US Dollar Talking Points:

- Today at 2PM ET brings the release of FOMC meeting minutes from the bank’s March rate decision; and that was a big meeting in the realm of expectations around Fed policy. This is when the bank finally cut rate forecasts for 2019 after a push of volatility showed up in Q4. FOMC tonality has been key to the Q4 sell-off and then the ensuing reversal that showed-up in Q1 as the bank grew less-optimistic around growth in the world’s largest economy.

- Just how dovish is the Fed? And how open is the bank to rate hikes later in the year? The details contained in today’s meeting minutes could carry a large bearing on the risk-trade given expectations that have built around the FOMC’s future posture.

- This morning has also brought a couple of high-impact items with the ECB rate decision along with US CPI numbers for the month of March, with Core CPI printing at 2% versus a 2.1% expectation, and headline CPI coming in at 1.9% against a 1.8% expectation.

Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment Indicator.

US Dollar Catches a Bid Ahead of FOMC Meeting Minutes

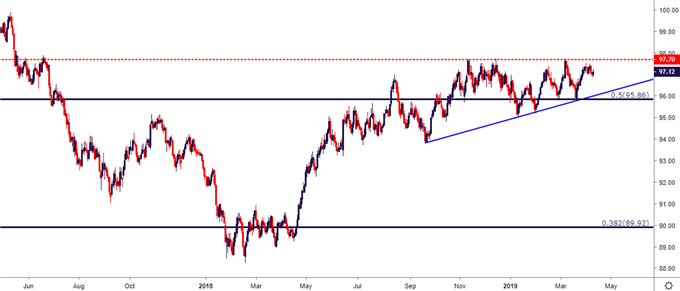

Is this the week that the US Dollar finally breaks out? This was the central question in this week’s Technical Forecast on the US Dollar, and this links with a theme that’s been brewing for the past five months. Prices in the US Dollar have been digesting within an ascending triangle formation. Resistance has held through three different tests in November, December and then again in March after the ECB rate decision. And support has continued to build since September, with the most recent inflection coming-in after the FOMC rate decision last month.

This type of formation will often be approached in a bullish manner, looking for the motivation that’s continued to drive-in bulls at higher-lows to, eventually, take over around resistance to allow a breakout through the horizontal level. This was the focus in the Q2 Technical Forecast for the US Dollar, looking for the topside of that formation to be taken-out at some point during the second quarter of this year.

Access the DailyFX Q2 Forecasts for USD, Euro, GBP and More

US Dollar Daily Price Chart

Chart prepared by James Stanley

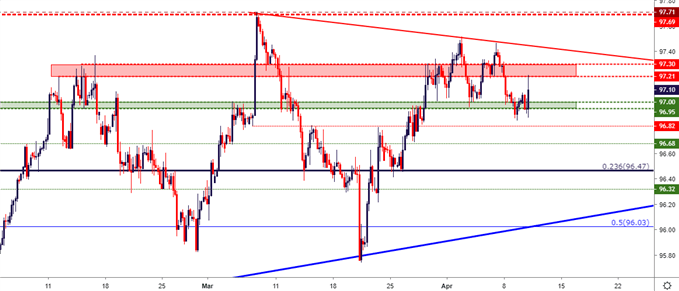

The big question at this point is whether the backdrop is amenable enough for bulls to pose that push anytime soon. This morning brought a couple of different drivers to the table, each of which served to push the US Dollar higher. The ECB rate decision saw no new announcements, but a bit of dovish commentary from ECB President Mario Draghi helped to push EURUSD back-down towards short-term supports. And the CPI report released out of the US showed Core CPI still at the Fed’s 2% target, and headline CPI came in a touch above expectations, printing at 1.9% versus the 1.8% that was expected.

Collectively, this morning’s drivers helped to perk the US Dollar up towards that batch of prior resistance.

US Dollar Four-Hour Price Chart

Chart prepared by James Stanley

Key for US Dollar Trend Themes: EURUSD

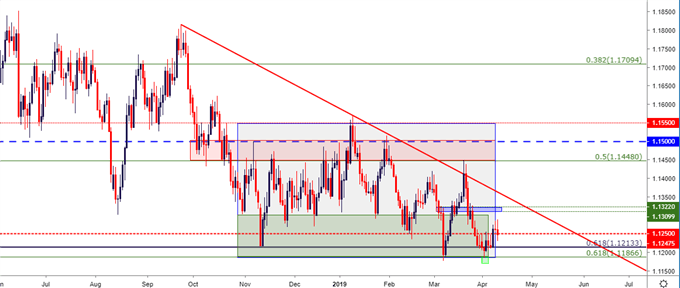

Given the heavy allocation of the single currency in the composition of the US Dollar, in which the Euro makes up more than 57% of DXY’s composition, and the case can be made that the Dollar likely isn’t going anywhere without the Euro’s agreement. To be sure, the theme of digestion in the US Dollar relates very well to a similar theme in EURUSD, in which prices have been range-bound for the past five months. Making matters even more interesting – this range has held through a variety of both positive and negative drivers.

Of recent, the support side of that formation has come under attack. But, to date, bears haven’t been able to make much ground as buyers have continued to thwart their efforts around two key Fibonacci levels on the chart. At the price of 1.1212 is the 61.8% retracement of the ‘lifetime move’ in EURUSD; and a bit-lower, around 1.1187 is the 61.8% marker of the 2017-2018 bullish move. This zone was a key part of the backdrop in EURUSD for FX Setups of the Week; and thus far this area has held the lows into this morning’s ECB rate decision.

EURUSD Two-Hour Price Chart

Chart prepared by James Stanley

If the US Dollar is going to post a bullish breakout beyond the 97.71 level that’s functioning as the yearly high, a downside break in EURUSD below 1.1175 will likely need to take place, as well. The big question is, again, whether the backdrop is supportive of such a theme from a timing perspective. In relevance to today’s FOMC meeting minutes, this would likely need to contain a considerably more-hawkish outlook than what is being expected across capital markets, where there has even been a growing chorus of calls for the next FOMC move to be a rate cut as opposed to a hike.

EURUSD Daily Price Chart

Chart prepared by James Stanley

For Strategies of USD-Weakness, a More Dovish Fed: Gold

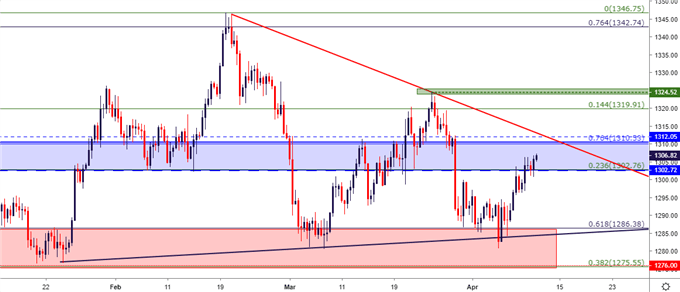

If the US Dollar is to continue showing trepidation around those yearly highs, and if there is a brewing bearish theme in the currency, Gold prices can remain as attractive.

As looked at yesterday in the Gold Price Outlook, support has built in around two key Fibonacci levels running from the approximate 1275-1286. This zone of price action has already held up three different tests from January to April; and if the US Dollar is going to show tendencies of breakdown, bullish breakouts and a continuation of strength in Gold prices could remain as an attractive theme.

Gold Price Eight-Hour Price Chart

Chart prepared by James Stanley

Taking a step back, and Gold prices are in a similar pattern of digestion, albeit shorter-term than that of the US Dollar. That longer-term support goes along with a series of lower-highs in Gold prices, and this can make for a difficult spot to establish exposure, particularly for trend or continuation strategies. Traders looking at top-side strategies in Gold prices can look for an initial test beyond trend-line resistance, which comes in around the 1314 level, at which point higher-low support can be sought out. Given the prior support/current resistance zone that runs from 1302-1310, that could be an area of interest to re-purpose in the event of a bullish backdrop.

Gold Price Daily Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q2 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX