General market sentiment turned cautious last week, with equities in North America (the Dow Jones and S&P 500 indices) and Europe (FTSE 100 and DAX 30 indices) spending most of their time trending lower. Those in Asia were mixed. Japan’s Nikkei 225 and China’s Shanghai Composite gained. Australia’s ASX 200 weakened.

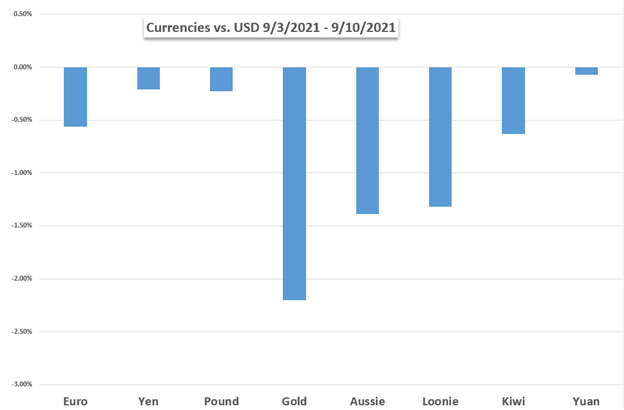

The cautious deterioration in sentiment meant that recent weakness in the US Dollar slowed. Growth-linked currencies like the Australian and New Zealand Dollars softened. The anti-risk Japanese Yen saw some strength. Anti-fiat gold prices fell as the Greenback gained. Crude oil prices also turned slightly lower.

Following key central bank rate decisions from the RBA, BoC and ECB, traders will likely be eyeing key inflation data. The US, UK and Canada will release their latest CPI data. These will continue shaping how central banks may approach policy tightening. This could make for some US Dollar, British Pound and Canadian Dollar volatility.

At the beginning of the week, OPEC will release the latest monthly oil market report. WTI crude oil prices have been weakening since July. This comes amid concerns about the global growth outlook as the Covid Delta variant has been sapping demand woes. US retail sales may also stir volatility, especially if Covid shows increasing signs of making its way into the economy.

Tuesday’s California gubernatorial recall election might be a source of market volatility. Democratic Governor Gavin Newsom could get ousted with a simple majority vote and replaced by leading Republican candidate Larry Elder. The latter could appoint a Republican senator should current Democratic Senator Dianne Feinstein step down during his tenure. That would threaten the Democrats’ razor-thin majority in the Senate, which would be consequential for being able to pass fiscal policy.

Foundational Trading Knowledge

Forex Fundamental Analysis

Recommended by Daniel Dubrovsky

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD

Fundamental Forecasts:

US Dollar Outlook Hinges on Inflation Report Amid Fed Blackout Period

The update to the US Consumer Price Index (CPI) is likely to sway the US Dollar during the Federal Reserve’s blackout period as the central bank braces for a transitory rise in inflation.

S&P 500 & FTSE 100 Forecasts for the Week Ahead

Beware of the Mid-Month S&P 500 Pullback. FTSE 100 Risks Geared to a Break of 7000

MPs Vote To Hike NI Tax, What Does This Mean For GBP?

Will GBP see long-term effects as MPs vote to raise taxes?

Euro Forecast: EUR/USD Outlook Positive for Week Ahead, EUR/GBP Too

With this month’s meeting of the ECB’s policymaking Governing Council now out of the way, there is little to stop the Euro from appreciating as tighter Eurozone monetary policy draws closer.

Oil Weekly Forecast: The Impact of Ida, OPEC Supply Boost and China’s Oil Reserves Auction

Brent Crude unfazed by Ida effects, OPEC’s supply boost and China’s auctioning of oil reserves as healthy demand forecasts for H2 2021 supports prices

Technical Forecasts:

US Dollar Drop Slows, Will Gains Resume? EUR/USD, USD/CAD, AUD/USD, GBP/USD

US Dollar weakness slowed last week. Could the advance from June resume? What is the technical outlook for EUR/USD, USD/CAD, AUD/USD and GBP/USD?

Dow Jones, Nasdaq 100, S&P 500 Forecasts for the Week Ahead

Stocks are pulling back a bit here, but so far the price action isn’t overly pervasive and damaging to the trend; support to watch in days ahead.

Gold Price Forecast: Near-Term Bias is Bearish, but Technical Confirmation is Needed

After breaking below the 200-day SMA, the outlook for gold prices has turned slightly negative, but to confirm the bearish bias, sellers must invalidate a key Fibonacci support

British Pound Technical Forecast: GBP/USD, GBP/AUD, GBP/CHF Charts for the Week Ahead

The British Pound’s technical posture versus the US Dollar, Australian Dollar, and Swiss Franc highlights potential for actionable trade levels. Here are the charts for GBPUSD, GBPAUD, and GBPCHF for the week ahead.

Canadian Dollar Forecast: USD/CAD Recovery Vulnerable– Loonie Levels

Canadian Dollar may yet stage a counter-offensive as the USD/CAD recovery remains capped by the yearly open. The Loonie levels that matter on the weekly technical chart.

Crypto Weekly Forecast: Bitcoin (BTC), Ether (ETH) and Cardano (ADA) Key Levels

Bitcoin prices recover from free-fall, Ether and Cardano follow