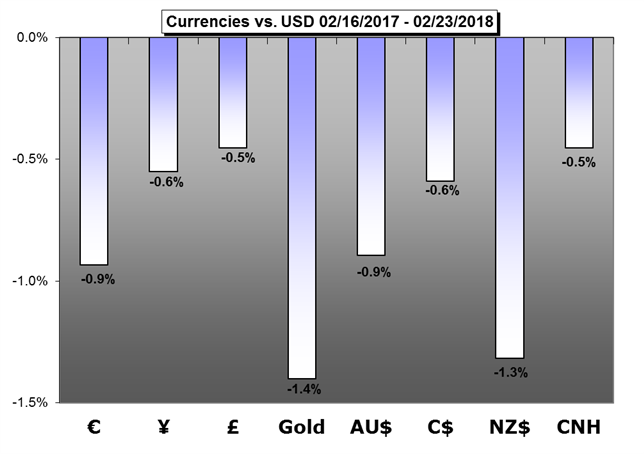

This past week’s price action from indices to FX to commodities was a notable transition from the extreme volatility earlier in the month. Can markets simply revert to the extreme complacency cultivated over the past years or has the recent jolt of volatility permanently changed the market’s relationship to burgeoning and mature fundamental risks that continue to gain traction in the global financial system?

US Dollar Forecast: Dollar Faces Monetary Policy, Protectionism and Euro's Cross Winds

We will be spoiled for event risk for the Dollar over the coming week. Yet, too many competing catalysts and the influence of market-wide volatility may create as much indecision as conviction.

Euro Forecast: Euro Faces Test with CPI Due as Economic Data Momentum Drops

Has the Euro gotten too big for its britches? Economic data momentum has plummeted sharply in recent weeks, making the release of the February CPI report a significant test for the single currency this week.

British Pound Forecast: UK Data Pushed Aside; Brexit Talks Drive Price Action

Sterling remains close to GBPUSD 1.4000, and continues to be stuck in a narrow range against the Euro, despite a weak set of UK hard data releases, as the UK government stands firm in Brexit talks.

Japanese Yen Forecast: Yen Weakness Remains Evasive as Inflation Prints at 34-Month High

Headline inflation continues to rise in Japan, coming in at a fresh 34-month high in January. With Yen-strength becoming a more prominent theme, inflation gains can remain as a key driver in the near-term.

Australian Dollar Forecast: Australian Dollar Likely Pulled One Way By US, Another By China

The Australian Dollar faces plenty of likely points of economic interest this week, but few of them are Australian. Chinese and US numbers will hold the trading key.

New Zealand Dollar Forecast: New Zealand Dollar Awaits Key US PCE Data, Powell Testimony

The New Zealand Dollar declined against its US counterpart as Fed rate hike expectations rose. External event risk may dominate domestic news next week.

Chinese Yuan Forecast: Yuan Eyes on GDP, Fiscal Deficit Targets at Annual Meetings

China will host the annual NPC and CPPCC meetings in a week; the growth target as well as other economic goals to be released by the Premier are in the spotlight.

Crude Oil Forecast: Crude Oil Bears Likely Wonder If Shale Producers Were Right All Along

After an inventory report delayed by the US holiday showed surging US exports, shale oil producers are looking smarter than ever while OPEC-member contemplates long-term relationship with Russia.

Equities Forecast: Outlook for S&P 500, DAX & FTSE Tentatively Constructive

In the week ahead, global stock markets will try to work their way higher, but still have obstacles to overcome; a few notable events on the calendar to keep an eye on.

Gold Forecast: Gold Trades Heavy on Fed Outlook- Prices Holding Uptrend Support

Gold prices are on pace to mark the largest weekly decline this year amid a short-term recovery in the USD. Here are the updated targets & invalidation levels that matter.

See what live coverage is scheduled to cover key event risk for the FX and capital markets on the DailyFX Webinar Calendar.

See how retail traders are positioning in the majors using the IG Client Sentiment readings on the sentiment page.