VIX INDEX SINKS WITH S&P 500 AT RECORD HIGH ON HOPES FOR FED RATE CUT, US-CHINA TRADE AGREEMENT

- The VIX Index dropped to its lowest level since late July as stock market investors sent the S&P 500 Index to a fresh record high amid hopes for a US-China Phase 1 Trade Agreement and another FOMC interest rate cut

- VIX could surge if the Fed disappoints, US-China trade tensions reignite, or recession risks resurface in response to dismal economic data scheduled for release this week

- Enhance your market knowledge with our free Forecasts & Trading Guides available for download

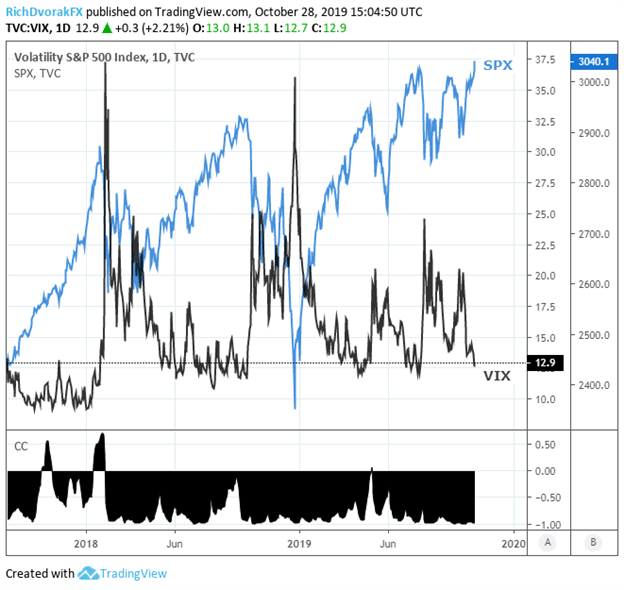

The S&P 500 Index leapt to a fresh all-time high slightly above the 3,040 price level this morning as risk assets like stocks continue to climb amid a lingering wave of investor optimism driven by US-China trade hopes and Fed rate cut expectations. At the same time, the influx of upbeat sentiment amongst traders has driven the VIX Index – a popular barometer of stock market uncertainty and risk gauge – below 13.00 and to its weakest reading since July 29.

Latest commentary from President Trump on US-China trade war progress helped push the S&P 500 Index to a new record right. POTUS stated that negotiations are “ahead of schedule” alluding to progress toward finalizing the ‘Phase 1 Trade Agreement’ text that is expected to be signed by Trump and Chinese President Xi next month. Also likely helping fuel stock prices higher and the VIX Index lower is the near-certain expectation by market participants that Fed Chair Powell and the FOMC will deliver its third consecutive 25-basis point interest rate cut later this week.

VIX INDEX VS S&P 500 INDEX PRICE CHART OVERLAY: DAILY TIME FRAME (AUGUST 18, 2018 TO OCTOBER 28, 2019)

Chart created by @RichDvorakFX with TradingView

Investors seem increasingly at risk of complacency, however, with the VIX Index taking an aggressive nosedive to the 13.00 handle. This level of technical confluence previously served as an area of support over recent history and has potential to send the VIX Index on an abrupt reversal higher once more.

A sharp rebound in the VIX Index – likely accompanied by a flood of risk aversion sparked by a fundamental catalyst such as rising US-China trade war tensions or a relatively firm monetary policy stance from the Fed – could seriously threaten the S&P 500 Index and stocks currently trading near record highs.

Also, worth noting is how the latest CoT report on speculative positioning revealed that net-shorts on the VIX Index edged closer toward extremes, which could be viewed as a contrarian signal that the VIX Index may soon pivot higher.

VIX INDEX PRESSURED AS RECESSION RISK EBBS ON MORE SANGUINE GLOBAL GROWTH OUTLOOK

Yet, the downshift in the VIX Index and perceived stock market risk could be warranted if the forthcoming US-China Phase 1 Trade Agreement is actually finalized while the string of ‘insurance’ FOMC interest rate cuts keep economic growth on track. In fact, the recent US Treasury yield curve inversion across the 2-year and 10-year maturities (a favorite recession indicator amongst traders) has reversed with the 2s10s spread climbing back in positive territory.

Nevertheless, investors could be a bit overzealous with pushing the S&P 500 Index to another record high in light of daunting event risk slated throughout the week, which is all detailed on the DailyFX Economic Calendar. For example, consumer confidence, inflation and nonfarm payroll data as well as Q3 GDP and ISM PMI reports scheduled for release throughout this week all have serious potential of reigniting recession fears.

FED CHAIR POWELL & FOMC COULD SIGNAL ‘MID-CYCLE’ RATE CUTS ARE OVER

Moreover, the Fed rate decision due Wednesday could reveal a shift away from the central bank’s dovish language in favor of a firmer stance on monetary policy outlook. The FOMC minutes from the September Fed meeting detailed how Fed officials have divided views over the future path for the target Federal funds rate (FFR) with a median projection of 1.9% for 2019 and 2020, which contrasts materially to the market’s priced expectations and compares to the current FFR target range of 1.75-2.00%. Though commentary on ‘not QE’ from the Fed pointing to the FOMC’s intent on beefing up its balance sheet necessitated by recent repo market turmoil could provide major liquidity to the market and further propel the risk rally and VIX Index plunge.

US-CHINA TRADE WAR FAR FROM OVER DESPITE PROMISE OF ‘PHASE 1’ AGREEMENT

That said, stock market investors have been exposed to this same old song and dance regarding US-China trade war rhetoric with the world’s two largest economies pivoting back and forth between relations deteriorating then improving and back to deteriorating again. This dangerous cycle could very well unfold again and would more than likely jeopardize the recent rise in the S&P 500 Index and risk assets alike.

We are already seeing signs of friction reemerging between the two nations, however, following a tense speech from VP Mike Pence on US-China trade relations. Failure to reach the Chile APEC Summit finish line for a Trump and Xi signing of the supposed US-China Phase 1 Trade Agreement, a hawkish pivot by the Fed or dismal economic data revealed the week could all equally destabilize risk assets, which would likely lead to a surge in the VIX Index and selloff in stocks.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight