US Dollar Weekly Technical Forecast Talking Points:

- The US Dollar continued the sell-off that started last Friday, falling below a number of key supports as the currency pushed down to fresh two-month-lows.

- A speech from Jerome Powell on Tuesday and NFP numbers on Friday helped to drive the move, with DXY finding a bit of support from the familiar Fibonacci level at 96.47. Can sellers continue to push the trend-lower?

USD Technical Forecast for Next Week: Neutral

US Dollar Bears Come Back with Aggression

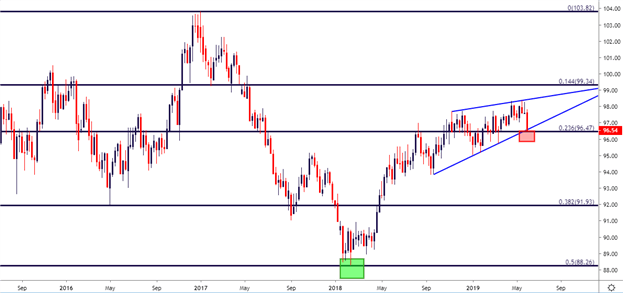

Last Friday brought a noticeable move of USD-weakness; but given that just 24 hours prior the currency was jumping up towards the two-year-high, that pullback appeared to be a part of a larger topside theme. This week nullified that potential as sellers continued to drive the move down to fresh two-month-lows, eventually finding a bit of support at the Fibonacci level around 96.47, which is the 23.6% retracement of the 2011-2017 major move. This is a level that’s had bearing on near-term price action over the past eight months since helping to set the monthly high in August of last year.

US Dollar Weekly Price Chart

Chart prepared by James Stanley

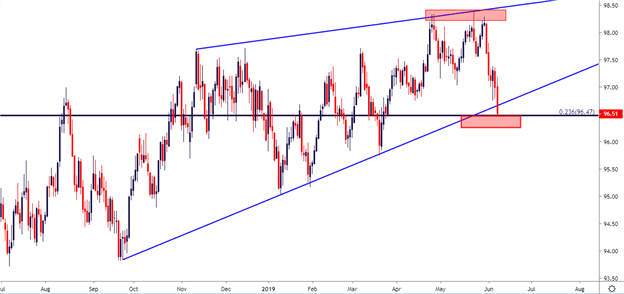

US Dollar’s Ascending Triangle Turns into a Rising Wedge

Coming into Q2 the US Dollar was showing an ascending triangle formation, which is often approached in a bullish manner with the expectation that’s brought bulls in at higher-lows to, eventually, take over at horizontal resistance to allow for a bullish breakout.

And that happened in both April and May. But once the Dollar climbed to fresh highs, bulls all of the sudden got bashful, allowing prices to drop back into the prior range. That bullish bias even lasted into last week’s failed attempt at taking out the two-year-highs. The resistance offered from those meager breakout attempts produces another upward sloping trend-line, although this one carries less angle than the support trend-line, thereby producing a rising wedge formation, which will often be approached with the aim for bearish reversals.

This can open the door for longer-term short-side themes in the US Dollar.

US Dollar Daily Price Chart

Chart prepared by James Stanley

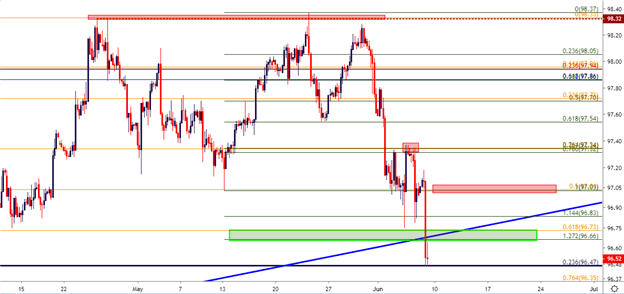

US Dollar Strategy for Next Week

While the potential for a fresh bearish theme remains of interest, the fact of the matter is that the USD moved very far, very fast. Selling at this point would be chasing the move, and while there may be context for bearish continuation; that’s a bit more difficult to justify from a risk management perspective.

The forecast for next week will be set to neutral; but the door may soon open for short-side setups should prices find lower-high resistance at a point of prior support. The 97.00 area on the DXY chart had exhibited a bit of support ahead of the NFP print on Friday. A pullback to this price could open the door for bearish setups with stops investigated above the confluent zone of Fibonacci resistance around this Wednesday’s swing highs.

US Dollar Four-Hour Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as USD/CAD, EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX