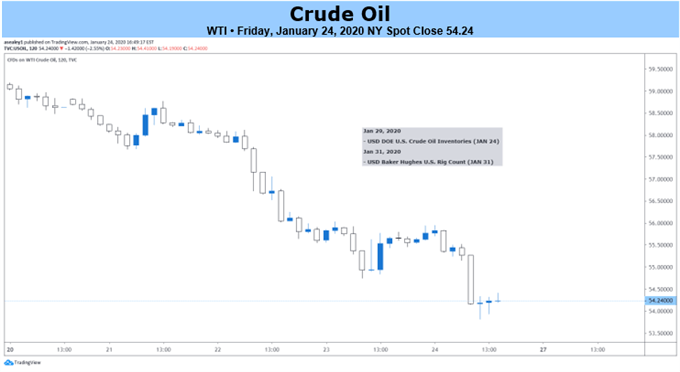

CRUDE OIL PRICE FORECAST: BEARISH

- Crude oil prices plunge amid worries about coronavirus spread

- Soft sentiment may limit scope for gains if outbreak risk abates

- FOMC and BOE rate decisions, US and Eurozone GDP on tap

Crude oil price volatility has perked up in 2020. The US-based WTI benchmark hit an eight-month high and a three-month low since the turn of the calendar year. The cumulative result has amounted to the biggest three-week loss since early June.

The early surge came amid worries that escalating conflict between the US and Iran would disrupt deliveries from the Middle East. At surface level, the subsequent selloff reflects the ebbing of those concerns, coupled with concerns about slowing global growth in the event of a true coronavirus outbreak.

CRUDE OIL PRICES MAY FIND LIFELINE IF CORONAVIRUS FEARS ABATE

The fourth quarter saw a cautious recovery in economic activity and a rosier tint to incoming data flow. An early batch of January PMI data from most major economies suggested positive momentum has been largely sustained, suggesting a firmer view on energy demand might have been more supportive.

This may yet materialize if the coronavirus scare dissipates without triggering a disruption akin to the SARS outbreak in 2003. That shaved about 1 percent of China’s GDP and reduced that of the Southeast Asia region by 0.5 percent. Total losses are estimated in the USD 30-100 billion range.

SOURING SENTIMENT MAY LIMIT SCOPE FOR CRUDE OIL PRICE GAINS

Yet markets may remain pressured even if – as the World Health Organization has thus far concluded – the latest virus does not amount to an “emergency”. Sentiment itself may have become vulnerable as scope for upside surprises is exhausted in the near term while potent risks remain.

Late-2019 successes appear priced in. Building on the ‘phase-one’ US-China trade deal seems unlikely for at least a year and failing to secure an EU/UK trade deal before 2021 may yet trigger no-deal Brexit. In addition, the US presidential election is now a likely source of anxiety as traders weigh the candidate pool.

Thus far, these issues have amounted to a non-specific sense of unease. If any of them are reconstituted as a near-term threat to growth, concerns about the impotence of whatever policy response follows might compound negativity. As much was amply telegraphed from annual Davos economic forum last week.

FOMC AND BOE RATE DECISIONS, CHINA PMI, US AND EUROZONE GDP ON TAP

To this end, the week ahead offers plenty of opportunities for data-driven speculation. Rate decisions from the Fed and the Bank of England will offer the banks’ assessment of the macroeconomic backdrop. A first look at US and Eurozone fourth-quarter GDP readings as well as Chinese PMI numbers are also eyed.

The EIA will also release its Monthly Petroleum Supply report as well as the Annual Energy Outlook, offering a view on what it thinks the supply/demand balance will look like in the near to medium term. The usual offering of weekly inventory flow statistics is also due.

How cycle-sensitive crude oil prices respond to this barrage of news-flow might prove telling. If markets appear immune to seemingly supportive outcomes, the ill effects of a more deep-seated affliction than the coronavirus may well be preparing to emerge.

--- Written by Ilya Spivak, Sr. Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

CRUDE OIL TRADING RESOURCES

- Just getting started? See our beginners’ guide for traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a live webinar and have your trading questions answered

OTHER FUNDAMENTAL FORECASTS: