Sterling Technical Price Outlook: GBP/USD Trade Levels

- Sterling technical trade level update – Daily & Intraday Charts

- GBP/USD in consolidation within March opening-range – breakout potential

- Focus range remains 1.38-1.40 post-BoE

The British Pound is virtually unchanged for the week against the US Dollar despite a range of more than 1.4%. Neither the FOMC nor the Bank of England offered any meaningful direction for Cable with price continuing to coil just below technical resistance. A Sterling breakout is brewing – buckle up! These are the updated targets and invalidation levels that matter on the GBP/USD price charts. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Sterling technical setup and more.

Sterling Price Chart – GBP/USD Daily

Chart Prepared by Michael Boutros, Technical Strategist; GBP/USD on Tradingview

Technical Outlook: Inlast month’s Sterling Price Outlook we noted that the GBP/USD breakout was testing the first major resistance hurdle near the 1.40-handle and that a breach higher, “would likely fuel accelerated gains for the British Pound with such a scenario exposing subsequent topside resistance objectives at 1.4145 and the 50% retracement / 2018 high at 1.4303/36.” The rally extended in the following days with Cable registering a high at 1.4243 before reversing sharply off channel resistance to close February back below this keytechnical pivot at 1.3955/95.

Sterling has now carved out a well-defined monthly opening-range just below resistance with the March lows now converging on the November trendline- we’re looking for the breakout of this range to offer guidance here. Ultimately, a break below 1.3743 would be needed to suggest a more significant high was registered last month with subsequent daily support eyed at the 2017 high-day close / 100% extension at 1.3504/41. A breach higher would expose critical resistance back at the yearly high-day close / February 2018 sing high at 1.4138/45- look for a larger reaction there IF reached.

Sterling Price Chart – GBP/USD 120min

Notes: A closer look at Sterling price action shows a few possible scenario’s playing out here. The broader focus is on a break of the consolidation pattern off the monthly highs / the monthly opening range between 1.3801-1.3995. An embedded ascending pitchfork formation may be in the works which would keep the focus higher IF price is able to hold support at the 61.8% Fibonacci retracement at 1.3862. A topside breach would keep the focus on 1.4036 and the 61.8% retracement of the decline off the highs at 1.4066.

Bottom line: Sterling is in consolidation just below resistance at the March range highs- respect a breakout of the monthly opening-range. From at trading standpoint, look for possible downside exhaustion within this near-term formation IF price is indeed heading higher with a breach / close above 1.4066 needed to suggest a larger reversal is underway. Review my latest British Pound Weekly Price Outlook for a closer look at the longer-term GBP/USD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Sterling Trader Sentiment – GBP/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-short GBP/USD - the ratio stands at -1.06 (48.65% of traders are long) – neutral reading

- Long positions are15.54% lower than yesterday and 18.17% lower from last week

- Short positions are2.59% higher than yesterday and 6.74% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias from a sentiment standpoint.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

---

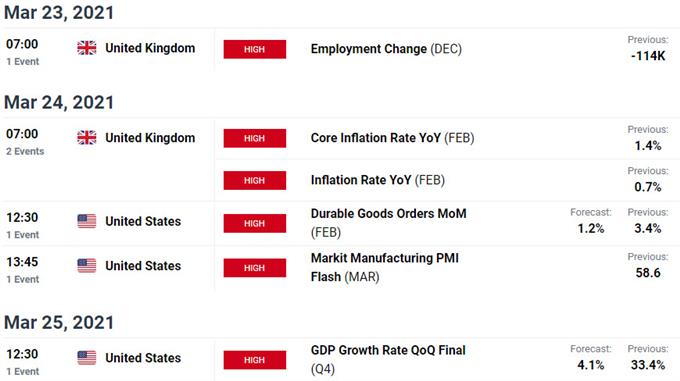

UK / US Economic Calendar

Economic Calendar - latest economic developments and upcoming event risk.

Active Technical Setups

- Gold Price Outlook: Gold Recovery at Risk- XAU/USD FOMC Levels

- Australian Dollar Outlook: AUD/USD Break Tests First Aussie Hurdle

- Canadian Dollar Outlook: USD/CAD Bearish Rebuke- BoC Battle Lines

- Bitcoin (BTC/USD) Outlook: Bitcoin Bulls Back Down- 50K back in Play

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex