US Dollar, EURUSD, USDJPY Price Outlook Talking Points:

- The US Dollar is putting in a bounce to start Q3 trade, and after a quick opening-gap, prices have pushed up to the 96.47 Fibonacci level.

- This USD bounce has brought upon a support test in EURUSD to go along with a resistance inflection in USDJPY. With USD weakness showing last month on the heels of a dovish flip at the Fed, can Dollar bears continue to push in the second-half of this year?

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

US Dollar Bounces to Start Q3, 2H 2019

The Q3 open is already showing some interesting items of volatility. US equity futures are trading at fresh all-time-highs, Oil prices have broken above the key psychological level of $60 and the US Dollar has shown a flicker of strength after last month’s break below rising wedge support.

As the second-half of 2019 gets underway, the big question is which risk trend might take over? After a slump in stocks in Q4 a strong ramp showed up as buyers clawed back those prior losses in Q1 and into Q2. But an aggressive sell-off in May appeared to emanate from a ‘not dovish enough’ stance at the FOMC; but all was restored to normal as the bank made the initial moves towards more-dovish policy at the June rate decision.

In the US Dollar, that flip at the Fed allowed for a downside break of a rising wedge pattern, which will often be approached with the aim of bearish reversals. And given the prior year-plus of strength in the USD, such a scenario made sense. This was the thesis of the Q3 technical forecast for the US Dollar, which is now available as part of the DailyFX Q3 Forecasts.

Download the DailyFX Q3 Forecasts

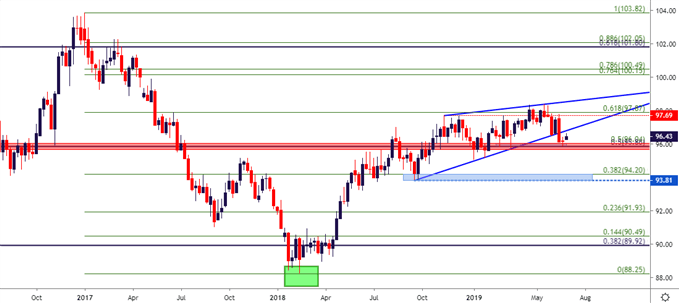

US Dollar Weekly Price Chart

Chart prepared by James Stanley

After a small gap-higher to start this week’s trade, the US Dollar has budged up to a fresh higher-high and appears to be trying to find higher-low support around prior resistance. If buyers are able to hold support above the 96.03 level during today’s trade, there may be scope for a deeper short-term retracement to develop.

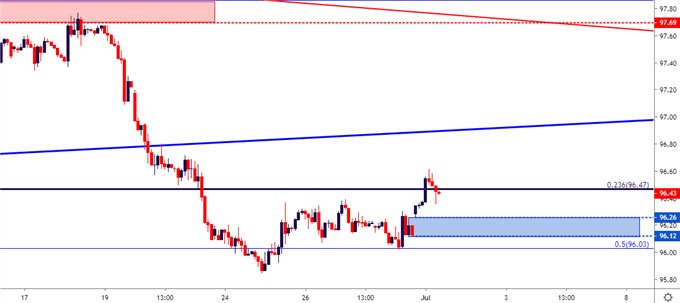

US Dollar Two-Hour Price Chart

Chart prepared by James Stanley

If buyers are able to push, there are a few areas of note where longer-term lower-high resistance could be of interest. The under-side of the rising wedge pattern currently projects to around 96.90. A bit higher is a prior swing-low around the 97.35 level that could be utilized as a secondary zone of resistance potential.

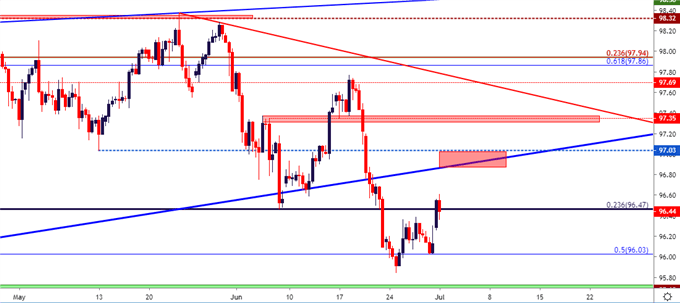

US Dollar Eight-Hour Price Chart

Chart prepared by James Stanley

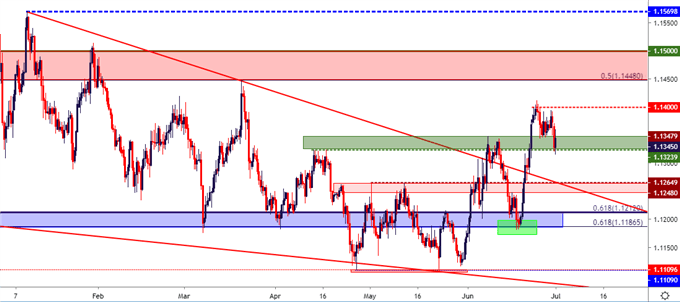

EURUSD Tests Higher-Low Support to Start Q3

Going along with that USD bounce to start Q3, EURUSD has pulled back to test a zone of support as taken from prior resistance. The area runs from around 1.1325-1.1350, which were the April and early-June swing highs, respectively.

For themes of USD weakness, the topside of EURUSD can remain as attractive as there’s the potential for an elongated short-squeeze scenario in the pair. Longer-term resistance lurks above from the prior range, running from the 1.1448-1.1500 area on the chart.

EURUSD Eight-Hour Price Chart

Chart prepared by James Stanley

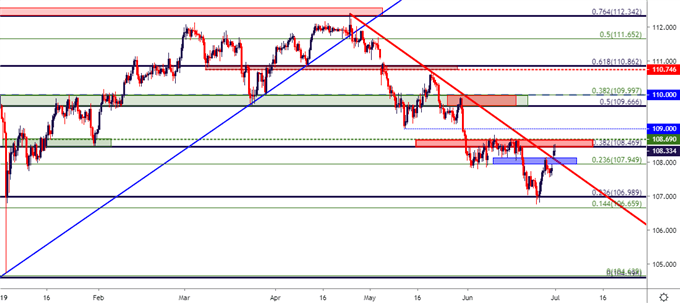

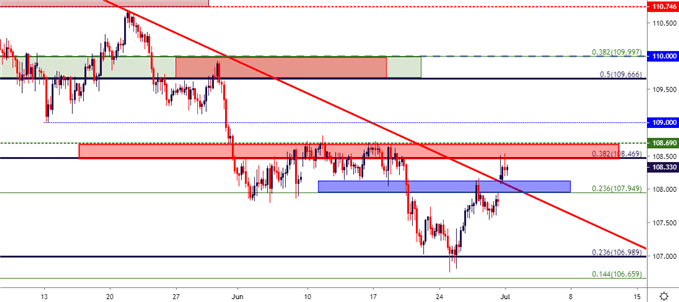

USDJPY Gap Re-Tests Resistance

Also on the short side of the US Dollar, I’ve been following USDJPY, looking to take advantage of Yen-strength to go along with a weak US Dollar. The pair has gapped-higher to start this week, finding a bit of resistance at the prior zone that runs from 108.47-108.70. Of note, this gap crossed above a bearish trend-line that’s been in play in USDJPY for a couple of months now.

USDJPY Eight-Hour Price Chart

Chart prepared by James Stanley

This sets the pair up for a fairly interesting start to this week: Should that gap get filled with buyers showing a penchant for support above the 107.50 swing-low, there may be bullish prospects that could soon become a workable theme, largely looking at the trendline break combined with higher-low support. Alternatively, if buyers are able to continue pushing in the early-portion of this week, re-testing the prior swing-low around 109.00 for a fresh monthly high, that bullish backdrop can also brighten, with focus for support at the current zone of resistance from 108.47-108.70.

USDJPY Four-Hour Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX