Euro Talking Points:

- The European Central Bank announced a fresh round of TLTRO’s this morning, set to begin in September of 2019, running until March of 2021. The ECB also lowered growth forecasts while extending expectations for a possible rate hike. This has kicked off a bearish move in the single currency, with short-term sellers pushing deeper into the longer-term support zone in EURUSD. Also of note is EURJPY, as the pair is selling-off after spending most of the past two months recovering from the early-year spill below the 120-handle.

- The week isn’t done yet: The economic calendar brings US and Canadian jobs numbers tomorrow morning at 8:30 AM ET and given the response in USDCAD to yesterday’s BoC rate decision, the potential for continued volatility remains.

- DailyFX Forecasts are published on a variety of currencies such as the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment Indicator.

Euro Drops as ECB Announces Fresh Round of TLTRO’s

This morning saw the European Central Bank announce a fresh round of stimulus via TLTRO’s, which is short for ‘Targeted Longer-Term Refinancing Operations.’ The bank will launch the program in September of this year, designed to run in to March of 2021. The ECB also updated their growth forecasts and rate guidance this morning, lowering expectations for 2019 growth from a prior 1.7% to 1.1% - marking a big change. The ECB also said that they’re expecting to keep rates at present levels through the end of 2019, whereas previously the ECB had said rates should remain at current levels ‘at least through the summer of 2019.’

Near immediately, odds for the next hike out of Europe moved out to September of 2020 while odds for a 10 basis point hike in 2019 dropped from 40% to 20%.

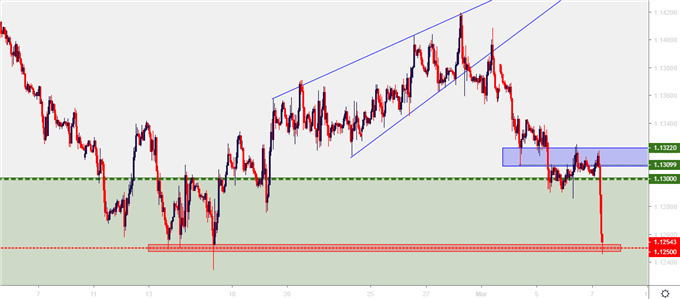

The single currency is still pricing-in this morning’s news as evidenced from the fact that prices are falling further into the longer-term support zone, as was discussed in yesterday’s article in the event of such an announcement. The big question is for how long this might run, and whether or not the almost four-month old range breaks later today. At this stage, sellers are pushing towards the 1.1250 psychological level that helped to arrest the February declines.

EURUSD Hourly Price Chart

Chart prepared by James Stanley

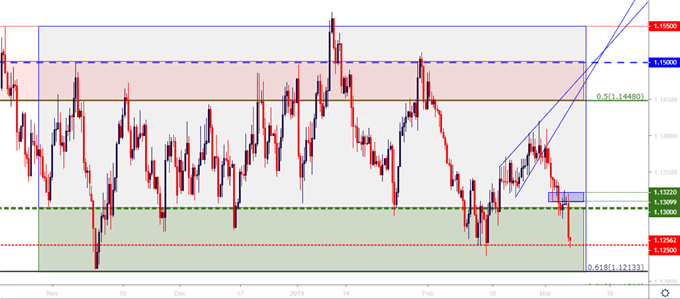

On slightly longer-term basis, the almost four-month old range formation remains in EURUSD. Will this morning’s announcement be the catalyst that gives bears the juice they need to finally break-down below this support? Or – will the range continue hold, much as it has over the past four months through a variety of potentially bearish-Euro drivers?

EURUSD Eight-Hour Price Chart

Chart prepared by James Stanley

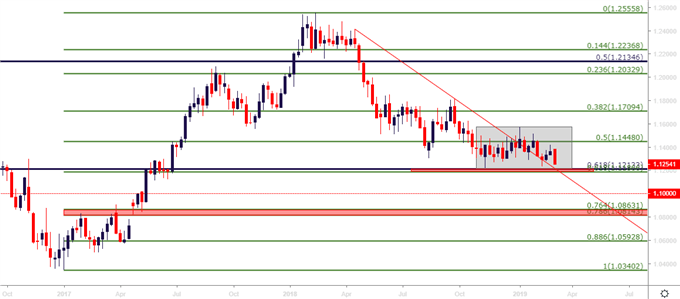

On a longer-term basis, a break of that range brings into play an interesting area around the 1.1200-handle, as 1.1186 is the 61.8% Fibonacci retracement of the 2017 bullish run in EURUSD, while 1.1212 is the 61.8% retracement of the 2000-2008 major move. A drop below this zone opens the door for a test of the 1.1000 psychological level, followed by a zone of prior swing support/resistance around the 76.4 and 78.6% retracements around 1.0814-1.0863.

EURUSD Weekly Price Chart

Chart prepared by James Stanley

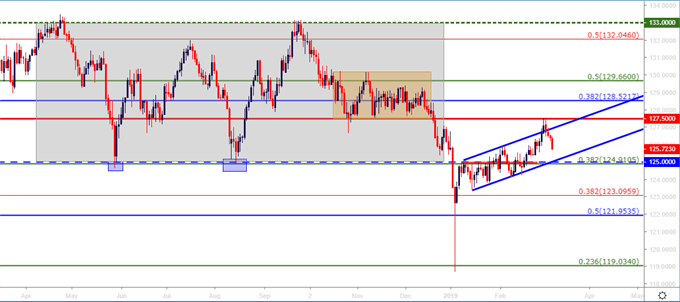

EURJPY Posts Precipitous Drop From Last week’s 127.50 Resistance Test

EURJPY has already had an interesting year and we’re not even through Q1 yet. This was my ‘Top Trade Idea for 2019,’ looking for more downside in the pair after last year’s build of a range inside of a longer-term range.

The pair plummeted into the New Year, testing below the 119.00 handle in the opening days of 2019. But, since then, EURJPY has spent much of the time recovering, building into a bear flag formation that was looked at last week. But on Friday prices ran into a key area of resistance at 127.50, as this was the support side of the range that had built during Q4. After that resistance was tested last Friday, prices have been on a course reversal, and given the source of the move with an announcement of fresh QE from the ECB, there may be scope for more.

EURJPY Daily Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q4 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX