One of the greater weights against the US currency to open 2019 – even though it seemed to hold its buoyancy – was the unmistakable dimming in the Federal Reserve’s monetary policy guidance. Last year, the world’s largest central bank hiked its benchmark rate range three times, lifting the rate to a 2.25-2.50 percent spread. That was a ‘gradual’ pace in historical terms; but in the context of the global market, it was remarkable. No other major policy group was normalizing monetary policy so consistently.

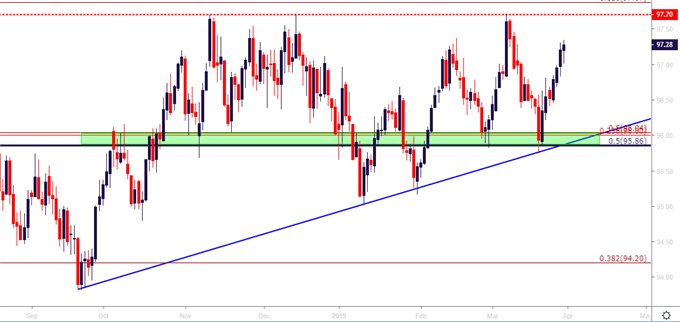

US Dollar Daily Price Chart: Ascending Triangle Builds into Q2

Chart prepared by James Stanley

Taking a step back on the US Dollar’s chart can provide some additional and perhaps usable context to this current bout of congestion. The US Dollar’s bearish 2017 trend finally caught support around February of last year; and at that point, a topside rally started that ran into the summer, with sellers showing up around the confluent area of support/resistance around 95.86-96.00.