EURUSD, US Dollar, USDJPY, EURJPY Talking Points:

- The end of Q1 is nearing and US Dollar strength has come roaring back following the FOMC-fueled breakdown to support. That support came-in around the bullish trend-line projection from the ascending triangle formation, keeping the door open for bullish scenarios around the US currency as the door opens into Q2.

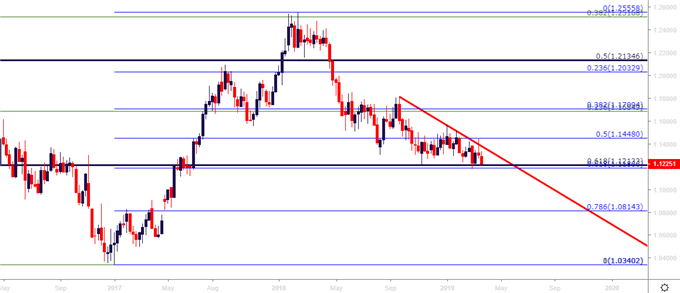

- Euro weakness is showing along with that US Dollar strength, begging the question as to whether EURUSD may carry break-down potential into Q2. The pair has been stuck in a range for most of Q4 and the entirety of Q1, 2019, even as the ECB announced a fresh round of TLTRO’s. Euro-weakness and Dollar-strength themes appear inextricably linked at this point, and this will remain a theme of interest into the second quarter.

- DailyFX Forecasts are published on a variety of currencies such as the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment Indicator.

US Dollar Bulls Back in the Fray Ahead of Q1 End

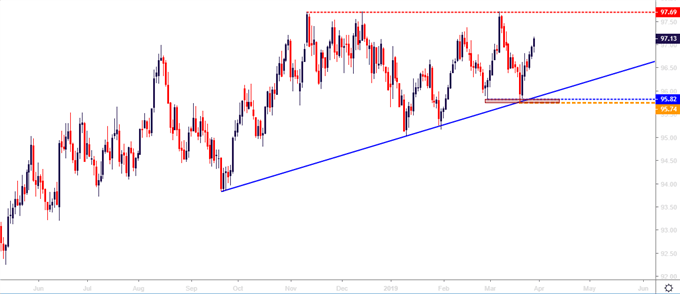

After last week’s sell-off in the US Dollar, in which the currency found support on the bullish trendline on the bottom of an ascending triangle pattern, US Dollar bulls have come back to the party to push the currency back-above the 97.00 level. This marks a stark contrast to the prior two-week trend, in which the US Dollar found resistance at the top of that formation around the ECB rate decision, followed by a show of consistent weakness until the currency ran into that support.

But over the past week, buyers have returned, prices have pushed higher, and with the end of Q1 bearing down, the prospect of another resistance test looks more likely.

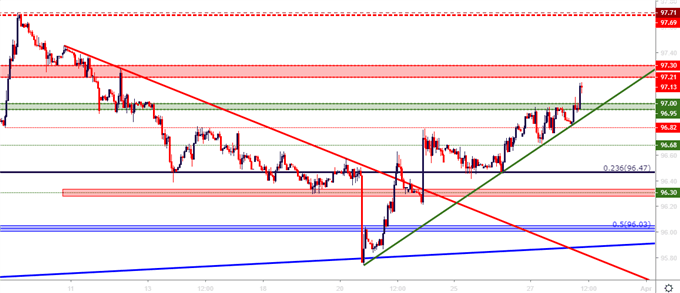

US Dollar Hourly Price Chart

Chart prepared by James Stanley

As discussed in last week’s webinar, the ascending triangle formation will often be approached in a bullish manner, looking for the motivation that’s driven buyers in at higher-lows to, eventually, to run through horizontal resistance. This keeps focus on bullish potential around the currency as the page turns into Q2, and as most developed Central Banks around-the-world are fomenting some form of dovish policy; enough so that the Fed’s step back from rate hike pledges earlier this month has been unable to produce a lasting impact in the currency.

Will the Fed go even more dovish in Q2? If they don’t, the topside breakout potential around the US Dollar can remain as a very, very interesting theme over the next few months.

US Dollar Daily Price Chart

Chart prepared by James Stanley

EURUSD Staging Re-Test of Support Zone: Can Bears Break Through This Time?

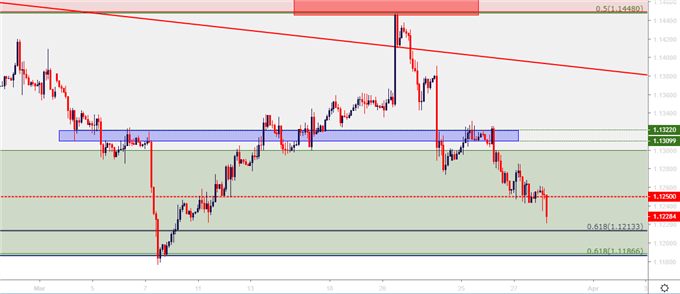

Currency market volatility has been rather lackluster over the past few months, and the primary culprit appears to be an impasse in the world’s largest FX market of EURUSD. While the ECB’s announcement of a fresh round of TLTRO’s brought in a support test a few weeks ago, bears were unable to continue the move as the US Dollar ran into that big level of resistance at the yearly highs. So, as the US Dollar was falling in response to that resistance test, EURUSD was rallying back into the prior range until, eventually, prices re-engaged with the resistance zone from that formation.

Last Wednesday around the FOMC rate decision, prices in the pair ran-up to re-test the 1.1448 level, which is the 50% marker of the 2017-2018 major move. Since then, bears have come back and prices have pushed back down into the support zone that runs from 1.1213-1.1300.

EURUSD Two-Hour Price Chart

Chart prepared by James Stanley

This theme is inextricably linked to the above scenario in the US Dollar. If the US Dollar can breakout from that 97.71 resistance, then a downside breakout in EURUSD will look more likely with targets set towards a re-test of the 1.1000 psychological level. Below that, another zone of support runs from a 49-pip zone between 1.0814-1.0863.

EURUSD Weekly Price Chart

Chart prepared by James Stanley

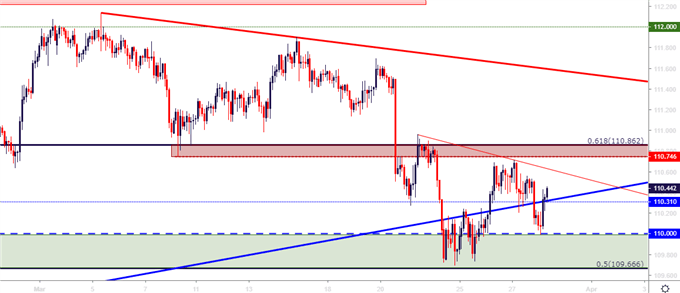

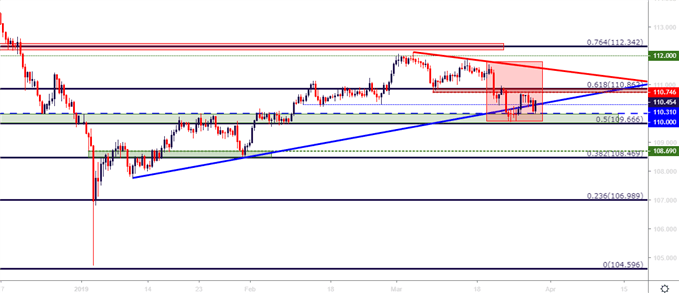

USDJPY Continued Pullback Potential

This quarter has been marked by a pronounced return of the risk-on trade: And this can be evidenced quite well in USDJPY. The pair came into 2019 screaming-lower as Q4 risk aversion ran into the first couple days of trade. But, as cooler heads prevailed and as investors started to nibble on the risk-on theme again, USDJPY began to rally and spent the next two-and-a-half months doing so.

I had looked at bullish breakout potential in the pair throughout February and into March. And that theme lasted fairly well into last week’s FOMC rate decision. But, as risk aversion showed-up again, USDJPY turned over and hasn’t really recovered since.

USDJPY Two-Hour Price Chart

Chart prepared by James Stanley

As the door opens into Q2, the big question is whether risk aversion continues similar to what’s been seen in the wake of the last FOMC rate decision. If so, the downside of USDJPY can become attractive or, perhaps more accurately, themes of Yen-strength can be more attractive. On the other hand, if the risk rally continues similar to what priced-in through January and February, topside can continue up to a re-test of 112.00 and, perhaps even a push up to the Fibonacci level at 112.34.

USDJPY Eight-Hour Price Chart

Chart prepared by James Stanley

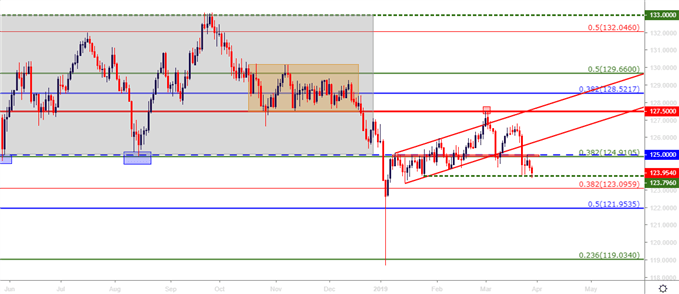

EURJPY for Risk Aversion Scenarios

Combining two the above themes, the prospect of short-side setups in EURJPY remains attractive should this theme of risk aversion continue. I had looked at the pair in this week’s FX Setups, plotting a resistance hold at a key area on the chart around 125.00. That resistance has since played out and sellers have pushed down for a re-test of two-month-lows; and if this theme is to continue, the short-side could remain attractive as both Euro-weakness and Yen-strength appear to be aligned with the further development of that theme.

This was my Top Trade Idea for 2019, largely on this same premise of continued risk aversion and a factor that has yet to produce much volatility: European politics; but the year is young yet, as we have three quarters to go.

EURJPY Daily Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q4 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX