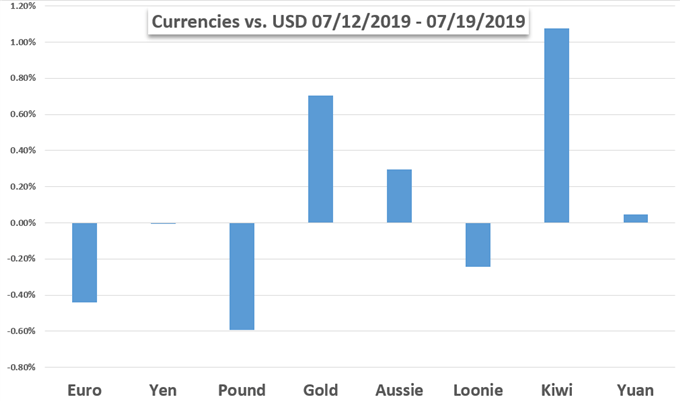

We may find the top scheduled event risk next week displaced for market moving potential by an increasingly volatile theme. Key event risk ahead includes Friday’s US 2Q GDP update and the global PMIs for July which would seem to put the focus on growth and recession concerns. Yet, the muddled picture from Fed remarks this past week and an ECB rate decision may find far more volatility in monetary policy.

US Dollar May Gain if IMF Report, US GDP Data Fuels Haven Demand

The US Dollar may find itself propelled higher if the IMF’s updated assessment of the world economy and an underwhelming US GDP data report stoke demand for liquidity.

Will ECB Cut Rates? Euro Outlook Turns Volatile as ECB Weighs Rate Cut

The Euro has struggled in recent sessions as the July ECB meeting has come into focus. With markets essentially predicting a coin flip’s chance of a rate cut, EUR-crosses appear destined for volatility in the second half of the week.

Australian Dollar Gains Should Hold As Markets Still Think Fed Will Cut

The Australian Dollar has shared fully in the broad US Dollar weakness seen as markets become more certain that US rates are going lower.

Gold Price Weekly Forecast: Fed Drives Next Leg Higher

The price of gold made a fresh six-year high Thursday, fueled by dovish Fed commentary. This stimulus comes on the back of recent, heavy, central bank buying of the precious metal alongside large gold ETF inflows.

Crude Oil Prices May Fall Further as Global Growth Outlook Dims

Crude oil prices may continue to fall after suffering the largest weekly drawdown in two months as the outlook for global growth – and thereby energy demand – sours.

DAX & FTSE MIB Fundamental Forecast: Eyes on ECB Rate Decision

DAX focus centered around ECB rate decision and heavyweight earnings, while Italian political risks weigh on the FTSE MIB.

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.