Crude Oil Price Talking Points:

- The two-week rally in crude oil has run into resistance at a confluent level on the chart, and sellers have held the buyers at bay around the 60-handle for the past three trading days.

- Next week brings an OPEC meeting to go along with the Q3 open; can sellers re-grab control?

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Crude Oil Price Caught at Resistance Ahead of OPEC

The final trading day of Q2 is winding down and along with Monday’s Q3 open will be a key OPEC meeting set to conclude early next week. As discussed by our own Justin McQueen, it looks as though production cuts are set to be extended. And this, combined with the heightened risk in the geopolitical backdrop after the US drone was shot down by Iran has helped crude oil prices to firm after what had become a strong gust of selling took prices down to fresh five-month-lows.

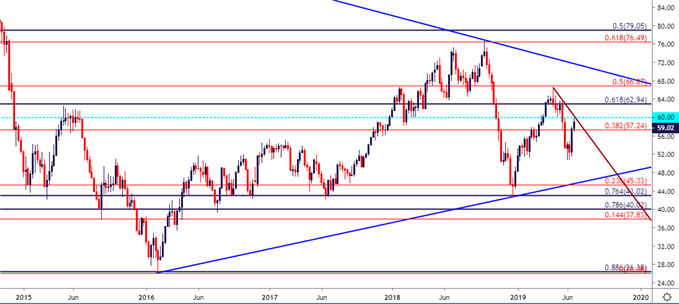

Oil Price Chart – Weekly

Chart prepared by James Stanley

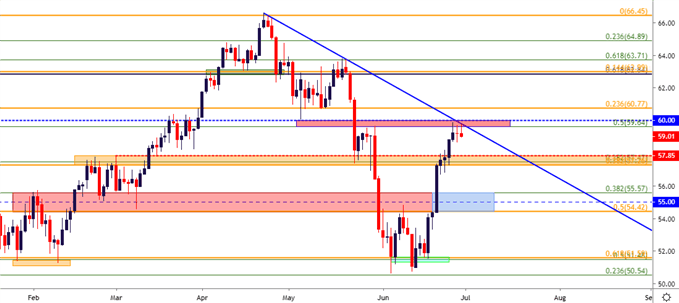

As looked at on Wednesday, a strong area of resistance has come into play around the $60 handle. This area is confluent as there are a few different Fibonacci levels in this region to go along with a trend-line projection as taken from the April and May swing-highs. Despite this seemingly bullish backdrop for Oil prices, in which both supply constraint and geopolitical tensions are in the headlines, this key zone of resistance has continued to hold the highs throughout this week.

Oil Price Chart – Daily

Chart prepared by James Stanley

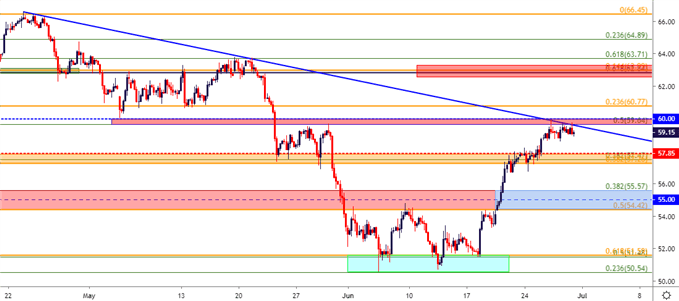

Crude Oil Price Strategy Moving Forward

Given the continued hold at resistance, the short-side of crude oil can remain as attractive, looking for a hold of this resistance and a revisit down to a prior support zone; such as the area around 57.50 or perhaps around the 55-level. If sellers can take that zone out in quick-order, focus could then shift towards the 51.50 area of prior support that was looked at for target potential earlier this month.

Crude Oil Price Four-Hour Chart

Chart prepared by James Stanley

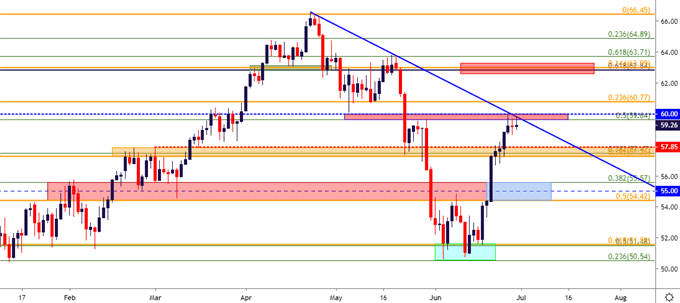

Crude Oil Price – Bullish Scenarios

Given the drivers that will be in the headlines combined with the overall dynamics of the risk trade of recent, and traders would likely want to at least entertain the possibility of a bullish outcome around next week’s OPEC meeting.

Just above current price action is another confluent zone of interest, and this exists around the 62.80 level on the chart. The price of 62.89 is the 14.4% retracement of the December-April bullish move, while 62.84 is the 61.8% retracement of the long-term major move spanning from the 1999 low up to the 2008 high. Traders can look for a re-test of this level to signal a bullish flip in the near-term trend, and that can re-open the door for higher-low support potential around the current zone of resistance.

Oil Price Chart – Daily

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX