Dow Jones, FTSE 100 and DAX 30 Fundamental Forecast:

- The Dow Jones will weigh conflicting fundamental themes ahead of Thursday’s US GDP

- FTSE 100 traders will be tied to UK Prime Minister Theresa May’s ability to get her Brexit deal through Parliament

- The DAX 30 will look to German CPI and unemployment on Thursday and Friday respectively

Dow Jones Fundamental Forecast: Neutral

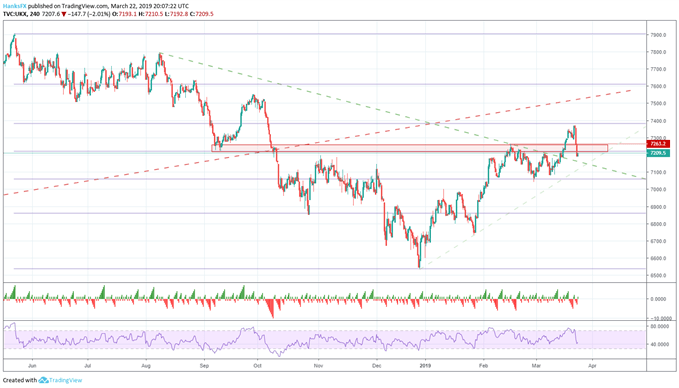

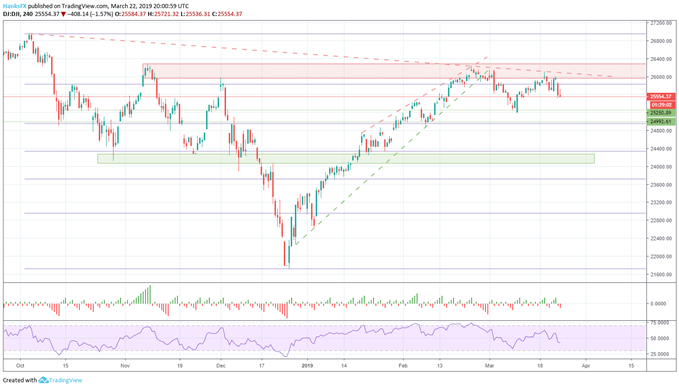

The Dow Jones should enjoy a tailwind from a dovish Federal Reserve, despite Friday’s selloff. That said, the Industrial Average will have to face Thursday’s release of US GDP. With recent forecast cuts, the outlook for first quarter GDP is grim. Still, ETF fund flows suggest some investors are confident the trend from December will continue.

Learn the differences between the Dow Jones and S&P 500 and how they might contribute to different outlooks.

Following GDP, Friday will see the release of PCE core – a key inflation metric. Given the Federal Reserve’s commitment to dovish policy, a single PCE core release is unlikely to spark significant price action. Should the data surprise, it is likely subsequent releases would need to confirm divergence for a more meaningful reaction to occur.

Dow Jones Price Chart: 4-Hour Time Frame (August 2018 to March 2019) (Chart 1)

How to day-trade the Dow Jones

FTSE 100 Fundamental Forecast: Neutral

Once again, the FTSE 100 will look to Brexit. After the EU agreed to a Brexit extension – contingent upon Parliament’s ability to pass Theresa May’s Brexit deal – the ball is back in the United Kingdom’s court. Last week UK MPs agreed to reject a ‘no-deal’ Brexit under any circumstances. Still, the possibility of divorce without a deal is present.

If Theresa May is unable to gather enough votes to pass her deal, the chances of a hard-exit increase substantially. Such an outcome would be undeniably bearish for the FTSE 100 and GBPUSD as investors have largely expected a deal to take shape. Thus, next week’s Brexit vote will be the event to watch for the FTSE, but ramifications of a breakdown would likely spread to US indices alongside European counterparts.

FTSE 100 Price Chart: 4 – Hour Time Frame (June 2018 – March 2019) (Chart 2)

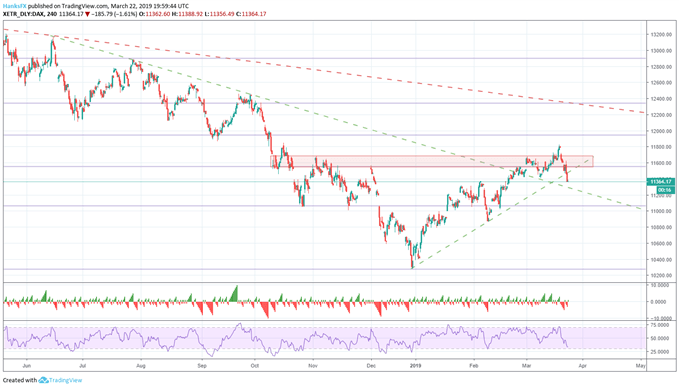

DAX 30 Fundamental Forecast: Bearish

Much like the United States, Germany is due to release inflation data of its own on Thursday followed by Eurozone CPI on Friday. Recent inflation data out of Germany and the European bloc has been wholly unimpressive and was a contributing factor to a new targeted long-term refinancing operation (TLTRO) from the ECB. With the bank’s commitment to this policy path, the inflation data may see reduced influence on price action outside of intraday trading.

DAX 30 Price Chart: 4 – Hour Time Frame (June 2018 – March 2019) (Chart 3)

After the whirlwind created by the FOMC meeting last week, next week appears hinged to inflation data, GDP releases and Brexit. As two of the most important central banks – the Fed and ECB – have predetermined policy paths for the near future, the risk from next week’s data appears muted.

Therefore, global equity markets will watch Brexit with keen intent as the EU and UK look to avoid a hard-exit that could rattle investor confidence and equity sentiment alike. The exact date for the vote is not set at the time of this article’s publication but check our economic calendar for an exact time as the information is released.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

DailyFX forecasts on a variety of currencies such as the Pound or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Other Weekly Fundamental Forecast:

Australian Dollar Forecast – Australian Dollar Likely Loser In Ugly Contest With US Cousin

British Pound Forecast – GBP Fundamental Forecast: And The Brexit Band Played On

US Dollar Forecast – Post-FOMC U.S. Dollar Recovery to Face Slowing GDP Report

Gold Forecast – Gold Price Outlook Clouded by Recession Signals, US Econ Data Drop

Euro Forecast – Euro at Risk on Data Flow and ECB Comments, Brexit Vote May Eyed