constantly updated Educational and Trading Guides

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1

Other Weekly Technical Forecast:

AUD Forecast – AUD/USD and AUD/JPY May Extend Climbs as AUD/CAD Holds its Ground

NZD Forecast – NZDUSD Rally May Stall at Resistance, NZDCAD to Test Support

Oil Forecast – Sharp Rebound Meets Inflection Point

British Pound Forecast – Charts Levels Remain Intact

US Dollar Forecast – Dollar Avoids Critical Breakdown, But for How Long?