The US Dollar was heading into the second half of 2019 in an uncomfortable state of uncertainty. While there have been a few abrupt declines registered by the benchmark currency through the year, each bout of fear seemed to burn itself out before unease became contagious panic. Yet, after months of congestion holding back increasingly frequent flashes of volatility, it seems the technical boundaries are starting to come under existential strain. Meanwhile, the fundamental seas are growing progressively more tumultuous.

To read the full US Dollar Forecast, download the free guide from the DailyFX Trading Guides page

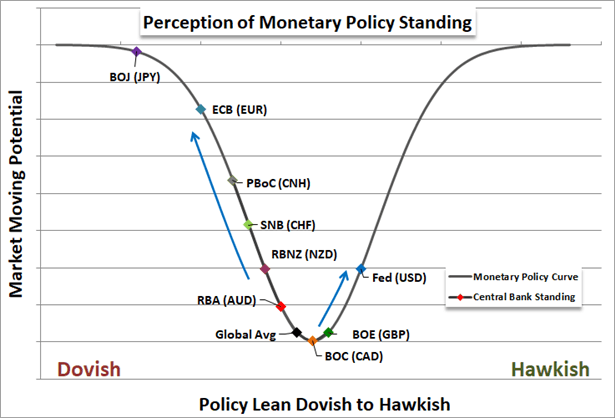

Graph of relative central bank policy standings. Created by John Kicklighter

US Dollar Bullish Backdrop Flips into Bearish Formation for 2H, 2019

Coming into last quarter, the US Dollar had continued a bullish theme that started more than a year prior. The lack of follow-through at the Q2 highs produced another upward-sloping trendline atop price action, and when combined with the support trendline from the previous ascending triangle, this makes for a rising wedge pattern. Unlike the triangle, a rising wedge will often be approached with the aim of a bearish reversal as the lack of enthusiasm near resistance may eventually lead in to a test through support. After all, if bulls are only looking to get long when the market is ‘on sale,’ what happens when the bottom falls out?

To read the full US Dollar Forecast, download the free guide from the DailyFX Trading Guides page

US Dollar Weekly Price Chart

Chart prepared by James Stanley

To read the full US Dollar Forecast, download the free guide from the DailyFX Trading Guides page