We have just closed out an exceptionally busy fundamental week with key event risk. And, we are now diving right back into a deep docket with markets on the cusp of key trend developments.

US Dollar Forecast – US Dollar to Tap Fed Speakers, NFPs For Another Run at 12 Year High

The Dollar was once again offered the opportunity to make a run on 2015’s highs and move on to levels not seen since 2003.

Euro Forecast - Further EUR/USD Losses Require Data Confirmation of Fed, ECB Divergence

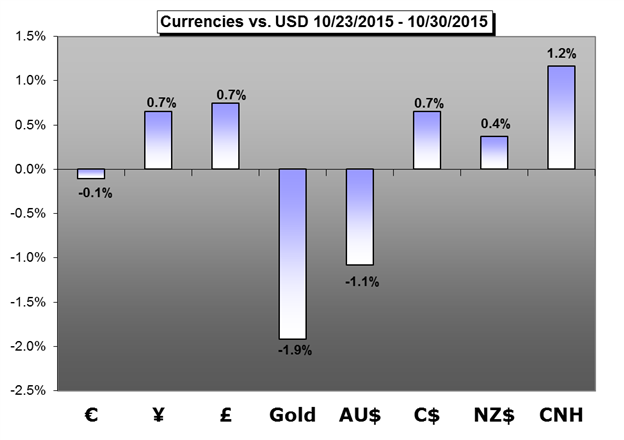

EUR/USD has steadied around $1.1000 as it appears both prospects of an ECB deposit rate cut and a Fed rate hike have been priced in. Recent data developments have helped buoy the pair, and a strong October US Nonfarm Payrolls this week is required for the next leg lower to begin.

British Pound Forecast – Post-Fed GBP/USD Rebound at Risk on Dovish BoE, Soft Inflation Report

With GBP/USD largely reversing the decline following the Federal Open Market Committee’s (FOMC) policy meeting, the pair may continue to face range-bound prices in the week ahead as market attention turns to the Bank of England (BoE) interest rate decision on November 3.

Japanese Yen Forecast – Bank of Japan Keeps the Japanese Yen in Tight Range – What Now?

A notable disappointment from the Bank of Japan meant the Japanese Yen and the USD/JPY exchange rate finished the week almost exactly where they began.

Canadian Dollar Forecast – Oil Prices Could Drive the CAD Lower Before the Recession Ends

The Canadian Dollar continued to slide lower to start the week, furthering the return of the up-trend in USD/CAD led by a precipitous drop in Oil prices.

Australian Dollar Forecast – Australian Dollar Fire as RBA Meeting, US Jobs Data Loom

The Australian Dollar is on the defensive, falling for a third consecutive week as an RBA monetary policy announcement and key US employment data loom ahead.

New Zealand Dollar Forecast – The End of China’s One-Child Policy Charges NZD Higher

The New Zealand Dollar took flight over the month of October. Much relief for NZD Bulls came this week specifically despite an overtly dovish Reserve Bank of New Zealand and surprisingly hawkish Federal Reserve.

Gold Forecast – Gold Pops and Drops on Fed-Prices Target Support Ahead of NFP’s

Gold prices are lower for a second consecutive week with the precious metal down 1.8% to trade at 1142 ahead of the New York close on Friday.

Sign up for a free trial of DailyFX-Plus to have access to Trading Q&A's, educational webinars, updated speculative positioning measures, trading signals and much more!

Want to develop a more in-depth knowledge on the market and strategies? Check out the DailyFX Trading Guides we have produced on a range of topics.