- Technical trade setups we’re tracking across the USD Majors / Commodities this week

- Check out our New 2019 projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

US Dollar Exhaustion Alert - Gold Prices at Support into the Open

The US Dollar is vulnerable into the start of the week / month with DXY holding just below technical resistance- we’re on the lookout for exhaustion here. Meanwhile, the gold trade has remained rather subdued with bullion trading just above a critical support zone into the open – looking for a reaction down here early in the week. In this webinar we review updated technical setups on DXY, EUR/USD, USD/CAD, AUD/USD, USD/JPY, NZD/USD, Gold(XAU/USD), Crude Oil, GBP/USD, USD/CHF and NZD/CAD.

Why does the average trader lose? Avoid these Mistakes in your trading

Key Trade Levels in Focus

US Dollar – The index was rejected at Fibonacci resistance last week at 98.40- Risk is lower while below Friday’s high with a break below slope support targeting the 98-handle. A close below the figure is needed to validate a larger reversal targeting 97.66/71. Review my latest US Dollar Price Outlook for a closer look at the longer-term DXY technical trade levels.

EUR/USD – Euro rebounded off a critical support barrier last week at 1.0982/94 – we’re looking for a breach above downslope resistance with a close above 1.1053 needed to validate a reversal. Review my latest Euro Price Outlook for a closer look at the EUR/USD technical trade levels.

USD/CAD –Price remains in a consolidation pattern and we’re looking for the breakout. Key resistance stands at 1.3335/55 – the long-bias is at risk into this threshold. Ultimately, a break below near-term support at 1.3252/60 is needed to validate a reversal targeting 1.3219.Review my latest Canadian Dollar Price Outlook for a closer look at the USD/CAD intraday technical trade levels.

Gold– Gold opens the month just above a critical support zone at 1451 – we’re looking for off this zone early in the month. Resistance near 1475 with bearish invalidation at 1489. A break lower form here exposes 1433. Review my latest Gold Price Outlook for a closer look longer-term technical trade levels.

Crude Oil– Oil prices have responded to a critical confluence resistance barrier at 58.45/61. The risk remains lower sub-57.19 with a break below near-term support at 54.91 targeting 53.67/99. Review my latest Oil Price Outlook for a look at the longer-term technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

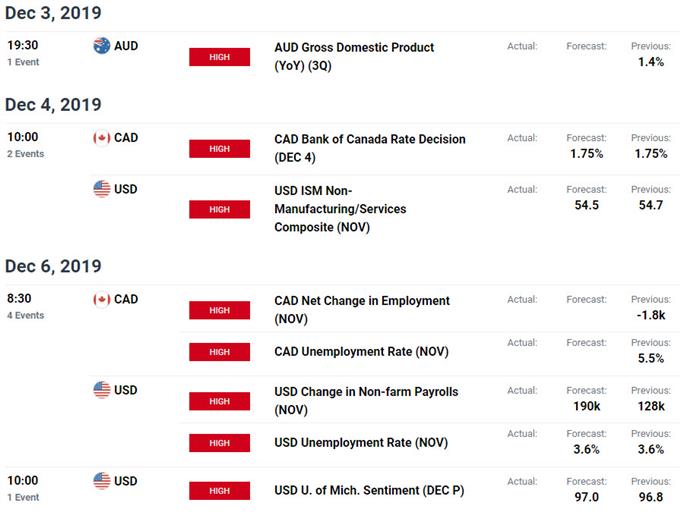

Key Event Risk This Week

Economic Calendar - latest economic development and upcoming event risk

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex