Asia Pacific Market Open Talking Points

- UK Parliament rejected a ‘no-deal’ Brexit, boosting market sentiment

- Remarkable GBP/USD rally lacked momentum, resistance range held

- AUD/USD may be torn between soft China data and rising Asia stocks

Build confidence in your own British Pound strategy with the help of our free guide!

Key FX Developments Wednesday

British Poundvolatility continued to be elevated as a series of Brexit-related votes in UK’s Parliament crossed the wires. On Wednesday, and by a thin margin of 4 votes, MPs rejected a ‘no-deal’ Brexit by favoring the ‘Spelman Amendment’. A subsequent vote to block a ‘no-deal’ by trying to take it permanently off the table then passed 321 to 278.

After Theresa May’s revised Brexit deal was rejected yesterday, increasing the odds of a ‘no-deal’ divorce, today’s round of voting seemed to be interpreted by the markets as decreasing the chances of the UK crashing out of the EU without any deal. Not surprisingly, the British Pound was the best-performing major currency by an overwhelming majority.

GBP/USD Technical Analysis

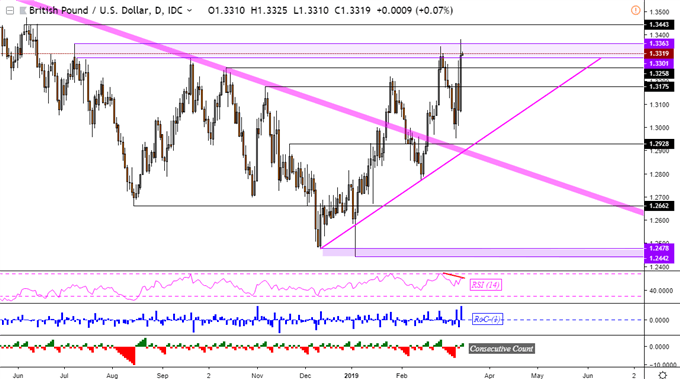

The 1.81% advance in GBP/USD on Wednesday was its most aggressive since April 2017, almost two years ago. On the daily chart below, Sterling is struggling to clear a range of resistances composed of the July and September 2018 highs between 1.3301 and 1.3363. Negative RSI divergence shows that upside momentum is fading and it may precede a turn lower.

GBP/USD Daily Chart

Chart Created in TradingView

Pronounced British Pound gains throughout Wednesday robbed most other major currencies from gains. In particular, the pro-risk Australian and New Zealand Dollars failed to capitalize on an improvement in sentiment as the S&P 500 trimmed its losses from last week. This is despite losses in Asia stocks earlier in the day. The uptick in market mood seemed to be supported by US durable goods surprising to the upside.

Thursday’s Asia Pacific Trading Session

AUD/USD will be eyeing Chinese industrial production and retail sales data early into Thursday’s session. China is Australia’s largest trading partner and economic performance in the former can have knock-on effects for the latter. According to the Citi surprise index, data in the world’s second-largest economy has been tending to disappoint relative to economists’ expectations.

While a downside surprise may bode ill for the Australian Dollar, this may be somewhat countered by APAC equities following Wall Street higher. S&P 500 futures are pointing to the upside as regional bourses begin opening for trading. In the medium-term, there remain numerous uncertainties for Brexit. Until that becomes increasingly clear, gains in stock markets based on alleviating hard-Brexit concerns may only be a temporary sugar rush. Especially with fears about slowing global growth lingering.

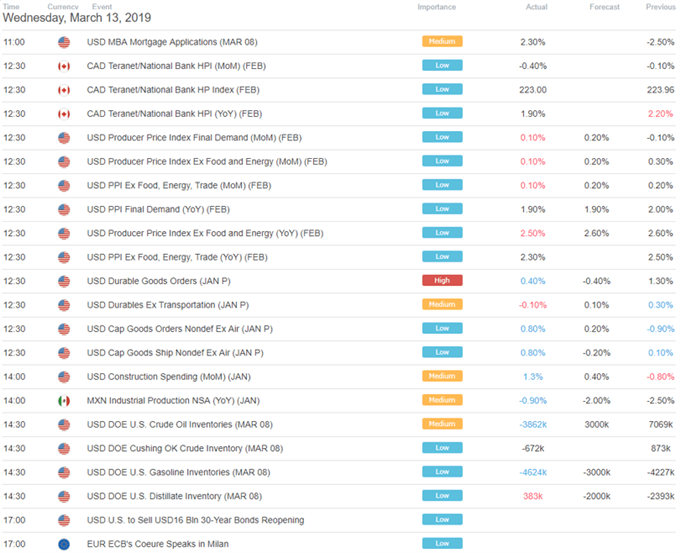

US Trading Session Economic Events

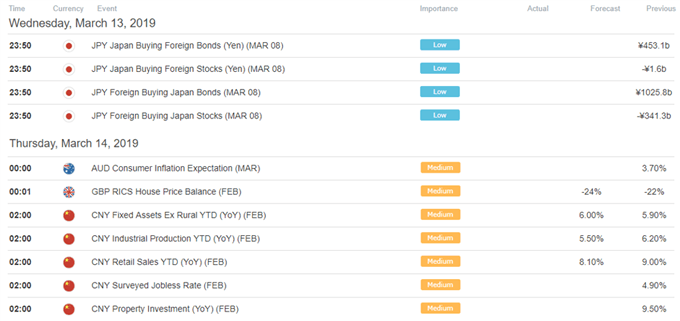

Asia Pacific Trading Session Economic Events

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter