Setting up long-term trades is quite a bit different than seeking out short-term setups or swing trades. While shorter-term charts will offer nearby support or resistance levels to use in pre-trade plans, longer-term setups generally require better incorporation of fundamental themes and considerably more projection; because, after all, the trader would be looking at a much longer holding period or time horizon. For this reason, I generally try to pick on cross-pairs for these types of ideas, as divergent policy approaches between various economies can allow for the build of extended trends that can assist with the greater projection potential needed. Coming into 2017, I looked at the topside of EUR/AUD which finally limited out a few months ago, and for 2018 I looked at the topside of GBP/NZD, which hit two of the four targets before turning around shortly after the Q4 open.

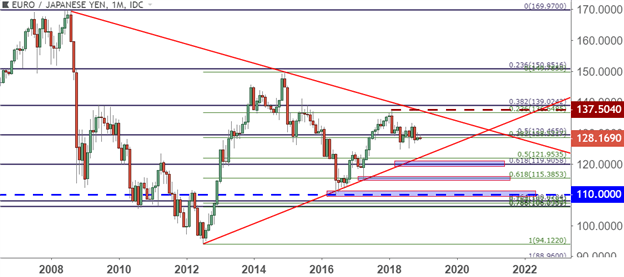

For 2019 I want to incorporate a bit of risk aversion as it appears that global markets may be nearing a turning point. For that purpose, the long side of the Japanese Yen could be attractive as the BoJ’s ‘pedal to the floor’ QE approach comes into further focus. On the short-side of the trade, I’m looking at the Euro as a number of issues remain on both fundamental and political fronts, and this can keep the door open for a deeper sell-off after the pair spent much of the year churning back-and-forth. Risk levels can be set above the 2018 high at 137.50, allowing for initial targets upon a re-test of the 120.00 psychological level. Secondary targets can be cast to 115.50, with tertiary targets set to a re-test of 110.00.

EUR/JPY Monthly Price Chart

Chart prepared by James Stanley

To see all the of the analysts Top Trade Ideas for 2019 and Top Lessons from 2018, download the guides on the DailyFX Trading Guides Page.

.