Talking Points:

- Equity indexes such as the S&P 500, DAX and Nikkei 225 gapped higher on their open Monday but still offer little conviction

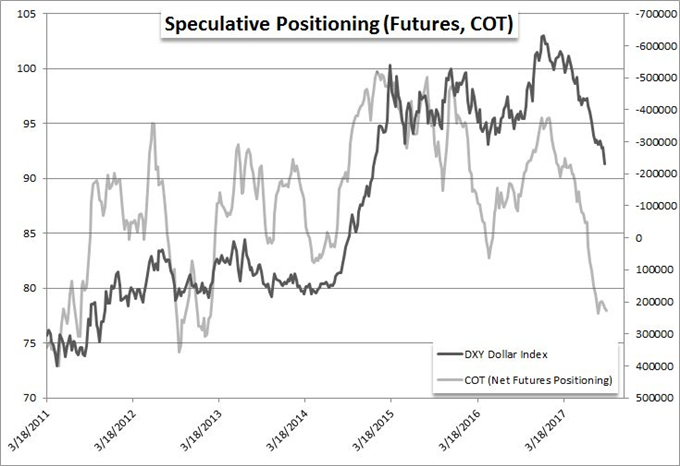

- While the net short Dollar view has been leveraged in the majors and COT, there is as yet little retreat ahead of FOMC

- Despite remarks consistent with their recent official bank views, both BoE Carney and BoC Lane see strong currency turns

The CFTC's COT figures show EUR/USD futures positioning with the heaviest bullish lean in years while US equity exposure has hit equivalent lows. How do these reading compare to retail FX traders' exposure? Check our DailyFX sentiment page to find out.

We are heading into heavy event risk a little later this week, but you wouldn't register that in recent market activity. Global equity indexes the world over are extending their advances - the US benchmarks like the S&P 500 hitting records - but hallmark lack of conviction remains. A key event risk Wednesday is the Federal Reserve's 'quarterly' monetary policy meeting. This group was the champion of the unorthodox easing regime and it started the turn that is inevitable for the world some years ago with Taper. And yet, sentiment feels there is time and room to squeeze a little more return from these markets before the musical chairs stops. Just as remarkable is the Dollar's persistence. There is no currency - perhaps even asset - with as direct an exposure to this event, and yet there is little of the telltale rebalance expected before major event risk. The markets have grown heavily short Dollar whether through price on pairs like EUR/USD or through COT readings of speculative futures traders. Normally, that extraordinary exposure would warrant some unwind from 'weak hands', but that has yet to happen.

In contrast, there were remarkable moves on the monetary policy front from two currencies that have seen their stars quickly rise on the spectrum: the Canadian Dollar and British Pound. BoE Governor Carney - who didn't speak after last week's policy gathering that produced a statement that made clear the time for tightening is likely soon at hand - was speaking at an IMF event. The central banker essentially re-enforced last week's statement that lit the fuse on speculative anticipation for a 2017 hike, but he hedged the group's bets by suggesting any tightening cycle would be gradual and that there was still clear concern over the health of the economy amid Brexit. Nothing surprising, and yet, the Sterling sunk soon after. GBP/USD, EUR/GBP and GBP/CHF all leveled up certain corrections around noteworthy technical boundaries. Holding a less senior position but generating no less the significant move, Bank of Canada Deputy Governor Timothy Lane spoke to the importance of exports, the watch over the Dollar and another reference to measured pace was offered up. In response, USD/CAD surged 110 pips in quick order. In addition to that benchmark pair, GBP/CAD, EUR/CAD and NZD/CAD are worth noting. The intense rise has given way to intense correction - even in the face of favorable developments.

Though they didn't find the direct fundamental motivation, the Australian and New Zealand Dollars were both active this past session. The former supported developments like AUD/USD's tentative trendline support break, EUR/AUD's wedge move and AUD/JPY dropped from a large technical resistance. Less motivated - but no less technically-oriented - were moves like EUR/NZD, NZD/JPY and NZD/CAD reversals. Outside the majors, the Chinese Yuan has finally started to retreat with a correction that seems to indicate government officials are looking to stabilize the exchange rate ahead of the country's Congress. From commodities, crude's bullish break still offers no measurable follow through; but gold's retreat extended with belief that though central banks may be moderating pace somewhat, they are still moving to tighten the policy reins (and raising the 'return' on currency). Further, Bitcoin led a rebound among cryptocurrency, though the fundamental 'reasoning' resonated less than the speculative appetite. We discuss all of this and more in today's Trading Video.

To receive John’s analysis directly via email, please SIGN UP HERE.