Technical Forecast for S&P 500, Dow, FTSE 100, DAX and Nikkei

- S&P 500 Outlook: Index Fights Resistance, US Ground Boeing 737 Max Models.

- DJIA: Dow Recovers from Fibonacci Support, Builds Rising Wedge.

- Are you looking for longer-term analysis of Equity prices? Check out our Quarterly Forecasts as part of the DailyFX Trading Guides.

It’s a week that started with fear following the tragedy in Ethiopia. A Boeing 737 Max crashed last weekend and Boeing stock gapped down aggressively to start the week. As one of the 30 constituents of the blue-chip index, this pushed the Dow Jones Industrial Average along with it. And despite a week of setbacks around that theme, with Canada announcing that they’re grounding all of these planes, followed by a similar statement from President Trump; the stock held support at a key area on the chart, assisting with recovery in the Dow as the S&P 500 moved-up for another test of fresh yearly highs.

For next week the big item on the calendar is Wednesday’s FOMC rate decision. There are minimal expectations for any rate hikes or future commitments to anything similar; but key will be what the bank says about continued balance sheet reduction and how the ultimate composition of the Fed’s balance sheet will look. This could create ripples through bond markets which could, in-turn, impact the global risk trade, pushing equities along with it.

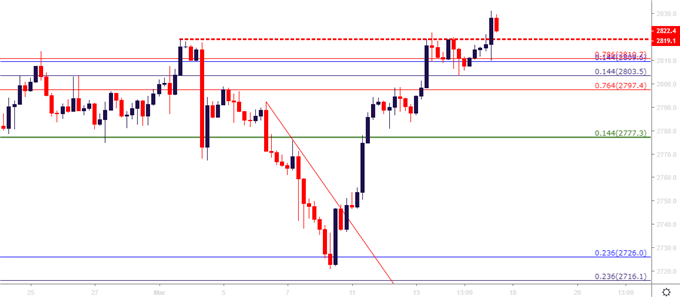

S&P 500 Powers to Fresh 2019 High

The first week of March saw a pullback in the S&P 500 as the index failed to breakthrough a big area of resistance. This was from around the same zone that had produced resistance in the S&P in November and December, just ahead of a precipitous sell-off that saw the S&P trade all the way down to the 2334-area on the chart.

But since that low came-in, buyers have very much remained in-charge, pushing through January and February until the early-March retracement began to show. Last Friday saw stocks rally off of their Monthly lows, and that strength continued through this week to help produce a fresh 2019 high. This keeps the S&P 500 in a bullish position as one of the more attractive global indices available to traders. For next week the forecast will be set to bullish on the S&P 500.

Technical Forecast for the S&P 500: Bullish

S&P 500 Four-Hour Price Chart

Chart prepared by James Stanley

Looking for a fundamental perspective on equity? Check out the Weekly Equity Fundamental Forecast.

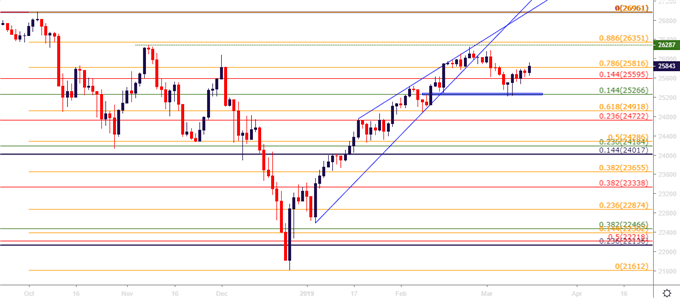

Dow Jones Lags Due to Boeing Trouble; Spends the Week Recovering

A similar backdrop had developed in the Dow in which a strong bullish theme through January and February took pause as a retracement showed in the first week of March. Prices in the Dow dipped down to the ‘s3’ support level looked at earlier last week, and that same support level helped to hold the lows for this week despite an outsized gap-lower in BA.

Since then, prices have continued to recover but the index remains a touch-less bullish than what was looked above in the S&P 500; and this can make for a more-challenging prospect of continuation given that price action remains subdued below the prior March high. The forecast on the Dow for next week will be set to neutral.

Technical forecast for the Dow for next week: Neutral

Dow Jones Daily Price Chart

Chart prepared by James Stanley

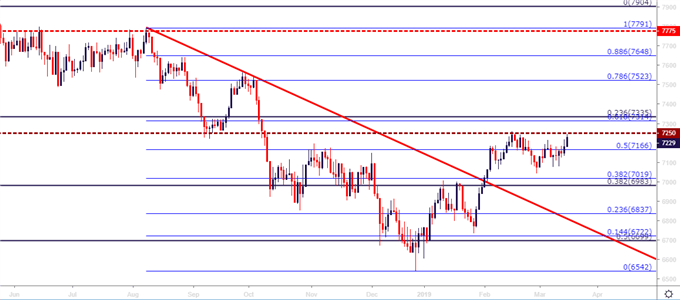

FTSE 100 Recovers, Resistance Remains Near 7250

It was a strong finish to the week for the FTSE 100 as prices pushed up towards a re-test of 2019 highs around the 7250 level. That 7250 area was a prior area of support in the index that had last come into play in September of last year and so far this year that price has helped to cap the advance. If prices are able to push through this area on the chart, the door may soon open for bullish strategies. But, until then, the forecast will remain at neutral on the FTSE 100.

Technical Forecast for the FTSE 100 for Next Week: Neutral

FTSE 100 Daily Price Chart

Chart prepared by James Stanley

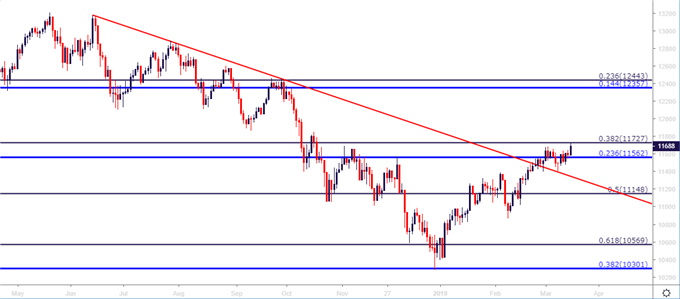

DAX Gains Capped at Key Fib – Room for More?

The German DAX rallied up to a fresh five-month-high this week; and this comes after an initial bearish move in response to last week’s news of the ECB triggering a fresh round of TLTRO’s. With a more-dovish backdrop in Europe, and continued recovery holding in the DAX through 2019, the door may be open for further gains. The forecast for next week will be set to bullish for the DAX.

Technical Forecast for the DAX for Next Week: Bullish

DAX Daily Price Chart

Chart prepared by James Stanley

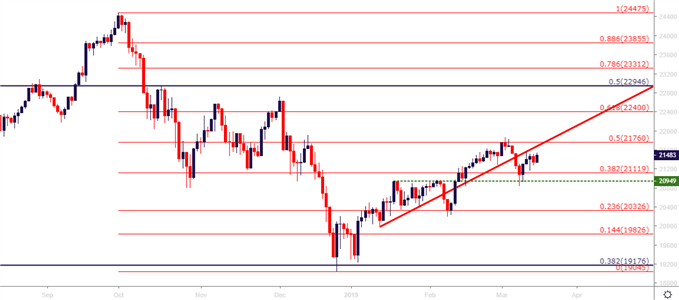

Nikkei in Middle of March Range; Subdued Below Fib Resistance

The Bank of Japan had a rather quiet rate decision this week and that was illustrated fairly-well in the Nikkei, which didn’t do much around that meeting. Prices in the index remain near the middle of the March range, and monthly resistance has held around the 50% marker of the Q4 sell-off. This keeps the index in a rather unattractive space for bullish strategies while bearish outlooks could be difficult to justify given the continuation of higher-lows that have held thus far in 2019. The outlook for next week will be set to neutral on the Nikkei.

Technical Outlook for the Nikkei: Neutral

Nikkei Daily Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q3 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers a plethora of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX

Other Weekly Technical Forecast:

AUD Forecast – AUD/USD, GBP/AUD and AUD/JPY Technical Outlook Bearish

Crude Oil Forecast– Prices Touches New 2019 High As OPEC Supply Doubts Remain

British Pound Forecast – Charts Highlight Bullish GBP Bias

US Dollar Forecast – Dollar Reverses in Large Range, EURUSD Pressure Builds Towards Break

Gold Forecast – XAU/USD Rebound to Fizzle

Euro Forecast –Trend & Resistance Give Euro Weak Backdrop Heading into Next Week