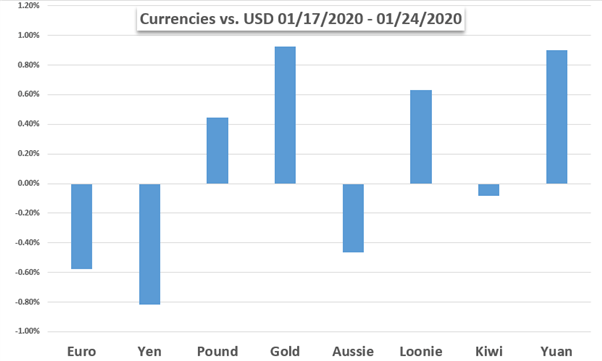

The S&P 500 experienced its worst week since the middle of August as fears of the deadly coronavirus spread into financial markets and anti-fiat gold prices rallied. Sentiment-linked WTI crude oil dropped about 7.6% in the sharpest decline over the course of 5 trading days since May. The anti-risk Japanese Yen and haven-linked US Dollar aimed higher.

The virus has been emanating from central China, spreading across the world with a third case reported in the United States on Friday as well as one in France. That this is also occurring during the Lunar New Year holiday is raising concerns over lower attendance rates impacting revenues. The Euro fell as the ECB further pushed back tightening prospects as rosy UK data boosted GBP.

The VIX (fear gauge) rose, anticipating what could be a tense week ahead for equities depending on how updates on the coronavirus unfold. Further contagion fears may continue denting sentiment, offering a boost to the Japanese Yen while perhaps pressuring the sentiment-linked Australian and New Zealand Dollars. The haven-linked US Dollar may capitalize on this further.

Looking at the economic calendar, the Federal Reserve is expected to leave rates unchanged while there may a chance the Bank of England reduces them. Investors will also be anxiously awaiting on updates to the Fed’s repo operations. These have been injecting liquidity into financial markets, helping to fuel gains in equities on Wall Street. Will this be the revival in volatility?

Fundamental Forecasts:

British Pound May Yet Fall on Brexit, BoE and Fed Are Risks

The British Pound may fall as Brexit commences, but will the Bank of England cut rates? The US Dollar could rise if the Fed spooks markets with plans to unwind repo operations.

Australian Dollar Heavy, Eyes CPI As Last Big Clue Before RBA

The Australian Dollar has been hit by the risk-appetite pullback occasioned by the spread of Wuhan-strain coronavirus. This week may see some domestic focus return, if headlines allow, with key inflation data due.

Dow Jones and FTSE 100 Forecast for the Week Ahead

Coronavirus latest shrugged off by Dow Jones, investors on Fed watch. FTSE 100 awaits Bank of England’s 50/50 rate decision.

Crude Oil Prices May Struggle Even if Coronavirus Fears Abate

Crude oil prices have plunged amid fears that a coronavirus outbreak will derail a cautious rebound in global economic growth. They may not rise much if that risk abates.

Technical Forecasts:

British Pound Forecast: GBP/USD Chart Coiling Towards a Breakout

Last week was more of the same, a narrowing range following the UK general election fireworks; GBP/USD has a couple of clear signposts to keep an eye on.

Euro Weekly Forecasts: EUR/USD and EUR/GBP Price Analysis

The Euro remains weak against a range of currencies and any move higher is struggling to gain traction as the single currency continues to be sold-off.

Gold Price Outlook: XAU/USD Rally Remains Precarious - GLD Levels

Gold prices are poised to mark the highest weekly-close in nearly seven-years, but the bulls aren’t in the clear yet. Here are the XAU/USD levels that matter next week.

Canadian Dollar Forecast – Trade or Fade: USD/CAD, CAD/JPY, EUR/CAD

The range in USD/CAD broke with aggression this week as CAD sellers pushed the currency after the Bank of Canada rate decision.

Dow Jones, DAX 30 & FTSE 100 Technical Forecasts for the Week Ahead

The Dow Jones traded near record levels last week until risk aversion took hold on Friday to pressure the Industrial Average lower. Will volatility spillover into next week?